Staples Stocks, ETFs Again Look Pricey

Considering it is allegedly a slow-moving group, the consumer staples sector has had action-packed 2014.

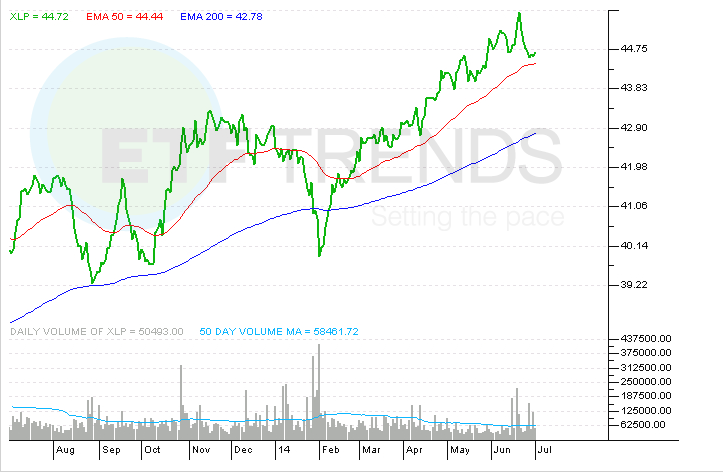

The sector was noticeable laggard at the start of the year with the Consumer Staples Select Sector SPDR (XLP) , the largest staples ETF, tumbling almost 6% before bottoming on Feb. 3. Year-to-date, XLP is up 5.4%, aided by a second-quarter gain of about 4.5%. [Problems for Staples ETFs]

The sector’s rebound has been undoubtedly impressive, but the downside is valuations are looking somewhat frothy, a scenario that should be ignored because staples often trade at a premium to the broader market.

“The sector’s P/E multiple has expanded considerably since the financial crisis, outpacing the recovery in multiples for the broader S&P500, and it remains at the top end of that range. As a result we think Consumer Staples is less attractive than the S&P500 going forward,” according to a new research note from AltaVista Research.

AltaVista rates XLP underweight, though that is not the equivalent of a sell rating. Funds rated overweight by AltaVista “consist of stocks trading at relatively expensive valuations and/or having below-average fundamentals,” according to the research firm. It appears the underweight rating on XLP is a valuation call.

The $6.9 billion XLP allocates over 29% of its combined weight to Dow components Procter & Gamble (PG), Coca-Cola (KO) and Wal-Mart (WMT).

Some investors have been stepping into staples names as others depart. In the first quarter, hedge funds reportedly liquidated almost $550 million in staples positions, but XLP pulled in over $1 billion in new assets in the second quarter, making it one of the best sector ETFs in terms of second-quarter flows. [Staples ETFs Become Market Leaders]

There is potential for further multiple expansion as sales increase in the back half of this year.

“Sales growth is forecast to pick up this year and next, which could translate into even faster earnings growth as margins tick upward,” according to AltaVista.

Consumer Staples Select Sector SPDR

Tom Lydon’s clients own shares of Coca-Cola and P&G.