Southern Copper: Is the Resilience Here to Stay?

Southern Copper Corp. (NYSE:SCCO) is a well-known copper mining player and integrated producer with mines, smelting and refining services in Peru and Mexico. Copper, molybdenum, zinc and silver are among the metals produced. It owns and operates several open-pit copper mines, including Toquepala, Cuajone, La Caridad and Buenavista, as well as a smelter and refinery in Peru. The company also runs a zinc refinery, five underground mines producing zinc, copper, lead, silver and gold and a coal mine producing coal and coke.

With copper prices being rock solid amid increasing demand, the company could be an interesting investment prospect at current levels. Let us take a closer look.

Macroeconomic outlook for copper

Copper is the world's third-most commonly used metal and is known to be a good conductor of electricity. Apart from electricity, copper has good thermal conductivity, corrosion resistance, ductility, recyclability and is non-magnetic. These properties allow it to be used in a variety of applications, including wires and cables, dynamos, transformers, motors, electromagnets, switches, communication cables and residential electrical circuits, among other things.

Demand for copper has recently increased due to the rise in popularity of electric vehicles. The increase in total global electronics and IT production is expected to boost demand for copper materials used in the electronics industry as well. As a result, copper prices have consistently been over $9,500 per metric ton since April 2021, though, as per Knoema research, they should fall to around $7,500 by the end of 2022 due to their cyclical nature. However, its long-term prospects are strong given the increasing demand.

Recent financial performance

Southern Copper started off 2022 on a positive note. The company reported a top line of $2.76 billion for the first quarter of the year, which ended March 31. It showed 9.13% top-line growth as compared to the $2.53 billion in revenue reported in the corresponding quarter of 2021. The company beat the analyst consensus estimate of $2.72 billion. A key factor for the revenue growth was the fact that copper prices, as per the London Stock Exchange, increased by 18% in the first quarter of 2022, from an average of $3.85 per pound in the first quarter of 2021 to $4.53 per pound.

Revenue translated into a gross margin of 62.77% and an operating margin of 53.19%, which was lower than in the same quarter of last year. The company reported net income of $784.70 million and its adjusted earnings per share of $1.02 were below the analyst consensus estimate of $1.09. In terms of cash flow, Southern Copper reported $820.70 million in the form of operating cash flow and spent $124.90 million in investing activities during the previous quarter. It produced higher cash flows as compared to the same period in 2021.

The Espacularita and San Lorenzo mining campaigns

Southern Copper has begun systematic on-ground analysis at its Especularita copper-gold project in northern Chile's coastal metallogenic belt. The project consists of 19,076 hectares of exploration and mining businesses that have been granted or are being granted. The company also has the right to purchase a 100% interest in the project. Its exploration programs at Especularita will include regional to prospect-scale mapping, experimenting and geophysics work to detect prospects for targeted drilling operations.

Exploration is also continuing at the company's San Lorenzo project, with thorough mapping and sampling of monzonite interruptions. This work is progressing toward identifying potential targets for drilling, which scheduled to begin in the coming weeks.

Both, San Lorenzo and Espacularita are large-scale exploration projects in Chile that could result in a significant output for the company in the years to come.

Latin America challenges

The company does face challenges in the Latin American market on account of mounting political and social unrest that hampered operations. However, the rising metal prices have encouraged miners like Southern Copper to keep ramping up output.

Regardless, social unrest has halted several Peruvian operations of the company. Given the huge copper deposits in Chile and Peru and with global demand for the metal set to soar in the transition to a low-carbon economy, Southern Copper has no choice but to navigate through these challenges and keep growing its output. After protests forced Southern Copper to halt operations at Cuajone in late February, the company lowered its copper guidance for 2022. According to the company, the impact on production will be temporary, with growth expected next year.

Southern Copper also expects copper production to bounce back in 2023 to around 971,000 tonnes as it gets Peruvian production back on track and generate new production from Pilares and the Buenavista Zinc concentrator. The $310 million El Pilar copper project in Mexico is expected to start production in 2024. This could be another growth driver, assuming copper prices stay solid in the coming years.

Final thoughts

While broader markets, particularly high-growth tech plays, have taken a major beating on account of the rising interest rates, metals as a sector have been quite resilient and Southern Copper is no exception to this rule. The company's stock has been moving sideways for the past 6 months.

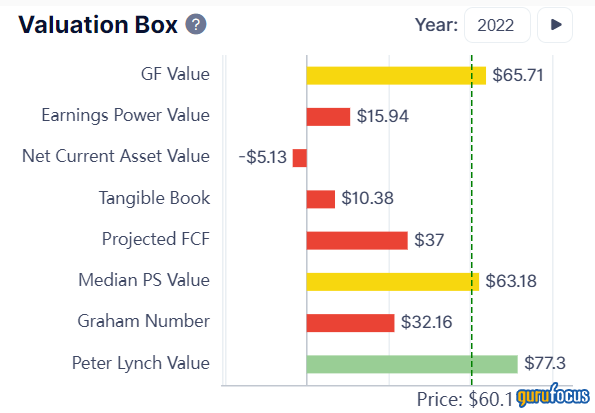

As a result, the stock is undervalued based on many of the valuation indicators in the Valuation Box above. The company is trading at an enterprise value-Ebitda of 9.53 and a price-earnings multiple of 13.79, which are more or less on par with its metals and mining peer group.

While the industry may be cyclical in nature, the macro for copper appears strong. Management also expects the demand to increase by 2% to 5% this year, especially in terms of copper consumption in the United States, which could be a positive sign even though consumption in China continues to be slow on account of the Covid-19 pandemic. Overall, investors who are interested in the stock can play it safe by accumulating on dips and holding to make the most of the robust long-term outlook for copper.

This article first appeared on GuruFocus.