Small-Cap ETFs are Rally’s Missing Ingredient

The S&P 500 and Dow Jones Industrial Average are trading near record highs but the weak relative performance of small-cap stocks recently is a worrying sign for the bulls.

For example, the small-cap iShares Russell 2000 ETF (IWM) is down 1.4% for the trailing month while the S&P 500 has gained 1.3%.

This divergence means small-cap stocks have not been confirming the recent S&P 500 move higher, according to the Charts etc. blog.

“The Russell 2000 Index has been trending lower since mid-March, making lower highs as the S&P 500 made a new high and is trending higher. It doesn’t always hold true, but more often than not one wants to see smaller-cap stocks confirm the move of larger-caps,” the blog notes.

“An index like the S&P 500 is very top-heavy, reflecting the ups and downs of several mega-caps, whereas the Russell 2000 Index is a much flatter and more equal-weighted benchmark, offering a better representation of market breadth,” it adds. “The average stock is not doing as well as the S&P 500 would suggest — another potential red-flag.”

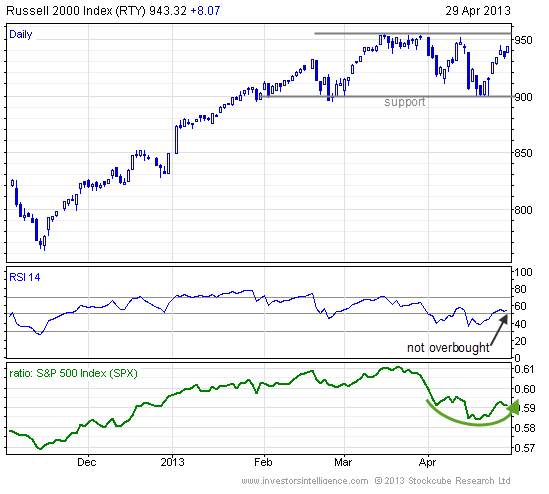

However, Investors Intelligence technical analyst Tarquin Coe points out that the Russell 2000 did bounce at an important support line this month.

“With momentum in a good field position, a breakout to new all-time highs is expected,” he wrote in a newsletter Monday. “The relative chart versus the S&P 500 is also rallying, with outperformance today.”

Full disclosure: Tom Lydon’s clients own IWM.