Steel Dynamics Closes Kentucky Electric Steel Assets Buyout

Steel Dynamics, Inc. STLD has closed the acquisition of all the assets of Kentucky Electric Steel for $5 million. The acquired assets include a rolling mill with annual capacity of 250,000 tons and are located outside of Ashland, KY.

Steel Dynamics intends to restart the operations of the rolling mill in November, which were closed earlier this year by the previous owner. Moreover, the plant will be operated as part of the company’s Steel of West Virginia (“SWVA”) operations that is located within 20 miles of Ashland. The buyout aids SWVA diversify products through the addition of flats and specialty alloy bars.

The company expects that complementary products to provide value to customers. It projects 100,000-150,000 tons of billets to be shipped annually from its long products steel mills, which will be further processed at the Ashland facility. This will provide higher through-cycle utilization and additional value-added capability for steel mills.

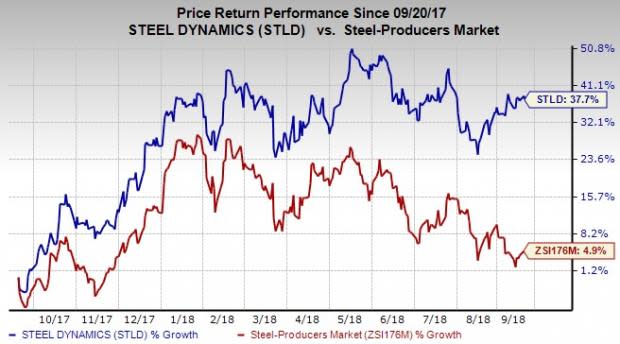

Shares of Steel Dynamics have rallied 37.7% in the past year, significantly outperforming the industry’s 4.9% rise.

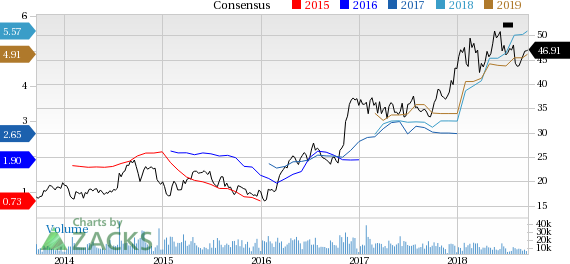

Steel Dynamics recently issued guidance for third-quarter 2018. The company expects earnings per share (EPS) in the range of $1.60-$1.64, including estimated charges of $13 million or 4 cents related to the Heartland buyout. Excluding these charges, adjusted earnings for the quarter is projected in the range of $1.64-$1.68.

The company expects profitability from steel operations to improve sequentially in the third quarter on the back of strong demand and significant metal spread expansion. Moreover, the average quarterly steel product pricing is likely to increase more than the average scrap costs across the steel platform. This is likely to boost the profitability for sheet and long product steel operations. It believes that market dynamics and steel consumption will remain strong, courtesy of customer optimism and strong steel demand fundamentals.

Steel Dynamics, Inc. Price and Consensus

Steel Dynamics, Inc. Price and Consensus | Steel Dynamics, Inc. Quote

Zacks Rank & Other Stocks to Consider

Steel Dynamics currently carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the basic materials space are Ingevity Corporation NGVT, Celanese Corporation CE and Trinseo S.A. TSE, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingevity has an expected long-term earnings growth rate of 12%. Its shares have moved up 69% in the past year.

Celanese has an expected long-term earnings growth rate of 10%. Its shares have gained 9.1% in the past year.

Trinseo has an expected long-term earnings growth rate of 12%. Its shares have returned 14.9% in a year.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Celanese Corporation (CE) : Free Stock Analysis Report

Trinseo S.A. (TSE) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

To read this article on Zacks.com click here.