Snap-on (SNA) to Report Q4 Earnings: What's in the Offing?

Snap-on Inc. SNA is scheduled to report fourth-quarter 2019 results on Feb 6, before the opening bell. In the last reported quarter, the global provider of professional tools, equipment, and related solutions delivered a positive earnings surprise of 0.7%. Moreover, its bottom line beat the Zacks Consensus Estimate over the trailing four quarters, delivering average positive surprise of 1.1%.

The Zacks Consensus Estimate for the company’s fourth-quarter earnings is $3.08, suggesting growth of 1.7% from the year-ago reported figure. The consensus mark for the same has been unchanged in the past 30 days. For fourth-quarter revenues, the consensus mark is pegged at $963.3 million, suggesting 1.1% growth from the prior-year reported figure.

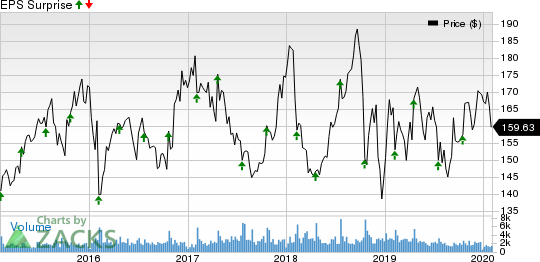

Snap-On Incorporated Price and EPS Surprise

Snap-On Incorporated price-eps-surprise | Snap-On Incorporated Quote

Key Factors to Note

Snap-on’s robust business model and focus on value-creation processes have been driving the company’s earnings performance. Backed by these efforts, it has been improving safety, quality of service, customer satisfaction and innovation. We expect the continuation of these trends to drive results in fourth-quarter 2019.

Moreover, benefits from the company’s growth strategy are likely to have aided the top and bottom lines in the to-be-reported quarter. Furthermore, the company’s Rapid Continuous Improvement program designed to enhance organizational effectiveness and efficiency as well as generate savings has been aiding margins.

However, headwinds across the company’s Tools Group division have been hurting top-line performance. Also, adverse impacts of currency have been weighing on Snap-on’s overall performance and segmental results.

What Our Model Suggests

Our proven model does not conclusively predict an earnings beat for Snap-on this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although the company has a Zacks Rank #3, its Earnings ESP of 0.00% makes surprise prediction difficult.

Stocks Poised to Beat Earnings Estimates

Here are some companies that you may want to consider as our model shows that these have the right combination of elements to post an earnings beat in the upcoming releases:

DISH Network Corporation DISH has an Earnings ESP of +1.94% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Adidas AG ADDYY has an Earnings ESP of +1.06% and a Zacks Rank of 3.

MGM Resorts International MGM has an Earnings ESP of +11.18% and a Zacks Rank #3.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGM Resorts International (MGM) : Free Stock Analysis Report

DISH Network Corporation (DISH) : Free Stock Analysis Report

Adidas AG (ADDYY) : Free Stock Analysis Report

Snap-On Incorporated (SNA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research