This Stock Could Be a Top Cybersecurity Pick for 2019

The cybersecurity industry is expected to get even bigger this year. Gartner estimates that global cybersecurity spending will jump nearly 9% in 2019 to $124 billion as companies beef up their cyberdefenses to protect against a wide variety of complex threats. This is not surprising, as hackers are employing advanced techniques to carry out attacks.

The increasing sophistication of cyberattacks is definitely bad news for all of us, but cybersecurity companies that make a living by selling solutions to protect against such threats stand to gain from this trend. Palo Alto Networks, for instance, has been in top form thanks to the rapid adoption of its cybersecurity solutions, while FireEye has turned itself around as demand for its offerings seems to have increased.

But Check Point Software Technologies (NASDAQ: CHKP) has found it difficult to match the growth of its peers, thanks mainly to a conservative strategy that focuses on bottom-line growth and share buybacks. But the cybersecurity specialist could change that image in 2019 and step up its game. Let's see why.

Image source: Getty Images.

Going after the cloud

Check Point recently acquired Israel-based cybersecurity start-up Dome9 to boost the cloud security features of its Infinity architecture.

Check Point's Infinity is an end-to-end cybersecurity platform that covers endpoints, the network infrastructure, the cloud, and mobile devices. The company aims to provide enterprises with complete threat protection against fifth-generation cybersecurity attacks with this architecture, so it needs to bolster the cloud security part to boost Infinity's adoption and bring it into the limelight.

That's exactly what the Dome9 acquisition does. Check Point paid $175 million in cash for this start-up to get Dome9's cloud-centric cybersecurity capabilities that can be deployed across popular public cloud services like Amazon's AWS, Microsoft Azure, and Google Cloud. Dome9's key features include identity protection, cloud traffic analysis, and ensuring compliance with security guidelines.

Check Point hasn't wasted much time in putting this acquisition to use. The company has integrated its CloudGuard solution with the AWS Security Hub, allowing enterprise customers to have a better idea about the gaps in their security architecture. Customers using the CloudGuard solution on AWS will get real-time alerts regarding potential security events, and Dome9's capabilities will also allow them to analyze and respond to such events.

This is a smart move for Check Point, as AWS is the biggest public cloud provider out there, controlling around 40% of this market. So the company is now in a better position to go after the cloud security opportunity that's expected to clock an annual growth rate of nearly 25% through 2024, hitting a size of nearly $24 billion at the end of the forecast period.

Turning on the heat

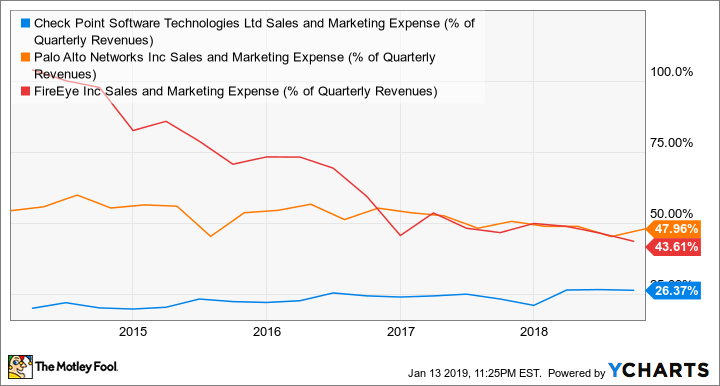

Check Point has been known to be thrifty when it comes to acquiring new customers. In fact, it spends the least amount of money on sales and marketing when compared to its peers.

CHKP Sales and Marketing Expense (% of Quarterly Revenues) data by YCharts.

However, Check Point's spending on this line item has increased over the past year. The company's sales and marketing expenses increased 17% annually during the last reported quarter, signifying a change in management's approach. The more important thing is that the bump in Check Point's sales and marketing spending is positively impacting the company's deferred revenue.

Check Point reported an 11% annual increase in deferred revenue during the third quarter, which is an improvement over the second quarter's deferred revenue growth of 8.7%. The faster growth of this metric bodes well for Check Point, as deferred revenue is the money collected in advance by a company for services that will be rendered at a later date.

As such, higher deferred revenue means that either Check Point customers are committing to buying more of its solutions, or it is successfully acquiring new ones. Either way, the increase in this metric indicates that the company's ramped-up marketing efforts are working.

So it won't be surprising to see Check Point's business kicking up a gear in 2019 thanks to its latest strategies. What's more, investors won't be paying too much for this growth, as Check Point stock has a price-to-earnings (P/E) ratio of just 21 and a forward P/E ratio of less than 18. That's really inexpensive considering that the cybersecurity industry's average P/E multiple is 102, which is why it is a good time to get into Check Point.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Amazon, Check Point Software Technologies, and Palo Alto Networks. The Motley Fool owns shares of Microsoft. The Motley Fool recommends FireEye and Gartner. The Motley Fool has a disclosure policy.