Sonos' (SONO) Sustainable Business Focus Makes It a Key Pick

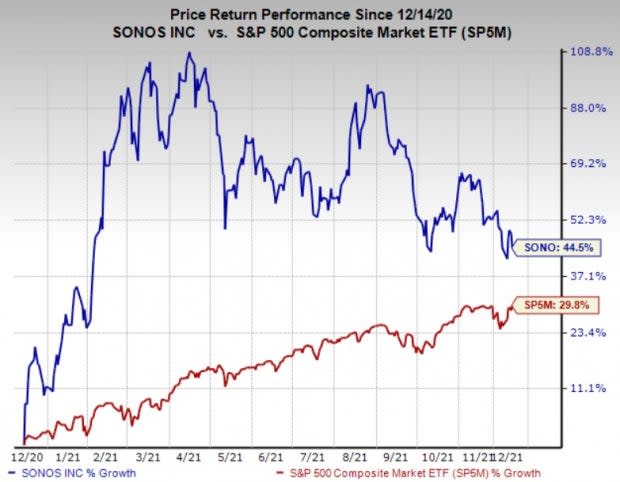

Shares of Sonos Inc. SONO have climbed 44.5% over the past year, driven by healthy revenues on the back of a flexible business model and solid market response for cost-effective solutions. Earnings estimates for the current and next fiscal year have increased 46.6% and 34.8%, respectively, over the past year, implying strong growth potential. Sonos has reaffirmed its commitments toward sustainable business practices to realize its goal of being carbon neutral by 2030 and achieving net-zero by 2040. With healthy fundamentals, this Zacks Rank #1 (Strong Buy) consumer and electronic equipment manufacturer appears to be a solid investment option at the moment.

Image Source: Zacks Investment Research

Growth Drivers

Headquartered in Santa Barbara, CA, Sonos is primarily involved in the manufacturing of smart speakers with immersive sound experience. The company leverages evolving consumer technology and entertainment trends to be on par with the audio consumption patterns of customers that are largely characterized by the fast-tracked adoption of voice assistants and streaming services.

Sonos is well-positioned to benefit from its proprietary software that serves as the backbone of Sonos sound system, making it different from other major players in the global market. The software enables an open platform for content partners with features like smart audio, multi-room experience and wireless home theater configurations. Moreover, it competes with the likes of established, audio-focused sellers of speakers and sound systems such as Bose, JBL and Harman International.

A wide customer base, significant market share, diversified product lines along with solid brand recognition act as driving force. Apart from its proprietary Sonos app and software platform, some of the primary competitive factors in the booming audio market that act as tailwinds are diligent customer support service, product quality and design, ease of setup and use, network technology, and price and wireless capabilities. Active patents and patent applications also form an integral part of Sonos’ business. It holds more than 1,000 issued patents, including design and utility. The company enters into various licensing agreements with third-party content partners so that its customers can get first-hand access to its diverse range of unique content.

Expansion of direct-to-consumer initiatives, extended partner ecosystem, continued launch of innovative products and services and augmented geographical footprint are some of the key elements of Sonos’ growth strategy. The company expects to develop its long-term business roadmap by tapping new customers while diversifying its international presence, especially in Asia. The company also anticipates expanding its presence in new regions, including underserved countries, over time on the back of country-specific distribution channels and marketing campaigns. Efforts to enhance its brand awareness in existing regions also remain one of Sonos’ top priorities.

Thanks to its dynamic business model, the company sells its products through more than 10,000 third-party physical retail stores. Sonos invests significantly in research & development (R&D) to keep itself abreast of the latest technology in hardware and software products, thereby expanding its capabilities in the global market. Dedicated audio, wireless and industrial design teams ensure that the products reflect a range of assembly architecture and proprietary manufacturing details, which empower it to be on par with evolving consumer preferences and industry trends. The company believes that its technological know-how and domain expertise, supported by the intellectual property rights of wireless multi-room and other audio technologies provide a competitive edge over its rivals.

Sonos is housed within the Audio Video Production industry, which carries a Zacks Industry Rank #72, which places it among the top 28% of more than 250 Zacks industries. The stock’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates encouraging prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1. Consequently, the stock appears to be an enticing investment option in the volatile market.

Other Key Picks

Another top-ranked stock in the broader industry is Clearfield, Inc. CLFD, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Clearfield delivered an earnings surprise of 50.8%, on average, in the trailing four quarters. Earnings estimates for the current year for the stock have moved up 68.2% since January 2021. Over the past year, Clearfield has gained a solid 146.5%.

GoPro Inc. GPRO, carrying a Zacks Rank #2, is another solid pick for investors. It has delivered an earnings surprise of 90%, on average, in the trailing four quarters.

Earnings estimates for the current year for the stock have moved up 42.4% over the past year. GoPro intends to transform itself from a “camera maker” to a ”content maker” and has taken significant steps to diversify into higher-margin businesses including video editing and virtual reality. Approximately 98% of about 800,000 GoPro cameras sold in the third quarter are above the $300 price tag, while its new Hero10 Black camera is also selling incredibly well despite a high price of $499.

Sierra Wireless, Inc. SWIR carries a Zacks Rank #2. It has a long-term earnings growth expectation of 12.5% and delivered an earnings surprise of 34.2%, on average, in the trailing four quarters.

Over the past year, Sierra Wireless has gained 15.5%. The company continues to launch innovative products for business-critical operations that require high security and optimum 5G performance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sierra Wireless, Inc. (SWIR) : Free Stock Analysis Report

GoPro, Inc. (GPRO) : Free Stock Analysis Report

Sonos, Inc. (SONO) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research