Stericycle (SRCL) Q4 Earnings Miss on High Operating Costs

Waste management firm Stericycle, Inc. SRCL reported lackluster fourth-quarter 2017 results with year-over-year decrease in revenues and higher operating expenses. GAAP earnings for the quarter were $83.3 million or 97 cents per share compared with $12.7 million or 15 cents per share in the year-ago quarter. The year-over-year increase in GAAP earnings was primarily attributable to the favorable impact from the tax reform.

For 2017, GAAP earnings were $23.4 million or 27 cents per share compared with $178.2 million or $2.08 per share in 2016. Adjusted earnings for the reported quarter remained flat at $1.00 per share and missed the Zacks Consensus Estimate by 13 cents.

Revenues & Margins

Fourth-quarter revenues were $887.8 million, down 2.1% year over year and beat the Zacks Consensus Estimate of $881 million. Organic revenues for the quarter declined 2.6%. Acquisitions contributed $6.8 million to quarterly revenues while divestures reduced the same by $10.2 million. For 2017, revenues were $3,580.7 million compared with $3,562.3 million in 2016.

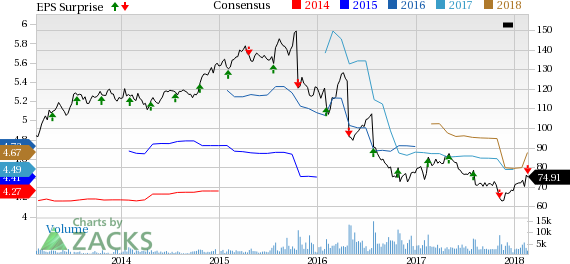

Stericycle, Inc. Price, Consensus and EPS Surprise

Stericycle, Inc. Price, Consensus and EPS Surprise | Stericycle, Inc. Quote

Revenues from the United States and Canada were $716.4 million, down 8.9% year over year while International revenues decreased 9.7% to $171.4 million. Regulated Waste and Compliance Services revenues declined to $497.7 million from $512.8 million. Secure Information Destruction Services revenues increased $17 million to $202.2 million. Communication and Related Services revenues decreased to $97.2 million from $112.4 million. Manufacturing and Industrial Services revenues declined $5.3 million to $90.7 million.

Gross profit (GAAP) in the reported quarter was $344 million, down 6.2% year over year. Gross margin was 38.7%, down from 40.5% in the prior-year quarter.

Acquisitions

During the reported quarter, Stericycle closed six tuck-in acquisitions (including five in the domestic market and one in the international market). The deals together contributed about $1 million to corporate revenues in the quarter.

Business Transformation Update

In concurrence with the quarterly results, Stericycle provided an update on the Business Transformation initiatives, which it began to execute during the fourth quarter to improve long-term metrics. As part of this strategic program, Stericycle aims to build the best-in-class EPM (enterprise performance management) operating model for higher efficiency, improved customer experience, effective utilization of future growth opportunities and greater control measures. Additionally, Stericycle intends to implement the ERP system, which will leverage standard processes throughout the organization to accelerate decision making, expedite integration, remediate compliance and control issues, and enable real-time analytics.

The key steps of the Business Transformation include:

• Portfolio Rationalization: This comprises a comprehensive review of the global service lines to identify and pursue the divestiture of non-strategic assets.

• Operational Optimization: This intends to standardize route planning logistics, modernize field operations and drive network efficiency across facilities for optimal utilization of resources.

• Organizational Excellence and Efficiency: This initiative aims to redesign the company’s organizational structure to optimize resources and align it according to a global shared business services model.

• Commercial Excellence: This aims to align the sales and service channels, standardize customer relationship management processes and expand customer self-service options.

• Strategic Sourcing: This would try to reduce expenses by leveraging organizational scale and through global procure-to-pay processes.

The Business Transformation initiatives are likely to result in a CAGR of 5-9% in adjusted EBITDA (earnings before interest, tax, depreciation and amortization) between 2018 and 2022 and 6% to 10% for adjusted EPS. Free cash flow is expected to record a CAGR of 10% to 14% during the same time period.

Financial Position

As of Dec 31, 2017, cash and cash equivalents were $42.2 million while long-term debt (net of current portion) was $2,615.3 million compared with respective tallies of $44.2 million and $2,877.3 million in the prior-year period.

Net cash from operating activities for 2017 was $508.6 million compared with $560.8 million in 2016. The debt-to-EBITDA ratio was 3.66 at the quarter end. Stericycle had an unused borrowing capacity of $597.5 million under its revolving credit facility. During the quarter, the company repurchased 65,000 mandatory preferred convertible shares for $3.4 million. At the end of the quarter, Stericycle had authorization to purchase additional 2.7 million shares.

Guidance

For 2018, Stericycle offered its guidance in accordance with the current market scenario. Adjusted earnings are currently expected in the range of $4.45-$4.85 per share on revenues of $3,480-$3,630 million and free cash flow in the range of $330-$400 million. Capital expenditure is projected to be in the range of $160-$180 million.

Zacks Rank & Key Picks

Stericycle has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader industry are Republic Services, Inc. RSG, Waste Connections, Inc. WCN, and Waste Management, Inc. WM, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Republic Services has a long-term earnings growth expectation of 10.2%. It delivered an average positive earnings surprise of 5.1% in the trailing four quarters, beating estimates in each.

Waste Connections has a long-term earnings growth expectation of 11%. It delivered an average positive earnings surprise of 5.2% in the trailing four quarters, beating estimates in each.

Waste Management has a long-term earnings growth expectation of 10.9%. It delivered an average positive earnings surprise of 0.9% in the trailing four quarters, beating estimates twice.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Stericycle, Inc. (SRCL) : Free Stock Analysis Report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

Waste Connections, Inc. (WCN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research