Sonic (SAH) Lags Q3 Earnings Estimates, Raises Dividend by 12%

Sonic Automotive, Inc. SAH registered third-quarter 2022 adjusted earnings per share of $2.23, which missed the Zacks Consensus Estimate of $2.50. Lower-than-expected sales from the new and used vehicle, the EchoPark and the wholesale vehicle units, and lesser-than-expected gross profit from new vehicle and EchoPark segments led to the underperformance. Yet, the bottom line rose nearly 14% from $1.96 per share reported in the year-ago quarter. Total revenues amounted to $3,448 million, increasing 12%. However, the figure missed the Zacks Consensus Estimate of $3,590 million.

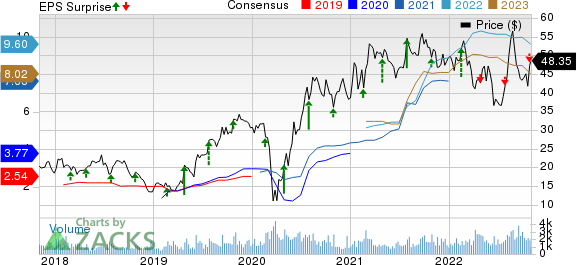

Sonic Automotive, Inc. Price, Consensus and EPS Surprise

Sonic Automotive, Inc. price-consensus-eps-surprise-chart | Sonic Automotive, Inc. Quote

Quarter in Detail

In the reported quarter, revenues from retail new vehicles increased 23% year over year to $1,405.1 million but missed the consensus mark of $1,583 million. Same-store unit sales volume fell 6% to 21,403, but gross profit per unit surged 28% to $6,443. Gross profit totaled $162 million, soaring 41% year over year but lagging the consensus mark of $164 million.

Revenues from the sales of used vehicles went up 3% from the prior-year level to $1,358 million but lagged the consensus mark of $1,570 million. Same-store unit sales decreased 12% to 23,043 in the quarter under review. Also, gross profit per unit came down 9% to $1,669. Gross profit totaled $45.4 million, declining 9% but topping the consensus mark of $42.36 million.

The EchoPark segment reported quarterly revenues of $607.8 million, reflecting an 8% decline from the year-ago figure and missing the consensus metric of $746 million. Its stores sold 15,422 used-vehicle units, down 27% on a year-over-year basis. The segment reported a record third-quarter gross profit of $48.6 million, up 88% on a year-over-year basis but lagging the consensus metric of $49.12 million.

Wholesale vehicle revenues rose 18% on a year-over-year basis to $114.7 million but missed the consensus mark of $118 million. Revenues from parts, services and collision repair were up 19% to $404.7 million and crossed the Zacks Consensus Estimate of $399 million. Finance, insurance and other revenues came in at $165.6 million, up 1% from the corresponding quarter of 2021. The metric beat the consensus estimate of $163 million.

Financials

Sonic had cash and cash equivalents of $139 million as of Sep 30, 2022, down from $299.4 million as of Dec 31, 2021. Long-term debt was $1,442.4 million, falling from $1,510.7 million recorded on Dec 31, 2021.

Selling, general and administrative expenses flared up 24% year over year to $399 million in the quarter. The board of directors approved a 12% increase to the company’s quarterly cash dividend, which amounted to 28 cents a share from 25 cents previously, payable on Jan 13, 2023, to all stockholders of record on Dec 15, 2022. During the third quarter of 2022, Sonic repurchased around 3.1 million shares of its Class A Common Stock for an aggregate purchase price of nearly $151.5 million. This leaves it with $481 million remaining under its share buyback authorization.

Zacks Rank & Key Picks

SAH currently has a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space are Cummins Inc. CMI, CarParts.com PRTS and Genuine Parts Company GPC, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Cummins has an expected earnings growth rate of 18.4% for the current year. The Zacks Consensus Estimate for CMI’s current-year earnings has been revised 1% upward in the past 30 days.

CarParts has an expected earnings growth rate of 45% for the current year. The Zacks Consensus Estimate for current-year earnings has remained constant over the past 30 days.

Genuine Parts has an expected earnings growth rate of 18.4% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 1.6% upward over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

Sonic Automotive, Inc. (SAH) : Free Stock Analysis Report

CarParts.com, Inc. (PRTS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research