Standex's (SXI) Enginetics Divestment to Aid Operating Margin

Standex International Corporation SXI yesterday announced that it divested Dayton, OH-based Enginetics Corporation to Enjet Aero, LLC. The transaction, valued at $11.5 million in cash, is believed to be consistent with Standex’s long-term growth strategy.

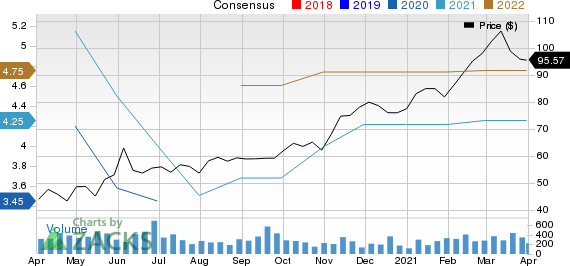

It is worth noting here that Standex’s shares decreased 1.11% yesterday, ending the trading session at $95.57.

The privately held Enjet Aero specializes in making components for use in both military and commercial aircraft engines. Also, it provides jet engine assemblies. Its prime customer base includes original equipment manufacturers in the defense and aerospace industry. Enjet Aero is headquartered in Overland Park, KS.

Inside the Headlines

As noted, Standex’s subsidiary Enginetics engages in the manufacturing and supplying of precision components. Its customers include manufacturers of aircraft engines and system integrators as well as engine manufacturers’ Tier 1 suppliers. Notably, Enginetics’ revenues totaled $9 million in the first three quarters of fiscal 2021 (ended March 2021, results are awaited).

Prior to the divestment, Enginetic’s results were integrated with Standex’s Engineering Technologies Group. The transaction will allow Engineering Technologies Group to strengthen its core business (spin forming solutions) in the defense, space and commercial aviation markets.

The divestment is anticipated to immediately boost Standex’s operating margin. Also, the sell-off is expected to result in transaction costs (pre-tax) of $14.5-$15.5 million in third-quarter fiscal 2021. Charges related to intangible assets and goodwill are expected to be $13 million.

Standex’s Inorganic Initiatives

The above-mentioned transaction is consistent with Standex’s policy of acquiring businesses or divesting non-core assets to improve its growth opportunities.

In addition to the above-mentioned transaction, Standex’s inorganic actions include the acquisition of Florida-based Renco Electronics so far in fiscal 2021 (ending June 2021). This buyout helped in strengthening Standex’s geographical presence, product offerings, and technical and engineering capabilities.

Notably, the Renco Electronics buyout boosted the Electronics segment’s revenues by $6 million in the third quarter of fiscal 2021.

In fiscal 2020 (ended June 2020), the company acquired Michigan-based Tenibac-Graphion Inc. The buyout was added to the Engraving segment. Also, Standex divested its Refrigerated Solutions Group in the year.

Zacks Rank, Price Performance and Estimate Trend

Standex, with $1.2-billion market capitalization, currently carries a Zacks Rank #3 (Hold). The company is poised to benefit from strengthening end markets, cost-saving actions and inorganic movements. However, revenue and margin weakness in the Engraving segment due to project timing and geographical mix issues might be concerning in the near term.

In the past three months, the company’s shares have gained 27.2% compared with the industry’s growth of 89.2%.

Also, the Zacks Consensus Estimate for its earnings per share is pegged at $1.06 for fourth-quarter fiscal 2021 (ended March 2021, results awaited), marking a decline of 5.4% from the 60-day-ago figure.

Standex International Corporation Price and Consensus

Standex International Corporation price-consensus-chart | Standex International Corporation Quote

Further, the consensus estimate is at $4.26 for fiscal 2021 (ending June 2021) and $4.76 for fiscal 2022 (ending June 2022), suggesting increases of 0.9% and 0.4% from the respective 60-day-ago figures.

Stocks to Consider

Some better-ranked stocks in the industry are EnPro Industries, Inc. NPO, Chart Industries, Inc. GTLS and Applied Industrial Technologies, Inc. AIT. While both EnPro and Chart Industries currently sport a Zacks Rank #1 (Strong Buy), Applied Industrial carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for these stocks have improved for the current year. Further, earnings surprise for the last reported quarter was 143.14% for EnPro Industries, 28.95% for Applied Industrial and 58.75% for Chart Industries.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

EnPro Industries (NPO) : Free Stock Analysis Report

Standex International Corporation (SXI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research