Sinopec (SNP) Foresees China Oil Consumption to Peak Around 2026

A top executive of China Petroleum & Chemical Corporation or Sinopec SNP foresees oil consumption in China to peak around 2026, per Reuters. Since China is the second-biggest oil-consuming country, this expected timeline can be concerning for oil producers.

The company expects crude oil consumption in the country to peak at 16 million barrels per day, per Reuters. Sinopec's acting chairman, Ma Yongsheng, recently said in a seminar in Beijing that oil will serve the purpose of creating chemicals, in due course, instead of fuel. The company is expected to actively reduce its carbon footprint, and boost green initiatives in the refining and petrochemical business.

With a growing focus on renewables and green projects coming up in the future, dependency on crude oil will likely decline. The timeline predicted by Ma Yongsheng is likely to be sensitive to the number of electric vehicles on the road by then. Without a substantial rise in electric vehicle usage and alternative fuels, the dependency on oil will not be easy to overcome.

Government policies on hydrocarbon consumption, import quotas and pollution control are expected to play a crucial role in overall fossil fuel dependency. A significant portion of China's electricity is generated by coal-fired power plants, which emit greenhouse gases that cause pollution. To solve this problem, the Chinese government is planning to increase natural gas usage in plants. This can lead to greater gas consumption, which is likely to peak by around 2040 at 620 billion cubic meters of natural gas demand, expects Sinopec. Hence, its natural gas business has immense potential for growth over the coming years.

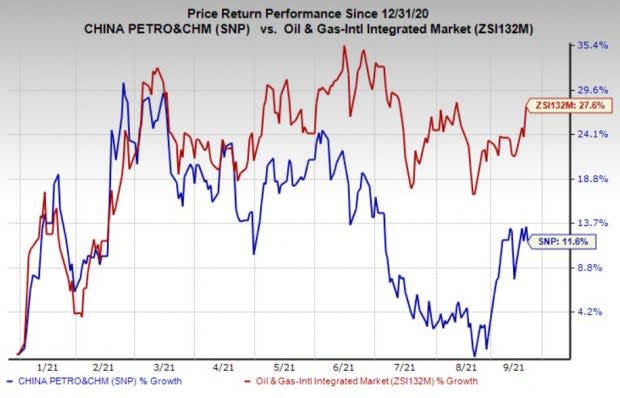

Price Performance

Sinopec has gained 11.6% in the past year compared with the 27.6% rally of the industry it belongs to.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, Sinopec has a Zacks Rank #3 (Hold). Some better-ranked stocks from the energy space include Ecopetrol S.A. EC, Kinder Morgan, Inc. KMI and Chevron Corporation CVX, each having a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ecopetrol’s bottom line for 2021 is pegged at $1.90 per share, indicating a massive increase from the year-ago figure of 28 cents.

Kinder Morgan’s bottom line for 2021 is expected to rise 47.7% year over year.

The consensus estimate for Chevron’s earnings for 2021 is pegged at $6.73 per share, indicating a major improvement from the year-ago loss of 20 cents.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

China Petroleum & Chemical Corporation (SNP) : Free Stock Analysis Report

Ecopetrol S.A. (EC): Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research