Smead Value Fund Sells Berkshire, Occidental Petroleum

The Smead Value Fund (Trades, Portfolio) manages a $949 million portfolio composed of 28 stocks. It sold shares of the following stocks during the second quarter of 2020.

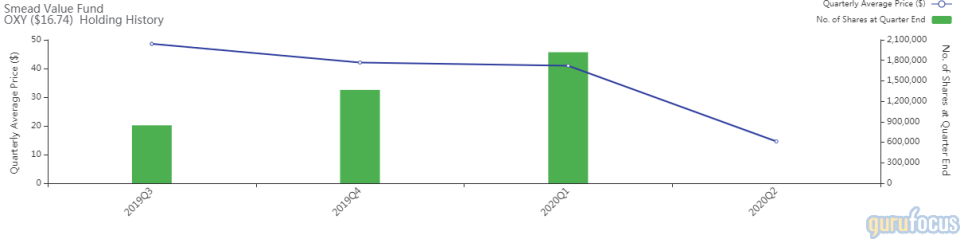

Occidental Petroleum

The fund exited its position in Occidental Petroleum Corp. (OXY). The trade had an impact of -5.42% on the portfolio.

The independent oil and gas exploration company has a market cap of $15.57 billion and an enterprise value of $63.05 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -13.35% and return on assets of -3.89% are underperforming 65% of companies in the oil and gas industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.05 is below the industry median of 0.38.

The largest guru shareholder of the company is Dodge & Cox with 12.86% of outstanding shares, followed by Carl Icahn (Trades, Portfolio) with 9.67% and Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway with 2.07%.

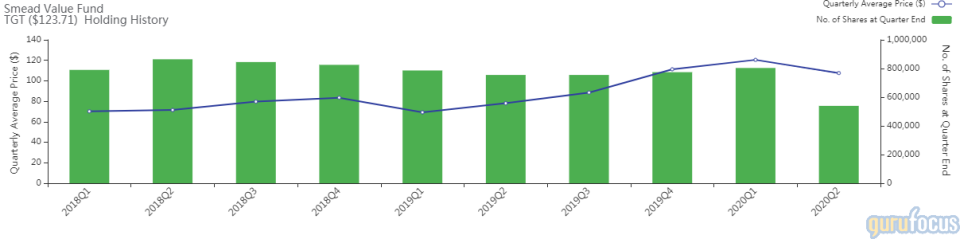

Target

The fund reduced its Target Corp. (TGT) stake by 32.87%. The portfolio was impacted by -2.35%.

The general merchandise retailer has a market cap of $61.86 billion and an enterprise value of $73.78 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 24.09% and return on assets of 6.49% are outperforming 81% of companies in the retail, defensive industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.28 is below the industry median of 0.34.

The largest guru shareholder of the company is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 1.40% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.16%.

Amgen

The fund's Amgen Inc.'s (AMGN) position was trimmed by 28.12%. The portfolio was impacted by -1.85%.

The biotechnology company has a market cap of $145 billion and an enterprise value of $169 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 74.21% and return on assets of 12.61% are outperforming 89% of companies in the drug manufacturers industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.25 is below the industry median of 0.87.

Some notable guru shareholders are PRIMECAP Management (Trades, Portfolio) with 3.14% of outstanding shares, Simons' firm with 0.64% and Richard Pzena (Trades, Portfolio) with 0.19%.

Walgreens Boots Alliance

The fund closed its position in Walgreens Boots Alliance Inc. (WBA), impacting the portfolio by -1.52%.

The retailer of pharmaceutical products has a market cap of $35.10 billion and an enterprise value of $75.64 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 3.28% and return on assets of 0.94% are underperforming 58% of companies in the healthcare providers and services industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.02 is below the industry median of 0.55.

Some notable guru shareholders are Tom Gayner (Trades, Portfolio) with 0.20% of outstanding shares and Pioneer Investments (Trades, Portfolio) with 0.09%.

Aflac

The investment fund closed its holding in Aflac Inc. (AFL). The trade had an impact of -1.45% on the portfolio.

The provider of health insurance in the U.S. and Japan has a market cap of $26.38 billion and an enterprise value of $28.99 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 10.57% and return on assets of 1.95% are outperforming 61% of companies in the insurance industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.61 is below the industry median of 2.28.

Another notable guru shareholder is John Rogers (Trades, Portfolio) with 0.22% of outstanding shares.

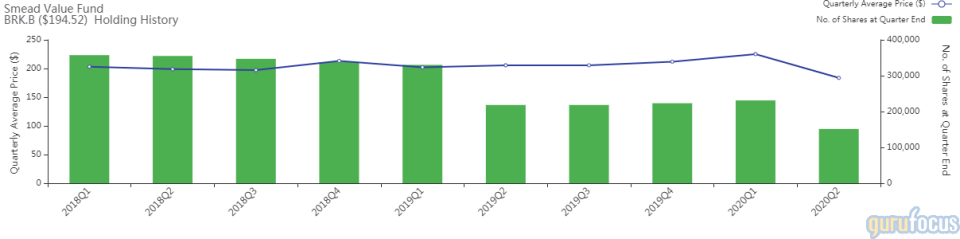

Berkshire Hathaway

The investment fund cut its Berkshire Hathaway Inc. (BRK.B) position by 34.49%. The trade had an impact of -1.42% on the portfolio.

The holding company has a market cap of $472 billion and an enterprise value of $537 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. While the return on equity of 2.57% is underperforming the sector, return on assets of 1.29% is outperforming 51% of companies in the insurance industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.41 is below the industry median of 2.28.

Some notable gurus shareholders are Tom Russo (Trades, Portfolio) with 0.23% of outstanding shares and Chris Davis (Trades, Portfolio) with 0.17%.

The Home Depot

The investment fund cut its holding in The Home Depot Inc. (HD) by 24.71%. The trade had an impact of -1.2% on the portfolio.

The home improvements retailer has a market cap of $285 million and an enterprise value of $318 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on assets of 20.64% is outperforming 98% of companies in the retail, cyclical industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.21 is below the industry median of 0.43.

Other notable shareholders include Ken Fisher (Trades, Portfolio) with 0.58% of outstanding shares and Pioneer Investments (Trades, Portfolio) with 0.49%.

Disclosure: I do not own any stocks mentioned.

Read more here:

The T Rowe Price Equity Income Fund Cuts JPMorgan

5 Utilities Outperforming the Market

Insiders Roundup: Mastercard, Eli Lilly

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.