Steven Cohen Plunges Into Paya Holdings

- By Sydnee Gatewood

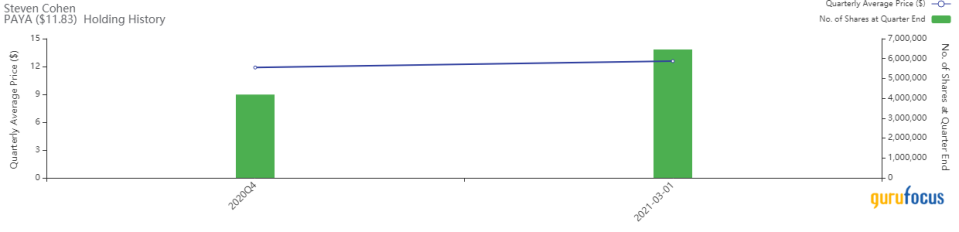

After establishing a stake in Paya Holdings Inc. (NASDAQ:PAYA) during the fourth quarter of 2020, Point72 Asset Management leader Steven Cohen (Trades, Portfolio) disclosed earlier this week he boosted it by 54.19%.

In an effort to generate superior risk-adjusted returns, the billionaire guru's Stamford, Connecticut-based firm invests in a wide range of asset classes worldwide. Its long-short strategy is based on bottom-up research processes focusing on fundamentals and macroeconomic conditions.

According to Real-Time Picks, a Premium GuruFocus feature, Cohen invested in 2.27 million additional shares of the Atlanta-based company on March 1, impacting the equity portfolio by 0.14%. The stock traded for an average price of $12.58 per share on the day of the transaction.

He now holds 6.45 million shares total, which represent 0.40% of the equity portfolio. Cohen has lost an estimated 2.49% on the investment so far.

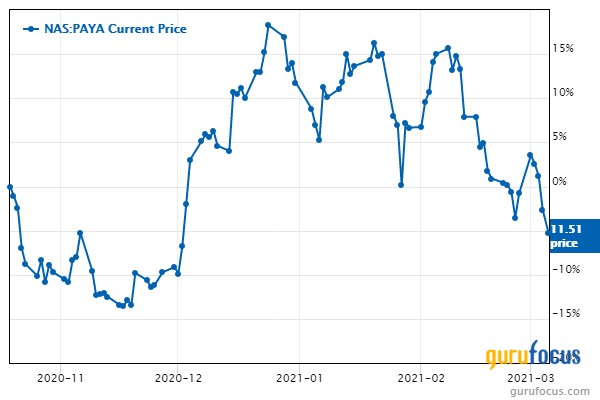

Paya, which offers integrated payment processing and commerce services, has a $1.38 billion market cap; its shares were trading around $11.66 on Friday.

Since going public via special purpose acquisition company last October, the stock has fallen over 5%.

Paya provides integrated payment solutions, processing over $30 billion for more than 100,000 customers. Through its proprietary card and ACH platform called Paya Connect, the company partners with software providers to deliver vertically tailored payments solutions to customers in a range of underpenetrated end markets, including business-to-business goods and services, health care, non-profit and faith-based organizations, government entities, utilities and education.

The company is scheduled to announce its fourth-quarter and full-year 2020 financial results before the opening bell on March 8.

With a 5.54% stake, Cohen is Paya's largest guru shareholder. Ron Baron (Trades, Portfolio), Louis Moore Bacon (Trades, Portfolio) and Jim Simons (Trades, Portfolio)' Renaissance Technologies also have positions in the stock.

Portfolio composition

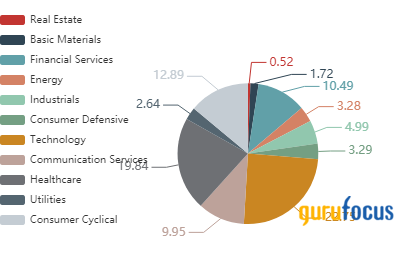

Cohen's $20.5 billion equity portfolio, which was composed of 879 stocks as of the three months ended Dec. 31, is most heavily invested in the technology, health care and consumer cyclical sectors.

Other software stocks Cohen was invested in as of the end of the fourth quarter included Microsoft Corp. (NASDAQ:MSFT), Uber Technologies Inc. (NYSE:UBER), Five9 Inc. (NASDAQ:FIVN), Palo Alto Networks Inc. (NYSE:PANW), NICE Ltd. (NASDAQ:NICE), Fiserv Inc. (NASDAQ:FISV), PagSeguro Digital Ltd. (NYSE:PAGS), RingCentral Inc. (NYSE:RNG) and CrowdStrike Holdings Inc. (NASDAQ:CRWD).

Disclosure: No positions.

Read more here:

Ron Baron Is Still Bullish on Tesla Despite Selling 1.8 Million Shares

MSD Capital Puts a Larger Cap on Independence Contract Drilling

Bill Nygren Adds 4 Stocks to Portfolio in 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.