Softer April Chinese Data Stunts Aussie Rebound; Retail Sales Meet Forecast

THE TAKEAWAY: CNY Fixed Assets Investments excl. Rural (APR) > +20.6% versus +21.0% expected, from +20.9% (y/y) > CNY Industrial Production (APR) > +9.3% versus +9.4% expected, from +8.9% (y/y) > CNY Retail Sales (APR) > +12.8% as expected, from +12.6% (y/y) > AUDUSD BEARISH

The major Chinese data for the week came in close enough to expectations to neither answer any lingering questions regarding the slowing growth picture nor to raise any new questions either. The good news about the set of April data: the Chinese consumer continues to strength, with Retail Sales growing by +12.8% y/y, in line with the consensus forecast provided by Bloomberg News. The bad news: Fixed Assets Investments excl. Rural expanded at a slower pace, at +20.6% y/y below +21.0% y/y; and Industrial Production grew by +9.3% y/y rather than +9.4% y/y.

The missed Industrial Production report falls in line with the continued deflation seen in the Producer Price Index, released last week. Generally speaking, there is a growing disconnect between trade data and consumption data, with significantly more of the burden falling on the consumer as time passes. For now, the strong Retail Sales report should counter the slight miss on the Industrial Production report, but it is an important miss nonetheless.

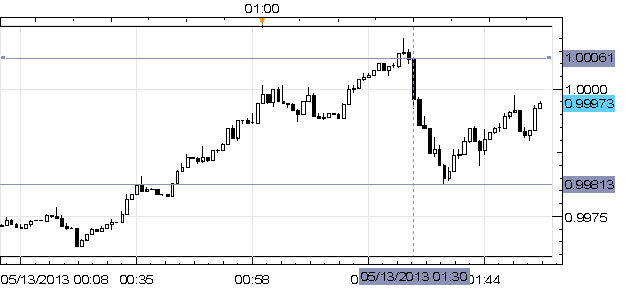

AUDUSD 1-minute Chart: May 13, 2013

Charts Created using Marketscope – prepared by Christopher Vecchio

Following the release, the AUDUSD dropped from $1.0006 to as low as 0.9981, before rebounding back to as high as 0.9999. At the time of writing, the AUDUSD was trading at 0.9997. Weakness was prevalent in the AUDJPY as well, which was exacerbated by a weaker USDJPY as well.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.