Steer Clear of Philippines ETFs for Now

Philippines stocks continue to plunge on multiple concerns. Adding to the agony, a depreciating peso is bad news for foreign investors, as they calculate their returns in their home currency.

What is Pulling Down the Market?

Apart from global issues, multiple factors at home are impacting the markets negatively. Per a Philstar article, net foreign selling has amounted to 39 billion pesos so far this year. As a result, the markets moved drastically lower, thanks to high dependence on foreign investors.

Moving on to economic data, consumer prices increased 4.3% year over year in March, owing to the new tax reform law’s impact on food and oil prices. The Tax Reform for Acceleration and Inclusion (TRAIN) law does indeed reduced personal income taxes; however, it also increased the taxes on household products and fuel. The figure compared with 3.8% reading for February. Inflation crossed the central bank’s 2-4% target range. As a result, investors are worried about consumer spending taking a hit and economic growth being impacted negatively.

“We could still see more selloff as there are concerns in the market that consumer spending is getting hurt from the weaker peso and higher inflation," per a Bloomberg article citing Jonathan Ravelas, chief market strategist at BDO Unibank. “The optimism that consumer spending will pick up from the tax reform has been replaced by questions such as how much earnings will be hit by the weaker peso and higher oil prices," he added.

Adding to the agony of investors, a downgrade by foreign banks has further led to a reduction in attractiveness of these investments. Despite increasing inflation, the central bank has held on to rates. As a result, earlier in March, JPMorgan Chase & Co.'s equity strategy team downgraded the country to underweight. Foreign investment plays a pivotal role in determining an economy’s success. President Rodrigo Duterte's deadly war on drugs might be another factor keeping foreign investors at bay.

Adding to the woes, trade war fears on increasing tensions between Washington and Beijing also concern investors. Rising oil prices thanks to increased geopolitical worries is another factor unnerving investors (read: How is the Current Trade Scenario Impacting Asia ETFs?).

Let us now discuss the most popular ETF focused on providing exposure to Philippines equities.

iShares MSCI Philippines ETF EPHE

This fund seeks to provide exposure to Philippine stocks primarily in the large-cap segment.

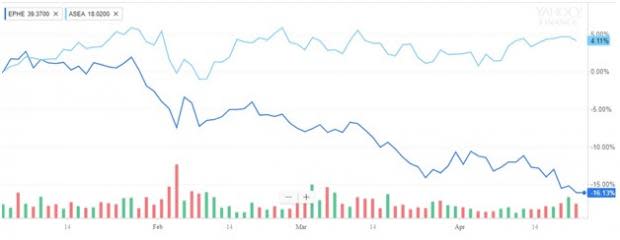

It has AUM of $144.6 million and charges a fee of 62 basis points a year. From a sector look, Financials, Real Estate and Industrials are the top three allocations of the fund, with 27.9%, 23.8% and 22.9% exposure, respectively. Ayala Land Inc, SM Prime Holdings Inc and BDO Unibank Inc are the top three holdings of this fund, with 9.7%, 9.2% and 8.5% exposure, respectively. The fund has lost 16.1% year to date and 8.8% in a year.

We will now compare the fund’s performance to a broader South East Asia based ETF, ASEA.

Global X Southeast Asia ETF ASEA

This fund provides broad exposure to the five members of the Association of Southeast Asian Nations, namely, Singapore, Indonesia, Malaysia, Thailand and the Philippines. It is appropriate for investors looking for diversified exposure to South East Asia.

ASEA is less popular with AUM of $21.5 million and charges a fee of 65 basis points a year. From a geographical perspective, the fund has 30.7% exposure to Singapore, 22.3% to Thailand, 21.4% to Malaysia, 19.1% to Indonesia and 6.5% to the Philippines. Financials, Telecommunication Services and Consumer Staples are the top three sectors of the fund, with a 47.9%, 13.7% and 7.9% allocation, respectively. DBS Group Holdings Ltd, Oversea-Chinese Banking Ltd and United Overseas Bank Ltd are the top three holdings of the fund, with an allocation of 9.1%, 7.7% and 6.5%, respectively. The fund has returned 24.8% in a year and 4.1% year to date.

Below is a chart comparing the year to date performance of the two funds.

Source: Yahoo Finance

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ISHARS-MS PHILP (EPHE): ETF Research Reports

GLBL-X SE ASIA (ASEA): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report