Southern Company (SO) to Post Q4 Earnings: Hit or Miss?

Electric utility firm Southern Company SO is set to release its fourth-quarter 2017 results before the opening bell on Wednesday, Feb 21. The current Zacks Consensus Estimate for the quarter under review is a profit of 46 cents on revenues of $5,410 million.

In the preceding three-month period, the Atlanta, GA-based service provider reported stronger-than-expected earnings due to robust performance of its wholesale unit and lower costs.

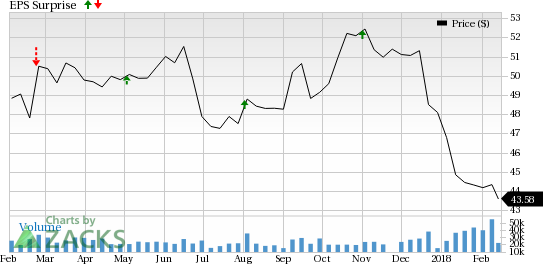

As far as earnings surprises are concerned, the utility is on a solid footing, having gone past the Zacks Consensus Estimate thrice in the last four reports. This is depicted in the graph below:

Southern Company (The) Price and EPS Surprise

Southern Company (The) Price and EPS Surprise | Southern Company (The) Quote

Investors are keeping their fingers crossed and hoping that Southern Company surpasses earnings estimate this time too. Let’s delve deeper and find out the factors impacting the results.

Factors to Consider This Quarter

A leading utility holding entity in the U.S., Southern Company dominates the power business across the Southeast. With a strong rate base growth and constructive regulation, we expect the firm to generate steady earnings.

Also, with operations in a stable and growing industry, Southern Company has a steady stream of cash flow. The utility’s history of consistent dividend payments indicates its confidence in itself.

We further believe that the AGL Resources acquisition will be accretive to Southern Company earnings.

However, with customer growth tepid and likely to remain so for some time, sales might be affected. This together with a large base, might make it difficult for Southern Company to manage rates. Higher operating and maintenance expenses is another concern.

The utility is also bearing the brunt of continued delays and cost overruns over two of its large construction projects — Vogtle and Kemper — which are again expected to weigh on Southern Company's fortunes.

Earnings Whispers

Our proven model does not conclusively show that Southern Company will beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to be able to beat consensus estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

That is not the case here as you will see below.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, for this company stands at +0.36%. A favorable Zacks ESP serves as a meaningful and leading indicator of a likely positive earnings surprise.

Zacks Rank: However, Southern Company’s Zacks Rank #4 (Sell), when combined with a positive ESP makes surprise prediction difficult.

As it is, we caution against Sell-rated stocks (Zacks Ranks #4 and 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

While earnings beat looks uncertain for Southern Company, here are some utilities you may want to consider on the basis of our model, which shows that they have the right combination of elements to post earnings beat this quarter:

CenterPoint Energy, Inc. CNP has an Earnings ESP of +2.65% and a Zacks Rank #2. The firm is expected to release earnings on Feb 22. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Public Service Enterprise Group Inc. PEG has an Earnings ESP of +0.72% and a Zacks Rank #2. The utility is anticipated to release earnings on Feb 23.

Edison International EIX has an Earnings ESP of +1.44% and a Zacks Rank #3. The utility is likely to release earnings on Feb 22.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Southern Company (The) (SO) : Free Stock Analysis Report

Edison International (EIX) : Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research