How Sprouts Farmers (SFM) Looks Just Ahead of Q4 Earnings

Sprouts Farmers Market, Inc. SFM is scheduled to report fourth-quarter 2019 results on Feb 20, after the closing bell. This provider of fresh, natural and organic food products has a trailing four-quarter positive earnings surprise of 6.8%, on average. In the last reported quarter, the company reported positive earnings surprise of 10%.

After registering a bottom-line decline of about 18.5% in third-quarter 2019, Sprouts Farmers is likely to witness year-over-year fall in the fourth quarter. Notably, the Zacks Consensus Estimate for the quarter under review is pegged at 14 cents, which indicates a sharp decline of 26.3% from the year-ago quarter’s figure. We note that the Zacks Consensus Estimate has been stable in the past 30 days.

The Zacks Consensus Estimate for revenues stands at $1,356 million, which suggests an improvement of approximately 6.8% from the year-ago quarter. We note that total revenues of this Phoenix, AZ-based company had increased 8.4% in the last reported quarter driven by comparable store sales growth and robust performance in new outlets.

Key Factors

Sprouts Farmers’ focus on product innovation, improving customer experience and enhancing technology is likely to have contributed to the top line in the to-be-reported quarter. Notably, the company’s steps to provide hassle-free shopping through Sprouts.com website and mobile app have been commendable. Moreover, the company’s initiative to offer same-day delivery is likely to have expanded customer base.

Further, Sprouts Farmers is expanding ready-to-eat, ready-to-heat and ready-to-cook items. Apart from these, the company is expanding private-label offerings in departments under the Sprouts Market Corner Deli, The Butcher Shop at Sprouts and Sprouts Fish Market brands. Moreover, with fresh item management technology, the company is lowering operational complexity, optimizing production, improving in-stock position and reducing shrink.

All these endeavors are likely to have made a favorable impact on the fourth-quarter top line. In the last earnings call, management had guided net sales growth of 6.5-7.5% for the to-be-reported quarter.

However, any deleverage in SG&A and direct store expenses are likely to show on margins, and in turn, the bottom line. Analysts pointed that deleverage in SG&A expenses may be due to wage investment, expansion of home delivery program, increased training related with the fresh item management and other systems implementations, and rise in health and benefit costs. The company had projected earnings of 12-15 cents a share for the quarter under review. This indicates a decline from earnings of 19 cents a share posted in the prior-year period.

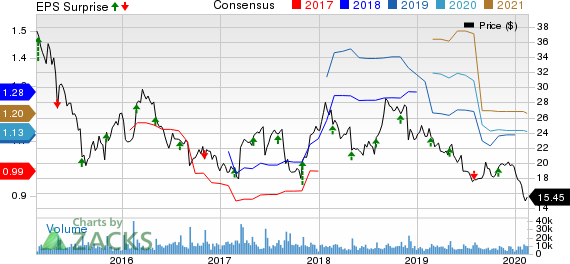

Sprouts Farmers Market, Inc. Price, Consensus and EPS Surprise

Sprouts Farmers Market, Inc. price-consensus-eps-surprise-chart | Sprouts Farmers Market, Inc. Quote

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Sprouts Farmers this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Sprouts Farmers carries a Zacks Rank #4 (Sell) and Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

3 More Stocks With a Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Burlington Stores BURL has an Earnings ESP of +0.36% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco COST has an Earnings ESP of +0.56% and a Zacks Rank #2.

Walmart WMT has an Earnings ESP of +0.70% and a Zacks Rank #3.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research