The Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (EPA:BAIN) Share Price Is Up 97% And Shareholders Are Holding On

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (EPA:BAIN) shareholders have seen the share price rise 97% over three years, well in excess of the market return (33%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 10%.

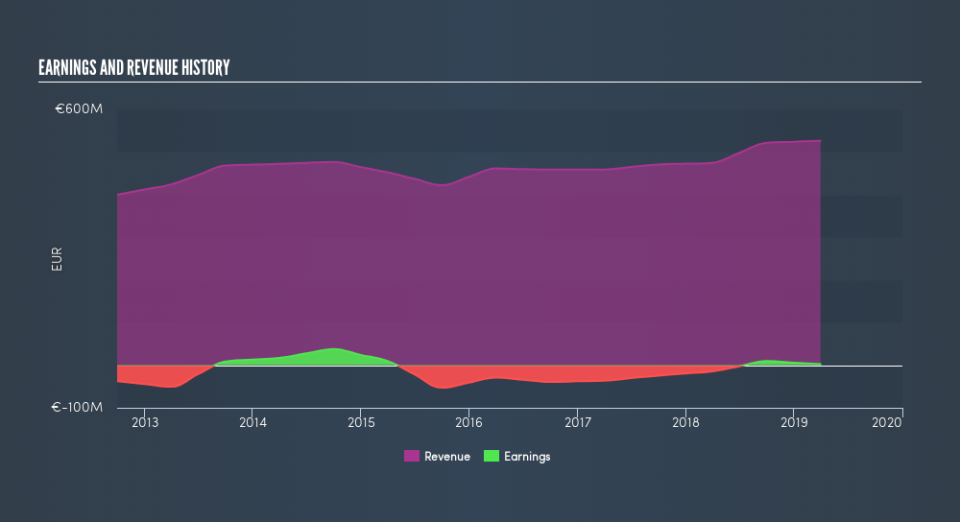

We don't think that Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's revenue trended up 5.1% each year over three years. Considering the company is losing money, we think that rate of revenue growth is uninspiring. The modest growth is probably broadly reflected in the share price, which is up 25%, per year over 3 years. The real question is when the business will generate profits, and how quickly they will grow. In this sort of situation it can be worth putting the stock on your watchlist. If it can become profitable, then even moderate revenue growth could grow profits quickly.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We've already covered Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco shareholders, and that cash payout contributed to why its TSR of 97%, over the last 3 years, is better than the share price return.

A Different Perspective

We're pleased to report that Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco shareholders have received a total shareholder return of 10% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 7.4% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.