Steel Dynamics (STLD) Expects Record Q4 Earnings on High Demand

Steel Dynamics, Inc. STLD announced fourth-quarter 2021 earnings guidance of $5.46-$5.5 per share, which suggests a record quarterly performance. It expects fourth-quarter adjusted earnings of $5.69-$5.73 per share.

The company’s third-quarter 2021 earnings were $4.85 per share, and adjusted earnings were $4.96 per share. Fourth-quarter earnings in the previous year were 89 cents per share and adjusted earnings were 97 cents per share.

Steel Dynamics expects sequentially higher profit in its steel operations in the fourth quarter, driven by strong underlying steel demand and metal spread expansion across the entire platform, which more than offset seasonally lower steel shipments. The company noted domestic steel demand remains robust with the automotive, construction, and industrial sectors continuing to lead the momentum.

Earnings from the company's metal recycling operations are projected to be in line with that reported in the third quarter on improved metal margins. Steel Dynamics also expects sequentially higher earnings for its steel fabrication operations in the fourth quarter on higher selling prices and near-record shipments which are anticipated to more than offset increased steel input costs. The company is seeing strength in the non-residential construction sector.

STLD bought back roughly $320 million of its common stock in the fourth quarter through Dec 14.

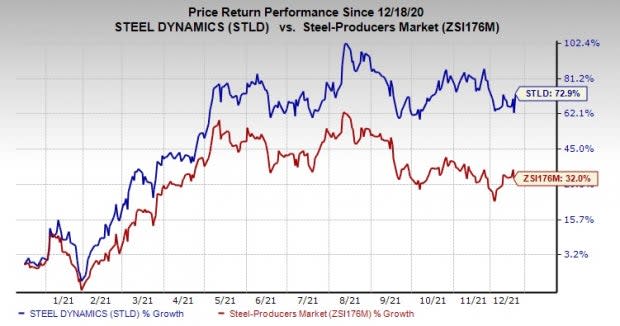

Shares of Steel Dynamics have gained 72.9% in the past year compared with a 32% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Steel Dynamics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Celanese Corporation CE, The Chemours Company CC and AdvanSix Inc. ASIX.

Celanese has an expected earnings growth rate of 139.5% for the current year. The Zacks Consensus Estimate for CE’s current-year earnings has been revised 8.7% upward in the past 60 days.

Celanese beat the Zacks Consensus Estimate for earnings in each of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 12.7%, on average. The stock has risen 23.1% in a year. CE currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chemours has an expected earnings growth rate of 105.1% for the current year. The Zacks Consensus Estimate for CC’s earnings for the current year has been revised 10% upward in the past 60 days.

Chemours beat the Zacks Consensus Estimate for earnings in the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 34.2%, on average. It has rallied 20.4% over a year. CC currently has a Zacks Rank #2.

AdvanSix has a projected earnings growth rate of 194.5% for the current year. The Zacks Consensus Estimate for ASIX’s earnings for the current year has been revised 5.9% upward over the last 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 46.9%. ASIX has rallied 124.9% in a year. It currently sports a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

AdvanSix (ASIX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research