SkyWest (SKYW) Q3 Earnings & Revenues Beat Estimates, Rise Y/Y

SkyWest SKYW reported third-quarter 2021 earnings (excluding $1.26 from non-recurring items) of $1.45 per share that surpassed the Zacks Consensus Estimate of 94 cents. The bottom line increased significantly on a year-over-year basis, reflecting the recovery in air-travel demand.

Revenues of $744.8 million also outperformed the Zacks Consensus Estimate of $674 million. The top line jumped 63% year over year due to 67% increase in block hours on completed flights. Nevertheless, revenues declined 2% in the third quarter from the pre-coronavirus levels with 1% dip in completed block hours from the third quarter of 2019.

Revenues from flying agreements (contributing 96.5% to the top line) surged 61.6% from the year-ago quarter’s figure. Total expenses (on a reported basis) increased 82% year over year to $698 million due to higher number of flights operated during third-quarter 2021 as well as a non-cash impairment charge of $85 million.

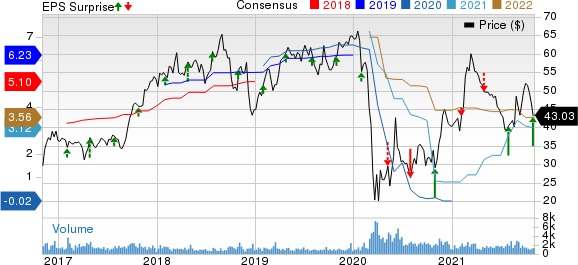

SkyWest, Inc. Price, Consensus and EPS Surprise

SkyWest, Inc. price-consensus-eps-surprise-chart | SkyWest, Inc. Quote

The airline, which carried 120.9% more passengers in the quarter compared with the year-ago level, reported a 66.5% increase in block hours (a measure of aircraft utilization). Passenger load factor (percentage of seats filled by passengers) increased 25 percentage points to 79.1% in the September quarter owing to the uptick in air-travel demand.

In October, the airline canceled as many as 1,700 flights due to a server outage. The company expects this adversity to weigh on its fourth-quarter results by approximately $15 million-$20 million.

Liquidity

SkyWest, carrying a Zacks Rank #4 (Sell), exited the third quarter with cash and marketable securities of $913 million, up from $826 million at the end of 2020. Long-term debt (net of current maturities) was $2.61 billion compared with $2.80 billion at December 2020-end.

Performance of Other Airlines

United Airlines UAL, carrying a Zacks Rank #3 (Hold), incurred a loss (excluding $2.46 from non-recurring items) of $1.02 per share in the third quarter of 2021, narrower than the Zacks Consensus Estimate of a loss of $1.65. Operating revenues of $7,750 million surpassed the Zacks Consensus Estimate of $7639.7 million. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Southwest Airlines LUV, carrying a Zacks Rank #4, incurred a loss (excluding 96 cents from non-recurring items) of 23 cents per share in the third quarter of 2021, narrower than the Zacks Consensus Estimate of a loss of 27 cents. Operating revenues of $4,679 million outperformed the Zacks Consensus Estimate of $4,581.5 million.

Spirit Airlines SAVE, carrying a Zacks Rank #4, incurred a loss (excluding 83 cents from non-recurring items) of 69 cents per share in the third quarter of 2021, narrower than the Zacks Consensus Estimate of a loss of 95 cents. Operating revenues of $922.6 million, however, fell short of the Zacks Consensus Estimate of $935.4 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

Spirit Airlines, Inc. (SAVE) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research