Steven Madden (SHOO) Q2 Earnings Beat, Revenues Rise Y/Y

Steven Madden, Ltd. SHOO reported second-quarter 2022 results, wherein both the top and the bottom lines not only surpassed the Zacks Consensus Estimate but also improved year over year. Quarterly results were driven by brand strength and effective marketing strategies. This designer and marketer of fashion-forward footwear, accessories and apparel witnessed a stellar performance in the wholesale business.

No wonder the company is focused on driving growth across the direct-to-consumer business, led by its digital capabilities; expanding categories apart from footwear, such as handbags and apparel; enhancing its presence in the international markets; and reinforcing its core U.S. wholesale footwear business.

Q2 Highlights

Steven Madden posted adjusted quarterly earnings of 63 cents a share that beat the Zacks Consensus Estimate of 59 cents and improved sharply from 48 cents reported in the prior-year period. Higher revenues drove the bottom-line performance.

Total revenues surged 34.5% year over year to $535 million. While net sales of $532.7 million increased 34.9%, commission and licensing fee income of $2.3 million declined 25.4% from the year-ago period. The top line handily surpassed the Zacks Consensus Estimate of $493 million.

During the quarter, Steven Madden’s international revenues surged 82% from the year-ago period, driven by a stellar performance in directly-owned subsidiary markets, Canada, Mexico and Europe. Overall, the international business represented 15% of total revenues, up from 11% a year ago.

Gross profit increased 28.1% year over year to $217.8 million; however, gross margin contracted 200 basis points to 40.7% due to a shift in revenue mix from the higher-margin direct-to-consumer business to the lower-margin wholesale business.

Gross profit as a percentage of wholesale revenues expanded 100 basis points to 31.6%, driven by margin improvement in wholesale footwear. Again, gross profit as a percentage of direct-to-consumer revenues increased 100 basis points to 66.4%, owing to margin improvement in international markets.

Adjusted operating expenses increased 26.6% year over year to $150.8 million. However, as a percentage of revenues, adjusted operating expenses shriveled 170 basis points to 28.2%.

Steven Madden reported an adjusted operating income of $67 million, up from $51 million registered in the same quarter a year ago. Adjusted operating margin contracted 30 bps to 12.5%.

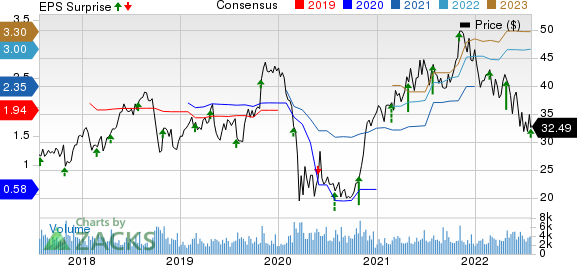

Steven Madden, Ltd. Price, Consensus and EPS Surprise

Steven Madden, Ltd. price-consensus-eps-surprise-chart | Steven Madden, Ltd. Quote

Segment Performance

Revenues for the Wholesale business increased 51.5% year over year to $397.1 million.

We note that Wholesale footwear revenues climbed 47.1% to $291.4 million. The year-over-year growth can be attributed to robust performance in flagship brand, Steve Madden, as well as in Dolce Vita, Anne Klein, Betsey Johnson and private labels. International wholesale footwear revenues jumped more than 60% year over year.

Meanwhile, Wholesale accessories/apparel revenues were up 65.2% to $105.7 million. The upside was driven by robust gains in Steve Madden handbags, BB Dakota Steve Madden apparel and private label accessories.

In spite of tough year-over-year comparison, direct-to-consumer revenues rose 2.2% to $135.5 million. The prior-year quarter had gained from stimulus checks and pent-up demand.

Steven Madden ended the first quarter with 213 brick-and-mortar retail outlets, six e-commerce websites and 19 company-operated concessions across the international markets.

Other Financial Aspects

Steven Madden ended the reported quarter with cash and cash equivalents of $150.9 million, short-term investments of $29.6 million and stockholders’ equity of $833.5 million, excluding non-controlling interest of $9.8 million. Management incurred capital expenditures of $1.7 million in the quarter.

In the reported quarter, the company repurchased approximately $34.6 million of its common stock, including shares acquired via the net settlement of employees’ stock awards.

Outlook

Management highlighted the challenging macro-economic conditions. It stated that consumer demand and sales trends started to moderate at the beginning of June and continued into July. Given the uncertainty, the company is treading cautiously to manage the business in the back half.

Steven Madden reaffirmed its 2022 guidance. Management retained its revenue growth outlook of 13-16% for the current year. The company also maintained an earnings outlook of $2.87-$2.97 per share and an adjusted earnings view of $2.90-$3.00 per share for the full year. Last year, the company reported revenues of $1.87 billion and adjusted earnings of $2.50 per share.

In the past three months, shares of this Zacks Rank #3 (Hold) company have fallen 20.9% compared with the industry’s decline of 14.5%.

3 Solid Picks

Here we have highlighted three better-ranked stocks, namely, Designer Brands DBI, G-III Apparel GIII and Capri Holdings CPRI.

Designer Brands designs, manufactures and retails footwear and accessories. The stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Designer Brands’ current financial year revenues and EPS suggests growth of 6.9% and 16.5%, respectively, from the year-ago reported figure. DBI has a trailing four-quarter earnings surprise of 102.5%, on average.

G-III Apparel designs, sources and markets apparel and accessories under owned, licensed and private label brands. The stock currently flaunts a Zacks Rank #1.

The Zacks Consensus Estimate for G-III Apparel’s current financial year revenues and EPS suggests growth of 13.8% and 8.2%, respectively, from the year-ago reported figure. G-III Apparel has a trailing four-quarter earnings surprise of 97.5%, on average.

Capri Holdings, a global fashion luxury group consisting of iconic brands Versace, Jimmy Choo and Michael Kors, carries a Zacks Rank #2 (Buy). CPRI has an expected EPS growth rate of 11.3% for three-five years.

The Zacks Consensus Estimate for Capri Holdings’ current financial year sales and EPS suggests growth of 3% and 9.8%, respectively, from the year-ago period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report

Capri Holdings Limited (CPRI) : Free Stock Analysis Report

Designer Brands Inc. (DBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research