Sleep Number (SNBR) Falls on Q2 Earnings Miss, Raises View

Sleep Number Corporation SNBR recently reported second-quarter fiscal 2021 (ended Jul 3, 2021) results, wherein earnings and revenues missed the Zacks Consensus Estimate. The company acknowledges that unprecedented demand growth combined with global supply chain disruption limited its second-quarter deliveries. Following the announcement, shares of the company dropped 10.9% in the after-hour trading session on Jul 20.

However, the top and the bottom line increased significantly on a year-over-year basis owing to robust consumer demand for sleep number 360 smart beds.

Earnings & Revenue Discussion

Sleep Number reported adjusted earnings of 88 cents per share, missing the Zacks Consensus Estimate of $1.11 per share by 20.7%. However, the bottom line improved substantially from a loss of 45 per share reported in the year-ago quarter.

Net sales of $484.3 million missed the consensus mark of $510.3 million by 5.1%. However, the top line grew 70% year over year mainly on strong consumer demand for smart beds and increased delivery volumes.

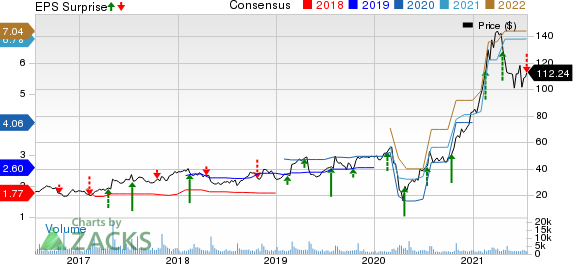

Sleep Number Corporation Price, Consensus and EPS Surprise

Sleep Number Corporation price-consensus-eps-surprise-chart | Sleep Number Corporation Quote

Robust Stores Sales and Comps

During the second quarter of fiscal 2021, the company’s retail comparable-store sales came in at 102% against a negative 40% in the year-ago quarter.

During the reported quarter, the company opened 26 stores and operated around 621 stores across the company. During the year-ago period, the company opened six stores and operated a number of 598 stores.

Meanwhile, Sleep Number reported average store sales of $3.5 million per store, up from $2.8 million per store reported a year ago.

Operating Highlights

Gross margin was 60.5%, up 330 basis points (bps) from the year-ago period.

Total operating expenses were 54.3% of net revenues compared with 61.5% in the year-ago quarter, reflecting an improvement of 720 bps. The upside was driven by robust top-line performance and the ongoing operational efficiencies achieved by the company.

Furthermore, the company reported operating margin of 6.1% against negative operating margin of 4.3% in the year-ago period.

Financials

As of Jul 3, 2021, Sleep Number had cash and cash equivalents of $2.2 million compared with $4.2 million at the end of Jan 2, 2021. Net cash provided by operations during the second quarter came in at $49.8 million, significantly up from $2.1 million in the prior-year period.

As of Jul 3, 2021, the company’s total debt (including capitalized operating lease obligations) came in at $958.1 million, up from $774 million at Jun 27, 2020-end.

The company’s free cash flow (on an adjusted basis) came in at $29.4 million against negative cash flow of $9.3 million in the year-ago quarter.

Fiscal 2021 Guidance

The company is optimistic about its business strength and raised its fiscal 2021 earnings guidance to at least $7.25 per share from the prior projection of at least $6.50 per share. This suggests a rise of not less than 58% from full-year 2020.

For fiscal 2021, the company expects operating cash flows to be higher than $300 million. It also anticipates capital expenditure at around $75 million. Meanwhile, the company expects an effective tax rate of 25% for the rest of fiscal 2021.

Zacks Rank

Sleep Number — which shares space with Bassett Furniture Industries, Incorporated BSET, WillScot Mobile Mini Holdings Corp. WSC and Leggett & Platt, Incorporated LEG in the Zacks Furniture industry — currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Leggett & Platt, Incorporated (LEG) : Free Stock Analysis Report

WillScot Mobile Mini Holdings Corp. (WSC) : Free Stock Analysis Report

Bassett Furniture Industries, Incorporated (BSET) : Free Stock Analysis Report

Sleep Number Corporation (SNBR) : Free Stock Analysis Report

To read this article on Zacks.com click here.