Spotify and the jobs report — What you need to know for the week ahead

The first quarter has come to a close.

And after an eventful three months for investors, the S&P 500 broke a nine-quarter winning streak after sustaining a 1.2% decline to kick off what Wall Street analysts expected to be another strong year for the stock market.

The Dow also lost ground in the first quarter, dropping 2.5% while the tech-heavy Nasdaq, the source of so much market stress in the last couple weeks of March, actually posted a 2.3% gain to start the year.

And so while the losses or gains posted by the market may appear unremarkable in the longer run, the action along the way showed investors that this year will be different.

The S&P 500 dropped more than 4% in two separate weeks during the quarter and a 10% peak-to-trough drop in just a handful of trading days in early February showed that the easy ride enjoyed in 2017 will not be repeated, even if returns end up being strong this year.

In the week ahead, investors look to start April and the second quarter off with a more positive outlook.

The March jobs report on Friday will punctuate the typically crowded early-month economic data schedule while the earnings flow will be light. A speech from Federal Reserve chair Jerome Powell on Friday afternoon regarding the U.S. economic outlook will also feature on the economic calendar.

The big event from public markets this week will be the Tuesday debut of Spotify (SPOT), which will float shares in a direct listing on the New York Stock Exchange.*

Economic calendar

Monday: Markit manufacturing PMI, March (55.7 expected; 55.7 previously); ISM manufacturing, March (60 expected; 60.8 previously); Construction spending, February (+0.4% expected; 0% previously)

Tuesday: Auto sales, March (16.9 million vehicle pace annualized; 16.96 million vehicle pace previously)

Wednesday: ADP private payrolls, March (205,000 expected; 235,000 previously); Markit services PMI, March (54.3 expected; 54.1 previously); ISM non-manufacturing PMI, March (59 expected; 59.5 previously); Factory orders, February (+1.7% expected; -1.4% previously)

Thursday: Initial jobless claims (215,000 previously)

Friday: Non-farm payrolls, March (+189,000 expected; +313,000 previously); unemployment rate, March (4% expected; 4.1% previously); average hourly earnings, month-on-month, March (+0.3% expected; +0.1% previously); average hourly earnings, year-on-year, March (+2.7% expected; +2.6% previously); consumer credit balances, February (+$15.75 billion expected; +13.9 billion previously)

The earnings outlook

The first quarter is in the books. And for investors coming off a 2017 that saw strong returns and low volatility, it was certainly a shock to the system.

In the end, the Dow and the S&P 500 both lost ground while the tech-heavy Nasdaq posted gains even with the market’s March turn against the sector, with Facebook (FB) and Alphabet (GOOGL) each dropping more than 15% from their highs in just a few weeks.

This performance to start the year also has the Wall Street analyst community caught out, as most strategists forecasted another strong year for the market in 2018. (Though many analysts, we’d note, did call for higher volatility.)

A large part of this call for another strong year for the stock market was that while 2017’s rally hinged on the hopes of tax reform, 2018 would allow investors to enjoy the stronger earnings realized by corporations.

And despite the bruises taken by the market in the first three months of the year, this call remains intact.

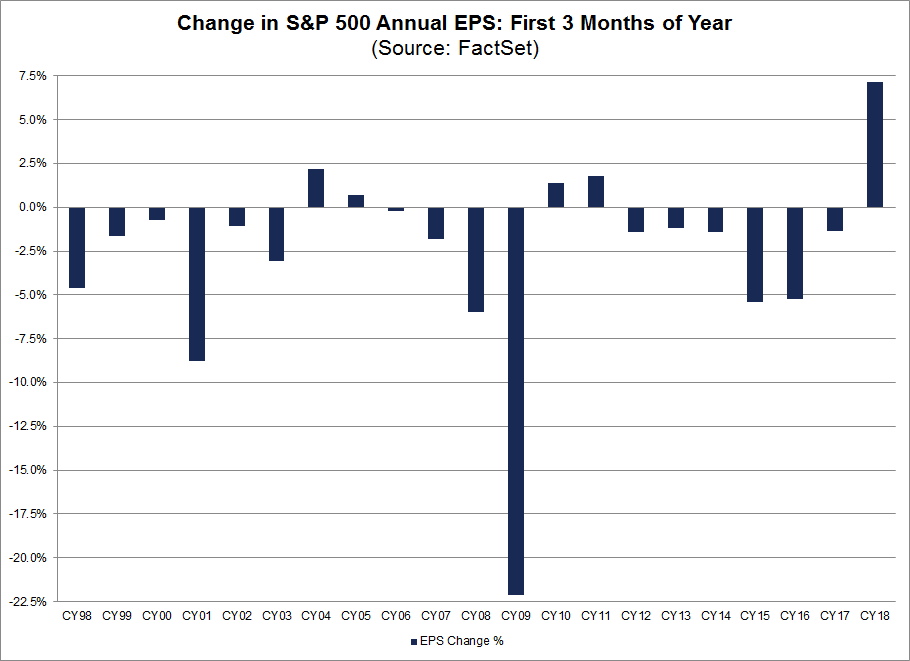

In the first quarter, bottom-up earnings estimates increased by 5.4%, according to data from FactSet. Typically, earnings estimates for a given quarter decrease as the quarter goes on.

“The

And in addition to increasing their forecasts for earnings in the first quarter, analysts have also raised their full-year earnings estimates by 7.1% since the beginning of the year, the largest increase for the index since FactSet began tracking this figure in 1996.

The fundamentals that analysts and investors so often refer as still being “supportive” of stocks, are, well, still supportive of stocks, and Wall Street expects this to remain the case through the balance of the year.

Now, earlier this year we highlighted work out of Bank of America Merrill Lynch which noted that strong earnings performance often comes in years when the market finishes in the red. This shows that expected earnings are more important to investors than realized earnings. The expectations of 2017, then, were a more useful stock price signal than the strong earnings results that are likely to be reported over the balance of 2018.

And so as we approach first quarter earnings season, keep in mind that the stellar results we see out of corporate America may not be enough to get investors excited about a market they fell out of love with in the first quarter of this year.

*NOTE: An earlier version of this post said Spotify would list on the Nasdaq. This has been corrected.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Trump’s trade moves put his favorite economic report card at risk

The Fed’s big message for markets — don’t worry about our forecasts

The Trump tax cut earned Warren Buffett’s Berkshire Hathaway $29 billion in 2017

Goldman Sachs says U.S. economic data right now is ‘as good as it gets’

One candidate for Amazon’s next headquarters looks like a clear frontrunner