Starbucks' Food Strategy Has Some Drawbacks

A breakfast sandwich goes well with your morning cappuccino or latte, and that pairing provides an obvious opportunity for Starbucks (NASDAQ: SBUX) to improve core operating metrics like customer traffic and average transaction size.

The coffee titan's new bakery options are already contributing to sales growth while giving the management team confidence as they prepare to roll out an expanded lunch program.

Food sales come with some big trade-offs, though. A few of these drawbacks showed up in the company's most recent earnings release, which was marked by a sharp drop in profitability.

Let's take a closer look.

Image source: Getty Images.

The good news

Starbucks credited food sales with helping the company hit its (reduced) sales growth forecast this quarter. In fact, strong demand for breakfast offerings meant that food delivered roughly half of its 2% comparable-store sales growth in the core U.S. market. Dunkin' Brands (NASDAQ: DNKN), by contrast, saw its comps decline slightly in the period.

The food segment is taking up a bigger portion of Starbucks' overall business, too. After food rose to 20% of sales last year, it ticked up to 21% in the first quarter of fiscal 2018 and hit another record of 22% this quarter. That rate should climb even more as the company attacks lunch in a bid to boost traffic outside of its peak early-morning hours.

The bad news

Food products like its hit Sous Vide Egg Bites and breakfast sandwiches, particularly, require additional equipment, ingredients, and labor, which makes them more expensive to produce than coffee drinks. There's a significant waste component involved, too, as Starbucks gets rid of food that goes past its strict internal guidelines for freshness.

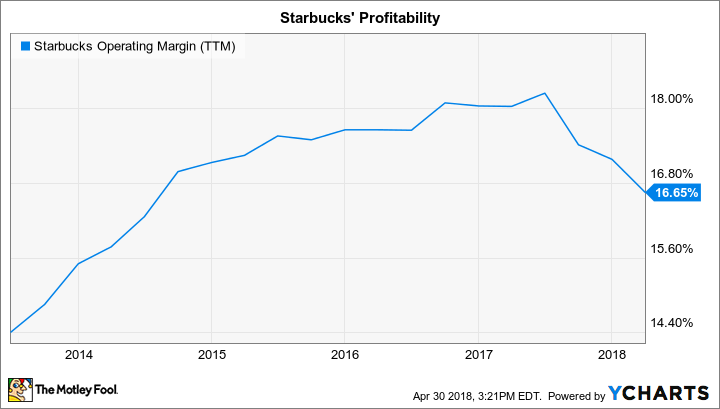

SBUX Operating Margin (TTM) data by YCharts.

All these challenges combined to send costs higher and push profitability down by almost 2 full percentage points, to 16% of sales, this past quarter. The profit pinch was even more pronounced in the U.S. segment, where operating margin dove to 20% of sales from 22.2% a year ago.

Leading with beverages

Starbucks is aiming to get cost trends lower over the next few quarters, in part thanks to reduced waste expenses, which currently average about $500 million per year. Yet the coffee giant expects to take a step backward in overall profitability for the full 2018 year. That trend might continue into fiscal 2019 as its Mercato lunch platform rollout drives an even faster tilt toward food sales.

Image source: Getty Images.

Starbucks isn't losing sight of its coffee roots. Executives said in a conference call with Wall Street analysts that their strategy prioritizes beverages and then seeks to add food to those core drink orders.

"We want beverage to lead," Chief Operating Officer Rosalind Brewer explained, "and you see that in the second half of the year [where we'll] focus on our beverage business, [for example in] adding new cold items to complement the rest of the product lines."

"So, it's beverages, new beverages," Brewer continued, "marketing against those new beverages and then applying a food attach plan with that."

It makes sense for the company to center its strategies on its core competitive strengths of coffee and tea drinks. Yet food is becoming a more tempting growth avenue, and the shift toward edible products promises to change the Starbucks experience for customers. It also threatens to pressure investor returns at least until sales growth picks back up from its current 2% pace.

More From The Motley Fool

Demitrios Kalogeropoulos owns shares of Dunkin' Brands Group and Starbucks. The Motley Fool owns shares of and recommends Starbucks. The Motley Fool recommends Dunkin' Brands Group. The Motley Fool has a disclosure policy.