Stellar Demand, Tight Supply Aid Micron and These 3 Chipmakers

The semiconductor industry has been one of the rare beneficiaries of the pandemic and saw sales soaring on higher demand for consumer electronic goods. Moreover, several industry participants are struggling to meet the demand for microchips thanks to the tightness in supply. This trend will aid the semiconductor industry, which is poised to grow further in 2021.

For instance, Micron Technology MU, last week, raised its revenue and earnings guidance for second-quarter fiscal 2021, citing higher memory chip demand and tight supply as the main reasons.

What’s Driving Demand for Micron’s Memory Chips?

During a Morgan Stanley conference last week, the company’s CFO David Zinsner stated that surging sales of mobile phones and computers are fueling demand for its dynamic random access memory (DRAM) chips. He noted that elevated DRAM chip demand, coupled with tightness in supply, will make it difficult to meet orders for the rest of the year.

According to the latest forecast by Gartner, worldwide sales of smartphones will likely be up 11.4% year over year to 1.5 billion units in 2021. This suggests a sharp improvement from the 10.5% decline registered in 2020.

Gartner analyst Anshul Gupta noted that “The combination of delayed smartphone replacements and the availability of lower end 5G smartphones are poised to increase smartphone sales in 2021.” The global research and advisory firm stated that 5G smartphones will account for 35% of the total shipments this year.

Furthermore, the COVID-19 pandemic-induced lockdown and social-distancing measures are spurring demand for PCs and notebooks as more and more workers and students are now working and learning from homes.

Per the latest data released by Gartner, PC shipments in the fourth quarter of 2020 were up 10.7% year on year to 79.4 million units. For full-year 2020, shipments grew 4.8% to 275 million units.

The global health crisis has necessitated the use of PC systems, be it for remote work, web-based learning, video conferencing, video gaming, social media, consumer entertainment and streaming or online shopping.

Demand Trends to Boost Chip Sales

Micron’s upbeat Q2 outlook reflects an upbeat business environment for the microchip industry.

The latest demand trend for consumer electronic products will, undoubtedly, benefit other players in the industry too, including graphics or processor chip makers. Additionally, the companies, which provide design and other components for chip making, are anticipated to benefit from this trend.

According to the Semiconductor Industry Association (SIA), microchip sales are expected to climb 8.4% on a year-over-year basis in 2021. The SIA projects that sales will continue to soar as the supply shortage might last through the fourth quarter this year.

Remarkably, 2021 began on a high note with semiconductor sales jumping in January. Per the SIA, global semiconductor sales surged 13.2% in January to $40 billion from the prior year’s $35.3 billion. Also, on a month-over-month basis, sales inched up 1% from December’s total of $39.6 billion.

Long-Term Prospects Look Promising

Semiconductors are the backbone of the current-day technology-driven economy. The digitization across industries, adoption of cloud computing, as well as the integration of AI and machine learning are likely to fuel demand for semiconductors.

The accelerated deployment of 5G technology — the next-generation wireless revolution — is likely to propel further growth. Apart from this, blockchain, IoT, autonomous vehicles, AR/VR and wearables are other growth prospects.

What Should Investors Do?

Considering growth prospects of the chip makers, it makes sense to invest for long-term gains.

The memory-chip maker — Micron — currently flaunts a Zacks Rank #1 (Strong Buy).

Apart from Micron, there are much more attractive bets in the semiconductor industry. Here, we have taken the help of the Zacks Stock Screener to shortlist four stocks that are incredible for investments. These stocks carry a Zacks Rank #1 or #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Also, the stocks have a VGM Score of A or B. Per the Zacks’ proprietary methodology, stocks with such favorable combinations offer solid investment opportunities.

Stocks to Focus

Skyworks SWKS, a RF component supplier, is well positioned to benefit from the accelerated 5G deployment and demand spike for 5G handsets. In fiscal 2020, Apple accounted for 51% of Skyworks’ net revenues.

This Zacks Rank #1 company’s Sky5 product portfolio facilitated several 5G smartphone launches. In addition, Skyworks continues to gain component share Samsung, VIVO and Xiaomi apart from Apple.

Moreover, Skyworks’ diversified portfolio positions it solidly the to capitalize on momentum witnessed across telemedicine along with remote work, online learning, and video streaming, triggered by the coronavirus crisis.

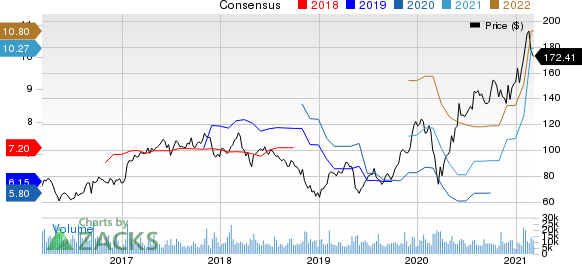

Notably, the Zacks Consensus Estimate for Skyworks fiscal 2021 earnings has moved up 36.6% to $10.27 per share over the past 60 days. It also has a VGM Score of B.

Skyworks Solutions, Inc. Price and Consensus

Skyworks Solutions, Inc. price-consensus-chart | Skyworks Solutions, Inc. Quote

Applied Materials AMAT is one of the world’s largest suppliers of equipment for the fabrication of semiconductor, flat panel liquid crystal displays, and solar photovoltaic cells and modules.

This Zacks Rank #2 company is poised to gain from strength in semiconductor equipment demand. Further, increased customer spending in foundry and logic on the back of rising need for specialty nodes in IoT, communications, automotive and sensor solutions is another positive.

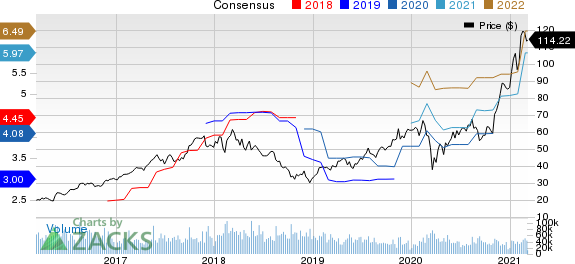

The stock has a VGM Score of A and the Zacks Consensus Estimate for fiscal 2021 earnings has moved 19.4% north over the past 30 days to $5.98 per share.

Applied Materials, Inc. Price and Consensus

Applied Materials, Inc. price-consensus-chart | Applied Materials, Inc. Quote

Qorvo QRVO is benefiting from the continued solid demand for ultra-high band front end modules (FEM) owing to the launch of next-gen 5G smartphones. Also, the company’s Bulk Acoustic Wave (BAW)-based multiplexers that enable advanced carrier aggregation are witnessing robust traction owing to their importance for the next-gen higher data-rate applications.

Furthermore, growing momentum for the company’s solutions in defense (advanced radars and other electronic warfare products) and connectivity (Wi-Fi 6) is a positive. Additionally, increase in work-from-home trends, owing to the COVID-19 pandemic, is driving demand for Wi-Fi 6, which is anticipated to boost revenues over the long run.

Qorvo currently carries a Zacks Rank #2 and has a VGM Score of B. The consensus mark for fiscal 2021 earnings has been revised upward by 9.2% to $9.45 per share in 60 days’ time.

Qorvo, Inc. Price and Consensus

Qorvo, Inc. price-consensus-chart | Qorvo, Inc. Quote

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research