Spain, Euro ETFs Tumble on Cyprus Bailout Fears

The iShares MSCI Spain (EWP) dropped more than 5% to lead European exchange traded funds lower Monday on worries the Cyprus model of taxing bank deposits could be used in any future bailouts in the region.

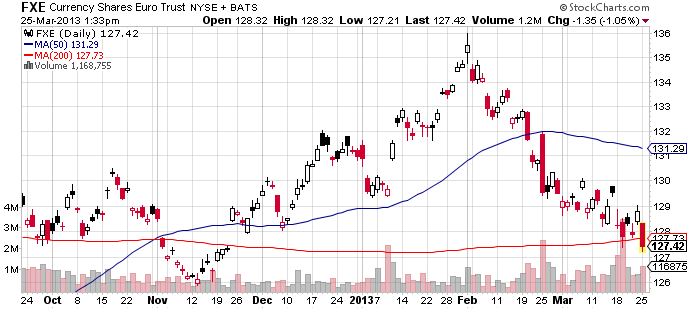

In currency markets, CurrencyShares Euro Trust (FXE) slipped over 1% to trade below its 200-day moving average, a level it hasn’t closed under since November 2012.

Jeroen Dijsselbloem, who heads the Eurogroup of euro zone finance ministers, told Reuters the Cyprus bailout deal could be a new template for resolving euro zone banking problems.

“The fire in Europe hasn’t been completely put out, though it has been tapered,” said John Carey, portfolio manager at Pioneer Investment Management, in the article. “There would be some unease if these problems persisted or got out of control.”

The euro currency ETF fell to a four-month low following reports Cypriot lawmaker Nicholas Papadopoulos said exiting the common currency should be considered following the bailout.

“What people are more worried about, which is really deterring people from going back into the euro zone in size, is the fact that a lot of trust has been broken,” Geoffrey Yu, a senior currency strategist at UBS, told Bloomberg News. “People are wary about the future of the euro at this point because of the precedents that have been established.”

“I think that there’s going to be a bitter aftertaste on the part of small depositors, not only in Cyprus but possibly in Greece and Spain,” added Alan Gayle, senior strategist at RidgeWorth Capital Management, in a separate Bloomberg story.

iShares MSCI Spain

CurrencyShares Euro Trust

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.