Steel Dynamics Hikes Dividend, Approves $500M Share Buyback

Steel Dynamics, Inc.’s STLD board has increased the quarterly cash dividend and approved an additional share repurchase program.

The dividend of 25 cents per common share for the first quarter of 2020 announced by the board is 4% higher than the quarterly rate of the company in 2019. The increased dividend will be paid out on or about Apr 10, 2020, to shareholders of record as of Mar 31, 2020.

Apart from increasing the quarterly cash dividend, the board approved an additional share repurchase program worth up to $500 million of Steel Dynamics’ common stock. The authorization is effective immediately and is an addition to the company’s earlier $750-million program, which had $51 million remaining authorized and available for buyback as of Dec 31, 2019.

An increase in the dividend and additional share repurchase authorization demonstrate Steel Dynamics’ confidence in generating industry-leading strong free cash flow in both strong and weak market environments. Through profitable growth and using other available tools, the company is committed to delivering shareholder value. It also believes that the strength of its foundational capital structure, liquidity profile and operating model will provide it with the unique ability to strategically grow, while returning value to shareholders.

Shares of Steel Dynamics have lost 25.3% in the past year compared with the industry’s 29.4% decline.

On the fourth-quarter earnings call, the company said that it believes that the North American steel consumption will experience modest growth in 2020. This is likely to be supported by the end of steel inventory destocking and further steel import reductions. The company expects the recent trade actions to further lower unfairly traded steel imports into the United States.

Steel Dynamics also has upbeat views on its Sinton, TX-based flat roll steel mill project as well as the related long-term value it will create through its value-added products and geographic diversification. The company targeted regional markets that represent more than 27 million tons of relevant flat roll steel consumption. This includes the growing Mexico-based flat roll steel market.

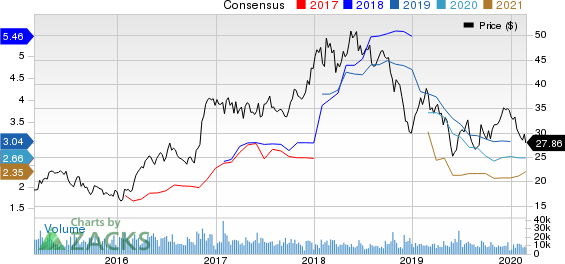

Steel Dynamics, Inc. Price and Consensus

Steel Dynamics, Inc. price-consensus-chart | Steel Dynamics, Inc. Quote

Zacks Rank & Stocks to Consider

Steel Dynamics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Daqo New Energy Corp. DQ, NovaGold Resources Inc. NG and Commercial Metals Company CMC.

Daqo New Energy has a projected earnings growth rate of 353.7% for 2020. The company’s shares have rallied 95.6% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NovaGold has a projected earnings growth rate of 11.1% for 2020. It currently carries a Zacks Rank #2 (Buy). The company’s shares have surged 135.3% year over year.

Commercial Metals currently has a Zacks Rank #2 and a projected earnings growth rate of 21.6% for 2020. The company’s shares have rallied 18.2% in a year.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

Novagold Resources Inc. (NG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research