Sterling Bancorp (Southfield MI) (NASDAQ:SBT) Share Prices Have Dropped 61% In The Last Year

This week we saw the Sterling Bancorp, Inc. (Southfield, MI) (NASDAQ:SBT) share price climb by 14%. But that isn't much consolation to those who have suffered through the declines of the last year. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 61% in that time. The share price recovery is not so impressive when you consider the fall. You could argue that the sell-off was too severe.

View our latest analysis for Sterling Bancorp (Southfield MI)

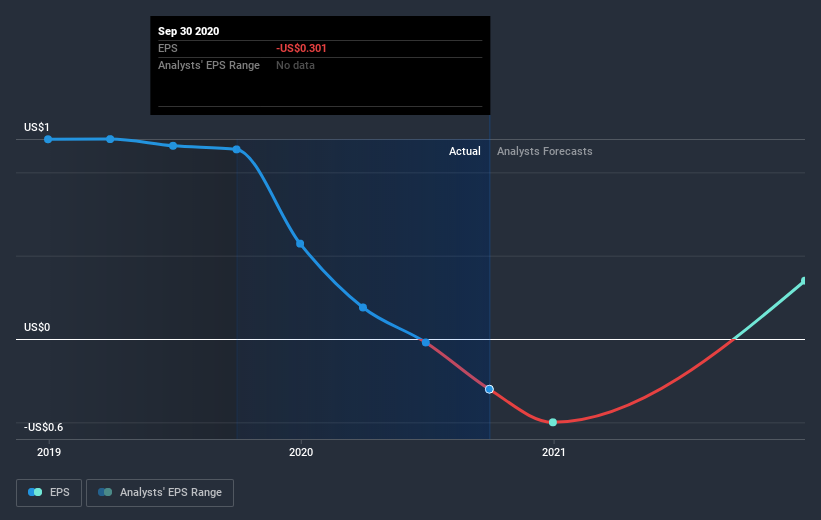

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Sterling Bancorp (Southfield MI) fell to a loss making position during the year. Some investors no doubt dumped the stock as a result. We hope for shareholders' sake that the company becomes profitable again soon.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Sterling Bancorp (Southfield MI)'s earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While Sterling Bancorp (Southfield MI) shareholders are down 61% for the year, the market itself is up 21%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 13% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.