Soft Demand to Hurt Hasbro's (HAS) Q2 Revenues & Earnings

Hasbro, Inc. HAS is scheduled to report second-quarter 2018 results on Jul 23, before the opening bell.

Not exempting the current fate of U.S. traditional toymakers, Hasbro is plagued by declining consumer demand and sales crunch for quite some time now. A look at Hasbro’s price trend reveals that the stock has had an unimpressive run on the bourses in the past year. Shares of the company have lost 14.5% against the industry’s rally of 27.3% in the same time frame. This reflects investors’ pessimism on the stock, given uncertain sales environment.

Meanwhile, despite testing waters with new distribution methods, the development of digital-play components and exploration of ventures with other industries, Hasbro is unable to revive sales post the Toys ‘R’ Us liquidation. In fact, owing to the liquidation, sales of Hasbro across every brand declined in the first quarter of 2018. We believe that the effect of this liquidation has lingered in the second quarter as well, as Toys “R” Us was the last major chain fully dedicated to selling toys.

Let’s take a look at the factors that are likely to have affected Hasbro’s results in the second quarter.

Stringent Demand Likely to Hurt Top Line

Hasbro is facing declining demand for products. Similar to most other traditional toymakers, the company has been fighting a broad array of alternative modes of entertainment including video games, MP3 players, tablets, smart phones and other electronic devices. Due to shift in demand patterns of kids, Hasbro’s revenues are pressurized and not likely to recover soon. In the first quarter of 2018, its net revenues declined 16% from the year-ago level. Also, the Zacks Consensus Estimate for second-quarter revenues is pegged at $844.2 million, suggesting a year-over-year decrease of 13.2%.

Rising Costs and Lower Revenues to Dent Earnings

Hasbro has been relying heavily on partnerships, mergers, product innovation and digital invention to revive sales. While such initiatives may aid profits in the long run, related costs would hurt the company in the near term. As it is, selling, distribution and administration expenses, as a percentage of net revenues, increased to 45.8% in the first quarter of 2018 from 28.7% in the prior-year quarter.

We believe that high cost of sales shall continue to weigh on the company’s margins and in turn affect earnings. Moreover, given an overall choppy top-line picture, earnings are likely to have declined in the to-be-reported quarter. In the first quarter, earnings declined 81.5% year over year. The consensus estimate for second-quarter earnings is pegged at 30 cents, reflecting a decline of 43.3% from the year-ago quarter.

Our Quantitative Model Predicts a Beat

Hasbro has the right combination of two main ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — that increases the odds of an earnings beat.

Zacks ESP: The company has an Earnings ESP of +1.11%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Hasbro has a Zacks Rank #3.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

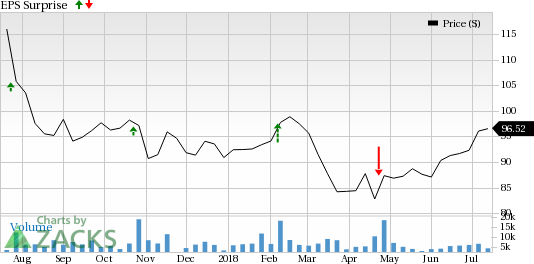

Hasbro, Inc. Price and EPS Surprise

Hasbro, Inc. Price and EPS Surprise | Hasbro, Inc. Quote

Other Stocks to Consider

Here are some other stocks from the Consumer Discretionary sector that investors may also consider, as our model shows that they have the right combination of elements to post an earnings beat in the to-be-reported quarter:

Netflix NFLX has an Earnings ESP of +0.21% and a Zacks Rank #3. The company is scheduled to report quarterly numbers on Jul 16. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Pool Corp POOL carries a Zacks Rank #2 (Buy) and has an Earnings ESP of +1.29%. The company is slated to report quarterly numbers on Jul 19.

Royal Caribbean RCL has an Earnings ESP of +9.10% and holds a Zacks Rank #3. The company is expected to announce quarterly numbers on Aug 7.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Pool Corporation (POOL) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research