Square Root Recovery

By: Janus Henderson Investors

Harvest Exchange

October 26, 2017

Square Root Recovery

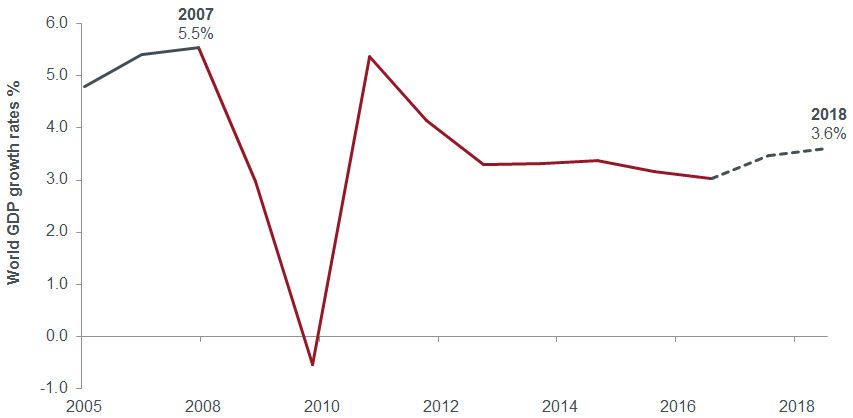

A decade on from the Global Financial Crisis, economic recovery has turned out to be both one of the weakest, and the longest, in modern history. John Pattullo shares his views on economic growth since the downturn, and into the future.

Remember 2009, when a year and a half after the worst financial crisis to hit the globe since the 1930s finally looked to be over, and economists had begun speculating over the likely shape of the recovery? The discussions turned emphatically alphabetical with various letters V, U, W and L thrown into the debate, and when they ran out of suitable letters, squiggly mathematical symbols (notably George Soros’ inverted square root sign) would do nicely.

Nearly eight years on, disappointingly, economic recovery has turned out to be both one of the weakest, and the longest, in modern history, with many bumps along the way.

In the U.S., where economic recovery began earlier than the rest of the developed world, growth has been uneven, both geographically and through the years, and at levels only modest at best. Reaching its eighth year and 96th month on June 30, this has been one of the longest economic cycles in the U.S., behind only two others — the 1960s (106 months) and the 1990s (120 months).

Nevertheless, there has been some positive news recently that the fairly tepid growth may have begun to accelerate. In October, the International Monetary Fund upgraded its forecasts for 2017 and 2018, stating that the world economy is gaining momentum, enjoying its most widespread growth since the temporary bounce back from the global recession in 2010.

However, many remain concerned that despite this benign short term outlook, the underlying growth dynamics in many advanced economies remain weak. This is based on low levels of investment, sluggish productivity and protectionist policies among other structural factors.

Today’s Alphabet Soup of Economic Recovery

Since the downturn, monetary policy efforts aimed at propelling economic growth have successfully brought about considerable asset price inflation, but very little wages or goods inflation. Did central bankers target the wrong sort of inflation?

The current economic expansion is a most unusual one. Different parts of the economy have displayed different shapes of recovery. Asset prices have had a V-shaped recovery, falling sharply but bouncing back even faster and continuing to rise. In fact equities seem to be reaching a new peak every day (widely referred to as “the most hated bull market ever”). The result has been more inequality in society with the rich getting richer and the poor, getting poorer; a situation exacerbated by new structural forces in the economy. One example is changes in the work force with a rapidly expanding new class of workers – the precariat – defined by the instability and insecurity of their jobs.

Productivity and real wages, which fell and failed to recover, exhibited a classic L-shape. Economic growth (as in gross domestic product, GDP), however, has taken on a square root shape.

As the chart shows, post the financial crisis the world economy collapsed, rebounded and has since almost plateaued.

A Square Root Recovery

Source: OECD (2017), "OECD Economic Outlook No. 101 (Edition 2017/1)", OECD Economic Outlook: Statistics and Projections (database). Dotted line represents forecasts for 2017 and 2018.

This has resulted in a dilemma for central banks. Numerous quantitative easing (QE) policies in the ten years since the financial crisis have failed to produce the desired inflation and growth environment. Lack of investment and productivity have contributed to the low growth pattern, while deteriorating demographics, deflationary effects of technology and behavioural changes in consumers have all contributed to the slow growth and low inflation world that we now live in. These factors are unlikely to disappear any time soon.

As a result, many tools used by central banks in gauging the economy and setting policy now look flawed, and with interest rates at such low levels, central bankers are facing the lobster pot problem, where they cannot get out of QE as easily as they assumed. The U.S. Federal Reserve has announced a very gradual tapering of its balance sheet while emphasising that rate hikes will be slow, gradual and data dependent, while the European Central Bank has also indicated a gradual tapering of its asset purchases. The emphasis is very much on the “gradual.”

Going Out with a Big Bang or a Whimper?

Despite the recent optimism on higher economic growth rates, given the fundamental picture of both short- and long-term structural factors that impede growth and inflation in today’s world, we believe, that we are likely to stay in the square root for a long time.

We also do not think that the economy will go out with a bang, but a whimper, and will continue to limp along for the foreseeable future. However, if there is another downturn, the underlying causes could be geopolitical, China-induced or from an asset price bubble, which could trigger a correction, but not, in our view, from an inflationary economic boom.

To read more insights from our experts,

Quantitative Easing (QE): A government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market

Originally Published at: Square Root Recovery