SolarEdge Call Buyers Could Triple Their Money By Next Month

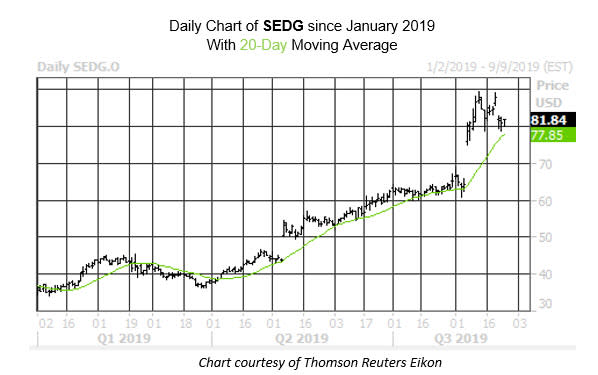

When we last checked in on SolarEdge Technologies Inc (NASDAQ:SEDG), the solar stock was under pressure from a rare bear note and C-suite shocker. Now, less than a week later, this pullback has brought SEDG near a trendline that could mark an attractive entry point for a bullish options trade.

More specifically, SolarEdge has pulled back to its 20-day moving average, which has proven to act as support over the past three years. According to Schaeffer's Senior Quantitative Analyst Rocky White, following the six other times the stock has tested support at this trendline during this time frame, it averaged a one-month return of 17.2%. A move higher of similar magnitude would put SEDG above $95 and at new record highs, based on it current perch of $81.84.

What's more, implied volatilities on the equity are at low levels. The equity's Schaeffer's Volatility Index (SVI) of 46% registers in the 20th percentile of its annual range. If the SVI holds steady around its two-year average over the next couple of weeks, White's modeling shows that an at-the-money SEDG call option could potentially return 200% on another expected bounce from support at the 20-day trendline. In other words, prospective call buyers could triple their money on a 17.2% gain in the shares.

Barring a dramatic pivot, SolarEdge stock will lock up its fifth straight monthly win this week. Since a Christmas Eve bottom at $32.42, SEDG has added 152%.

Some of this upside was likely sparked by short sellers heading for the exits. Short interest has halved since the Jan. 1 reporting period, yet still accounts for a healthy 11% of the security's total available float, or seven days' worth of pent-up buying demand, at the average pace of trading. An extended round of short covering could keep the wind at SEDG's back.