Singapore's Sea Reports Wider Loss on E-Commerce Investment

(Bloomberg) -- Sea Ltd., operator of Southeast Asia’s biggest gaming platform, reported a wider third-quarter loss on rising investments at e-commerce unit Shopee.

Net loss increased to $218 million in the three months ended Sept. 30 from $132.8 million a year earlier, the company said. Total revenue rose to $204.9 million from $94.1 million.

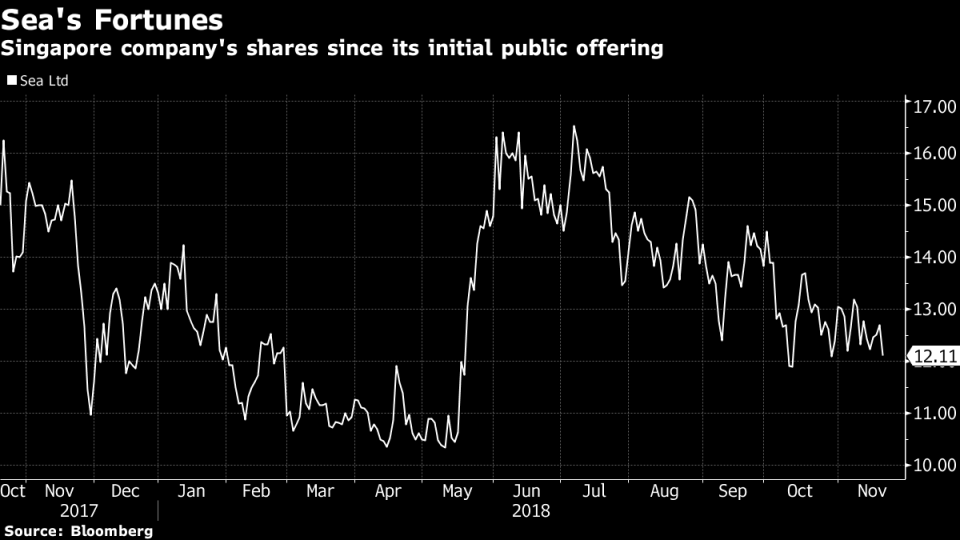

Sea has been struggling to keep its footing since going public in October 2017. The Singapore-based company sold stock in its IPO at $15 a share, while its shares closed in U.S. trading at $12.11.

Key Insights

Revenue at digital entertainment unit Garena increased 41 percent to $112.5 million during the quarter, aided by the popularity of Free Fire, the first self-developed hit game at the company.Revenue at e-commerce unit Shopee increased to $65.9 million Group Chief Strategy Officer Alan Hellawell will depart the company effective November 23, according to a statement. Hellawell, a former analyst, has been a key executive to deal with investors since joining the company last year.The move follows high-profile departures that include Group President Nick Nash whose retirement at the end of 2018 was announced in February and Jin Oh, former CEO of Garena who left the firm effective August 31. The company said it has promoted Terry Zhao as president of Garena. Sea raised its 2018 forecast for total adjusted revenue -- which considers changes in deferred revenue -- to between $930 million and $970 million. That compares with its previous guidance of between $780 million and $820 million. “The robust momentum across our e-commerce and digital entertainment businesses is reflected in our full-year outlook,” Sea Chief Executive Officer Forrest Li said during today’s earnings conference call.Sea is also forecasting e-commerce GMV for the full year 2018 to between $9.2 billion and $9.7 billion, up from its previous estimate of between $8.2 billion and $8.7 billion.Sea encourages investors and analysts to focus on financial results that are adjusted or not in compliance with generally accepted accounting principles. In its earnings release, it uses the term "adjusted" more than 60 times, while it uses GAAP three times.Howard Soh, Sea’s director of strategy and corporate development, said on the conference call that non-GAAP financial measures such as adjusted revenue and adjusted net loss can help in understanding the company. “We believe these measures can enhance our investors’ understanding of actual cash flows of major businesses when used as a compliment to GAAP disclosures,” he said.

Get More

Sea announced a deal with Tencent Holdings Ltd. this week to publish and distribute Tencent’s online games in Southeast Asia. The deal gives Garena a five-year right of first refusal to sell Tencent’s games, according to a statement. Sales and marketing expense increased by 37 percent to $180.3 million in the third quarter. For more details on the results, click here.

Market Reaction

Shares in Sea fell 4.7 percent Tuesday in New York ahead of the earnings report, and have fallen 9.2 percent this year.

(Updates with Sea’s full-year adjusted revenue guidance under Key Insights.)

To contact the reporter on this story: Yoolim Lee in Singapore at yoolim@bloomberg.net

To contact the editors responsible for this story: Robert Fenner at rfenner@bloomberg.net, Peter Elstrom

For more articles like this, please visit us at bloomberg.com

©2018 Bloomberg L.P.