Can Solid European Sales Boost Inogen (INGN) in Q3 Earnings?

Inogen Inc.’s INGN third-quarter 2018 results are scheduled for release on Nov 6, after the market closes. Strong performance in the European markets is likely to drive the top line in the upcoming quarterly results. However, rental revenues are likely to decline.

Q2 Results at a Glance

Notably, in the last reported quarter, Inogen posted earnings per share of 65 cents, beating the Zacks Consensus Estimate by 47.7%. Earnings also improved a whopping 71.1% year over year. Revenues totaled $97.2 million, which outpaced the Zacks Consensus Estimate of $81.6 million. On a year-over-year basis, second-quarter revenues climbed 51.6%.

The company delivered average positive earnings surprise of 46.7% in the trailing four quarters.

Which Way are Estimates Treading for Q3?

For the quarter to be reported, the Zacks Consensus Estimate for revenues is pegged at $91 million, reflecting rise of 32% year over year. The Zacks Consensus Estimate for earnings is pegged at 52 cents per share, reflecting rise of 57.6% year over year.

Let’s delve into other factors, which are likely to impact Inogen’sthird-quarter 2018 results.

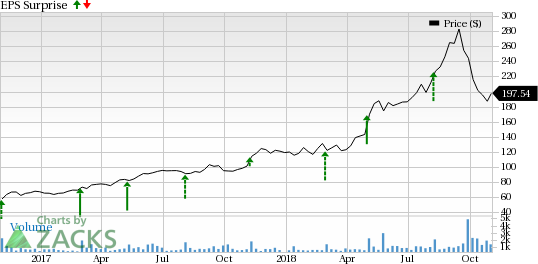

Inogen, Inc Price and EPS Surprise

Inogen, Inc Price and EPS Surprise | Inogen, Inc Quote

Factors to Influence Q3 Results

European Sales to Boost Top Line in Q3

Inogen’s strong operations team and supply chain in Europe is likely to be the key driver of third-quarter top line. Per management, Inogen’s core business-to-business sales will have a modest growth rate in the third quarter, with key focus in the European markets.

For investors’ notice, Inogen has been one of the leading providers of portable oxygen concentrators (POC) in Europe. In the last reported quarter, Europe contributed 88.3% to international sales, up from 87.6% in the year-ago quarter.

We expect the trend to continue in the upcoming quarterly results.

In fact, management expects long-term opportunity in the European zone as the market transitions from tank and liquid oxygen systems to non-delivery solutions. Not to forget, in the last reported quarter, Inogen received French reimbursement coverage for the Inogen One G4 platform.

Dull Rental Revenues

Inogen derives a significant portion of its revenues from Medicare’s service reimbursement programs. The company expects rental revenues per patient to decline in the third quarter due to lower reimbursement rates in connection with the nationalization of competitive bidding and continued reimbursement declines. Management expects rental revenues to decline around 10% in 2018 on a year-over-year basis.

Rental revenues represented 5.4% of Inogen’s total revenues in the second quarter of 2018. Notably, rental revenues totaled $5.3 million, reflecting a decline of 13.1% year over year.

What Our Model Predicts

Per our proven quantitative model, a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to deliver a positive earnings surprise. This is not the case here as you will see below.

Earnings ESP: Inogen has an Earnings ESP of +0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Inogen currently carries a Zacks Rank #2.

Please note that we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is witnessing negative estimate revision.

Stocks Worth a Look

Here are a few medical stocks worth considering as they have the right combination of elements to post an earnings beat in their upcoming quarterly results.

BioLife Solutions, Inc. BLFS has an Earnings ESP of +36.36% and a Zacks Rank #3.

ICU Medical, Inc. ICUI has an Earnings ESP of +8.65% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

OraSure Technologies, Inc. OSUR has an Earnings ESP of +4.76% and a Zacks Rank #2.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Inogen, Inc (INGN) : Free Stock Analysis Report

OraSure Technologies, Inc. (OSUR) : Free Stock Analysis Report

ICU Medical, Inc. (ICUI) : Free Stock Analysis Report

To read this article on Zacks.com click here.