Skyworks Solutions (SWKS) Up 6.9% Since Earnings Report: Can It Continue?

A month has gone by since the last earnings report for Skyworks Solutions, Inc. SWKS. Shares have added about 6.9% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is SWKS due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Recent Earnings

Skyworks delivered second-quarter fiscal 2018 non-GAAP earnings of $1.64 per share, which beat the Zacks Consensus Estimate by 4 cents. The figure improved 13.1% from the year-ago quarter but declined 13.1% on a sequential basis.

Revenues of $913.4 million were up 7.2% year over year but down 13.2% sequentially. The reported figure missed the Zacks Consensus Estimate of $914 million.

Both earnings and revenues came ahead of management’s guidance. The better-than-expected performance was driven by worldwide demand for its wireless communications engines. The results reflected Skyworks’ growing clout in the connectivity solutions and 5G markets. Meanwhile, the company’s solutions continue to capture strategic design wins across the broad markets.

Adoption of Connected Home Solutions: Key Catalyst

The emergence of connected homes, autonomous vehicles, artificial intelligence (AI), augmented reality, wearables and network infrastructure presents significant growth opportunity for Skyworks’ connectivity solutions.

In the quarter, Skyworks powered connected home and virtual assistant systems at Bosch, Amazon, GE, AT&T/DIRECTV, Netgear, Sonos and Google.

Across broad markets, the company ramped Wi-Fi, fully-integrated Zigbee and Thread devices for Nest’s portfolio of video doorbells.

Further, management is elated that world’s largest automotive manufacturer leveraged its connectivity solutions.

Other Developments in the Quarter

In the wearables segment, Skyworks supported Forerunner fitness smartwatches for Garmin. The company also enabled Honeywell’s LTE handheld enterprise hubs. The company witnessed additional design wins for its high-speed mesh networks at Belkin.

The company partnered major European network infrastructure suppliers to support small cell deployments in the quarter including Verizon, AT&T, Vodafone and T-Mobile. It furnished massive MIMO solutions to India’s largest network carrier.

The company launched a new suit of network-driven solution that supports wireless 5G networks, called Sky5. Notably, Sky5 solution is a platform that deals with revolutionary 5G applications. Across high-performance computing markets, Skyworks has commenced volume production of SkyOne Ultra.

The company witnessed dominant mobile customers leveraging its precision antenna tuners, DRx modules, SkyOne and SkyBlue which aided the top line.

Margin Details

Non-GAAP gross margin expanded 30 basis points (bps) on a year-over-year basis and contracted 70 bps sequentially to 50.7%. The year-over-year improvement can be attributed to higher revenues and unit volumes, improving operating efficiency and filter in-sourcing.

Research & development (R&D) expenses, as percentage of revenues, increased 120 bps year over year and 240 bps sequentially to 11.7%.

Selling, general & administrative (SG&A) expenses expanded 70 bps from the year-ago quarter and 140 bps sequentially to 4.9%.As a result, non-GAAP operating margin contracted 40 bps on a year-over-year basis and 310 bps sequentially to 36.3% in the reported quarter.

Balance Sheet & Cash Flow

As of Mar 30, 2018, cash & cash equivalents were $1.88 billion, up from $1.68 billion in the previous quarter. Cash flow from operating activities was $434.2 million, up from $360.8 million in the previous quarter and $228.7 in the year-ago quarter.

The company declared a cash dividend of 32 cents per share in the second quarter, payable on Jun 12, 2018. It paid dividend of $58.4 million and repurchased 1 million shares for a total of $111.7 million.

Guidance

For third-quarter fiscal 2018, revenues are projected to be in the range of $875-$900 million.

Non-GAAP earnings are expected to be $1.59 per share, up 1.3% year over year and down 3% sequentially.

Gross margin is expected in the range of 50.7-51%, relatively flat sequentially. Operating expenses are also projected to remain flat sequentially.

Conclusion

Skyworks is currently plagued by trade restrictions imposed by the U.S. government on ZTE. Management anticipates that it will hurt third-quarter revenues by $25-$30 million.

Furthermore, the near-term softness witnessed across leading smart-phone customers keeps the analysts cautious. Overdependence on Apple for revenue generation continues to be a major headwind for the company. The company generates around 40% of its revenues by selling radio frequency chips, which are used in iPhone devices. Sequential decline reported in iPhone unit sales is likely to impact its performance, going forward.

However, management remains optimistic on Skyworks’ expanding product portfolio and new customer wins to keep revenues churning and help its gross margins improve to achieve long-term target of 53%.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There have been two revisions higher for the current quarter compared to seven lower. In the past month, the consensus estimate has shifted downward by 6.1% due to these changes.

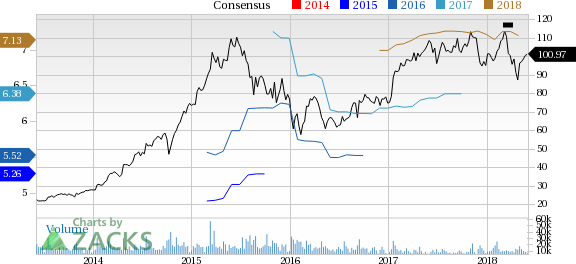

Skyworks Solutions, Inc. Price and Consensus

Skyworks Solutions, Inc. Price and Consensus | Skyworks Solutions, Inc. Quote

VGM Scores

At this time, SWKS has a nice Growth Score of B, though it is lagging a lot on the momentum front with a D. However, the stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than growth investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. Notably, SWKS has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Skyworks Solutions, Inc. (SWKS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research