Embrace the uncertainty: Morning Brief

Tuesday, August 18, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET.

There will always be things to be uncertain about

"Embrace the uncertainty," writes John Stoltzfus, CIO of Oppenheimer Asset Management.

This is Stoltzfus’ message to clients as the Democratic National Convention kicks off, which will be followed by the Republican convention next week.

“In the week ahead and next, we would expect that some ripple effects could begin to be felt in market performance,” he said. “Campaign platform positions from both parties will surface, and pundits and political commentators will flush out positives and negatives with the purpose of providing their assumptions of where the country and the markets might be headed over the course of the next few months leading to the election and post-election, depending on the outcome.”

If there's one truth about stocks it's that uncertainty is an ongoing part of investing. There's always something to worry about. Just take a look at the Morning Brief’s chart of the decade. Uncertainty is why the returns are higher for riskier assets like stocks.

This brings us to presidential elections, which are always a risk to investors as they represent potential regime changes when it comes to policies affecting business. But historically, elections haven’t done much to prevent stocks from going up, regardless of political party.

Even the current set of candidates and election outcomes has Wall Street analysts predicting that stocks will continue to go up or present a brief buying opportunity.

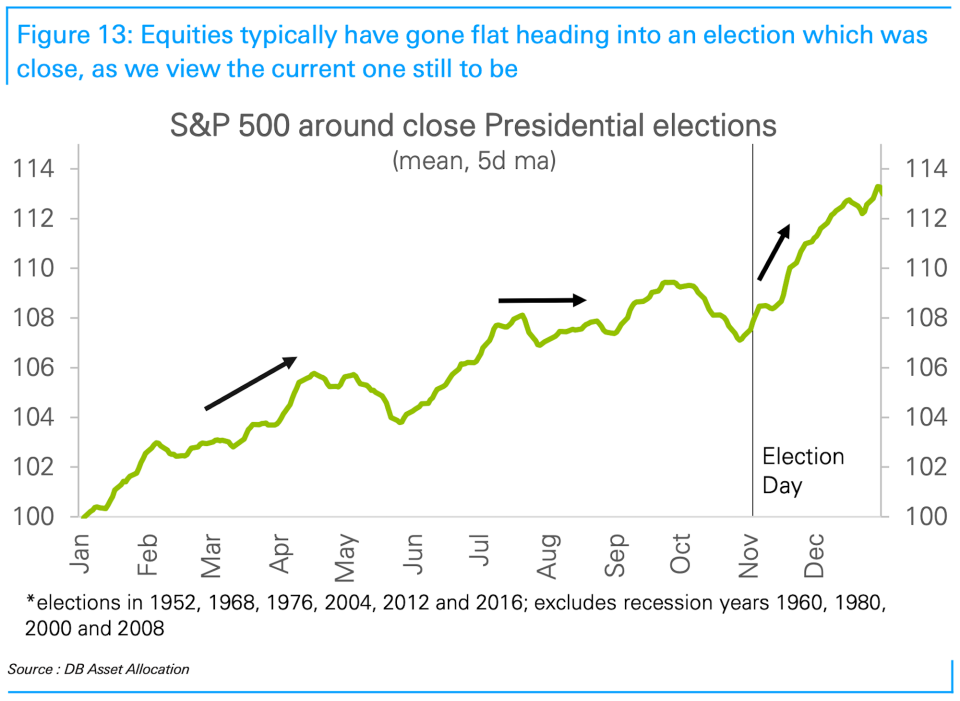

And if you’re worried about how close the candidates are in the polling, Deutsche Bank recently reviewed that history and saw that it’s generally not been a reason to get out of stocks.

Of course, none of that’s to say this time isn’t different.

"The U.S. election is just 81 days away and represents a significant risk to our year-end forecast,” Goldman Sachs’ David Kostin wrote in a new note to clients. “As we have highlighted previously, the coronavirus introduces a major complication in the timely tabulation of voting results. Consider the New York 12th Congressional District Democratic primary, where it took six weeks to count all the absentee ballots and determine a winner. And this was just a primary election."

At this point, no one can say they were blindsided if we didn’t have a clear winner the night of the election.

For what it’s worth, you could characterize this particular risk as a known unknown. In other words, it's a risk that investors are at least aware of, and so the market may be prepared should some of these concerns come into fruition. (Unknown unknowns — or risks that aren’t even on the radar — are much more problematic. Consider the COVID-19 pandemic; at the beginning of the year, no one had any reasonable expectation of what was to come.)

It's worth noting that this risk didn’t prevent Kostin from raising his year-end forecast for the S&P 500 (^GSPC) to 3,600, which would represent another 6% gain from here.

Stoltzfus also maintains a risk-on slant in his recommendations.

"We remain diversified in our investment portfolios, maintain an overweight in equities versus fixed income, and favor cyclical sectors over defensive sectors," he writes.

“Uncertainty is found in most aspects of life whether tied to relationships, health, business, travel—you name it,” Stoltzfus continued. “With uncertainty come choices to be made that could prove in their outcome to be pointless, useless, or damaging, or that could be fruitful, beneficial, and constructive or that could be a mix of all the aforementioned.

“Regardless, uncertainty usually comes with opportunity and risk—two considerations essential in making investments. As professional investors, we’ll opt once again to embrace the uncertainty, hedge the perceived risks as best we are able (mainly via diversification), and seek opportunities that match our goals, objectives, and the mandates we serve.”

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

8:30 a.m. ET: Housing starts, July (1.245 million expected, 1.186 million in June)

8:30 a.m. ET: Building permits, July (1.325 million expected, 1.258 million in June)

Earnings

Pre-market

6:00 a.m. ET: Home Depot (HD) is expected to report adjusted earnings of $3.66 per share on revenue of $34.47 billion

6:30 a.m. ET: Advance Auto Parts (AAP) is expected to report adjusted earnings of $1.96 per share on revenue of $2.37 billion

7:00 a.m. ET: Kohl’s (KSS) is expected to report an adjusted loss of 87 cents per share on revenue of $3.06 billion

7:00 a.m. ET: Walmart (WMT) is expected to report adjusted earnings of $1.24 per share on revenue of $135.61 billon

Post-market

5:35 p.m. ET: Jack Henry & Associates (JHY) is expected to report adjusted earnings of 79 cents per share on revenue of $413 million

Top News

New U.S. sanctions to slam Huawei, further roil tech supply [Reuters]

Oracle said to be weighing bid for TikTok’s U.S. business [Bloomberg]

SoftBank bets $3.9B on U.S. giants from Amazon to Tesla [Bloomberg]

KKR’s Academy Sports confidentially files for IPO [Bloomberg]

YAHOO FINANCE HIGHLIGHTS

Warren Buffett and Charlie Munger have a history of trashing gold

Voters expect the economy to get worse by Election Day

Most companies plan to give raises and bonuses in 2021: survey

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay