Stock buybacks have hit record levels this year but they're about to get hit by taxes. These 10 companies have been the biggest buyers of their own shares in 2022.

The Democrats plan to introduce a 1% tax on stock buybacks as part of Joe Biden's climate and tax bill.

S&P 500 companies spent over $280 billion buying back their own shares in the most recent quarter.

Stock buybacks tend to be bullish for investor sentiment because they show a company has faith in itself.

The Democrats are set to introduce a 1% tax on stock buybacks as part of President Joe Biden's Inflation Reduction Act.

The tax - which has been supported in the past by high-profile Democrats including Senator Elizabeth Warren - is unlikely to be welcomed by investors.

A buyback is when a company repurchases its own shares in the marketplace. It returns money to investors by boosting the company's stock price, while also boosting key performance metrics such as earnings per share.

Mega-cap companies including Apple and Facebook parent Meta Platforms have been major proponents of stock buybacks in recent years.

And the top 20 S&P 500 companies spent a record $118 billion buying back their own shares in the first quarter of 2022, up 70% from the same quarter in 2021, according to index data. Over the last five years, that number rises to a staggering $1.24 trillion.

Here are the 10 companies that have spent most on stock buybacks so far this year.

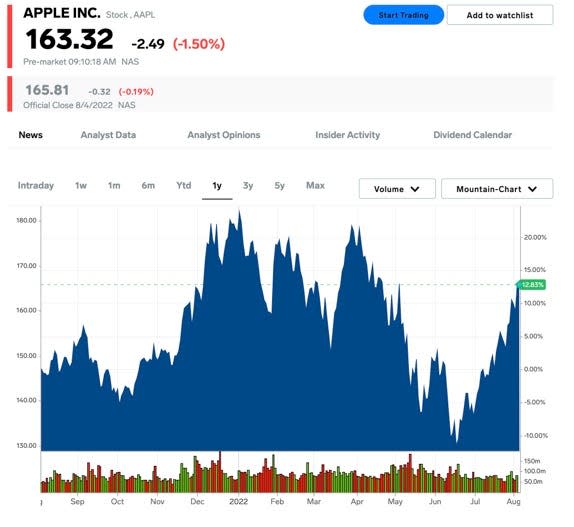

1. Apple

Ticker: AAPL

Buyback value: $22.96 billion

2022 performance vs S&P 500: +6.8 percentage points

2. Alphabet

Ticker: GOOGL

Buyback value: $13.30 billion

2022 performance vs S&P 500: -6.3 percentage points

3. Meta Platforms

Ticker: META

Buyback value: $10.43 billion

2022 performance vs S&P 500: -37.5 percentage points

4. Microsoft

Ticker: MSFT

Buyback value: $8.82 billion

2022 performance vs S&P 500: -3.8 percentage points

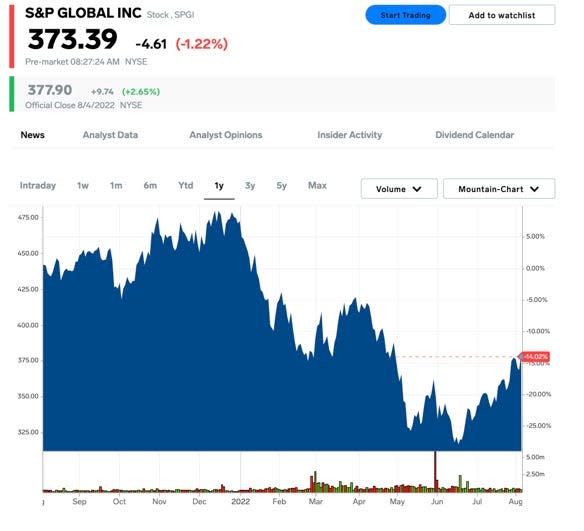

5. S&P Global

Ticker: SPGI

Buyback value: $7.07 billion

2022 performance vs S&P 500: -6.1 percentage points

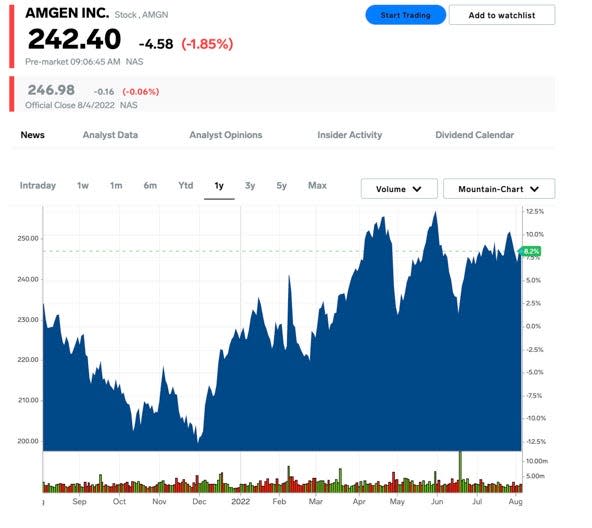

6. Amgen

Ticker: AMGN

Buyback value: $6.36 billion

2022 performance vs S&P 500: +19.9 percentage points

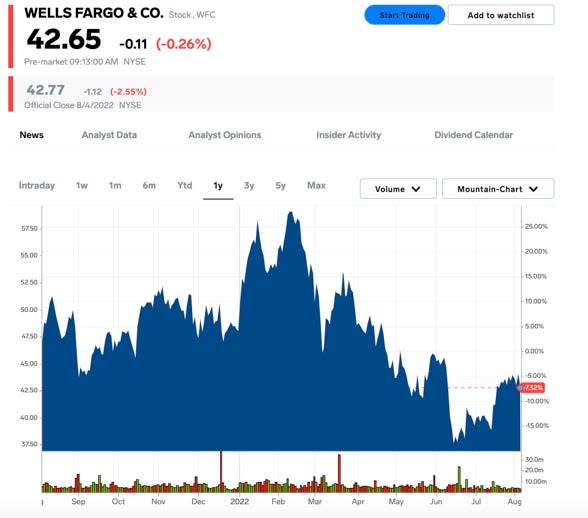

7. Wells Fargo

Ticker: WFC

Buyback value: $6.02 billion

2022 performance vs S&P 500: +2.4 percentage points

8. Bristol-Myers Squibb

Ticker: BMY

Buyback value: $5 billion

2022 performance vs S&P 500: +28.9 percentage points

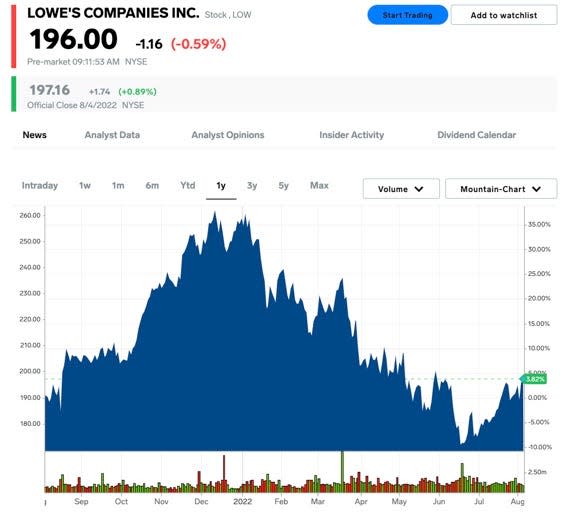

9. Lowe's Companies

Ticker: LOW

Buyback value: $4.04 billion

2022 performance vs S&P 500: +9.5 percentage points

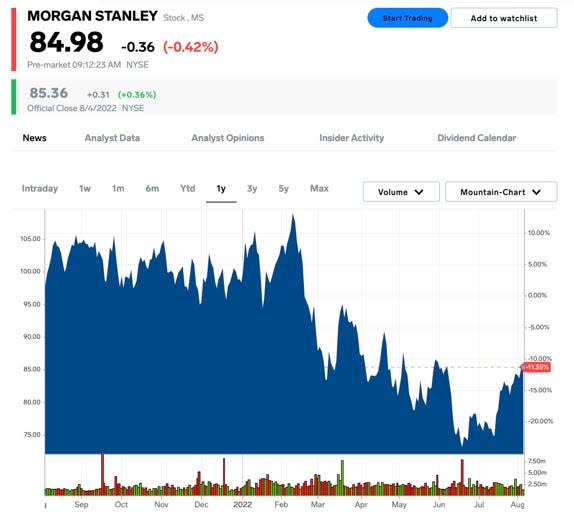

10. Morgan Stanley

Ticker: MS

Buyback value: $3.68 billion

2022 performance vs S&P 500: -0.1 percentage points

Read the original article on Business Insider