Is Smartpay Holdings' (NZSE:SPY) Share Price Gain Of 145% Well Earned?

Smartpay Holdings Limited (NZSE:SPY) shareholders might understandably be very concerned that the share price has dropped 39% in the last quarter. But that doesn't detract from the splendid returns of the last year. We're very pleased to report the share price shot up 145% in that time. So some might not be surprised to see the price retrace some. The real question is whether the business is trending in the right direction.

View our latest analysis for Smartpay Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

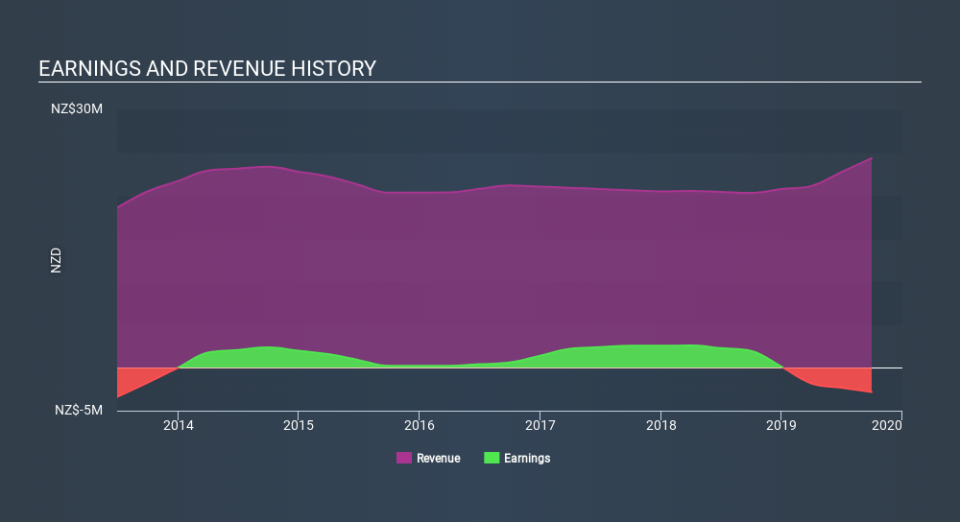

Over the last twelve months Smartpay Holdings went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. We might get a clue to explain the share price move by looking to other metrics.

However the year on year revenue growth of 20% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Smartpay Holdings's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Smartpay Holdings shareholders have received a total shareholder return of 145% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 17% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Smartpay Holdings better, we need to consider many other factors. Take risks, for example - Smartpay Holdings has 3 warning signs (and 1 which is potentially serious) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.