Stock Market Facing a 2019 Crash: 70% Correction Warning

July 2019 will mark exactly 10 years since the end of the Global Financial Crisis in 2009. It will also mark the longest period of economic expansion on record, surpassing the 1991 to 2001 internet boom.

The question – Is the current boom sustainable?

The 90s economic boom was fuelled by the internet. This economic recovery has been fuelled by historically low-interest rates and cheap credit – a situation many investors and economists say cannot last.

Warning Signs: The End of the Economic Boom

2018 has been the most volatile year in the stock market since the recession, and volatility can make stock market crises more likely.

Yet, volatility is just one reason the world’s biggest hedge fund managers and leading economists are predicting a 2019 crash. Another reason is rising interest rates.

The Interest Rates and Financial Crises Relationship

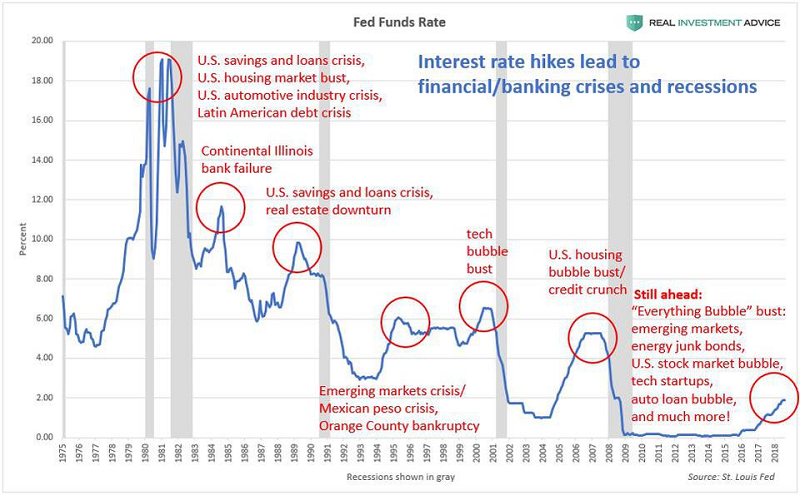

As the US economy firing on all cylinders, the Federal Reserve has increased interest rates eight times since 2015. However, as the US nears full employment, there is an increased danger of rising inflation and consumer prices.

Increasing interest rates is a strategy to curb the rise of inflation – increasing the cost of credit and making saving more attractive strikes a balance between people spending and saving.

However, there are also dangers to this approach. Lower consumer spending has a negative impact on the revenue of consumer-facing businesses. Declining revenue then tightens spending across both the consumer and business landscapes. At the same time, higher interest rates make it harder for financially weak companies to meet their debt obligations.

In a vicious cycle that can lead to economic shrinkage, falling stock prices, and stock market crashes, it’s not surprising that interest rate hikes have preceded over 10 economic recessions in the past 40 years.

Expert Predictions: A 70% Stock Market Crash

Increased volatility and rising interest rates are leading investors and economists to warn of an impending stock market crash.

According to hedge fund manager Paul Tudor Jones, “We have the strongest economy in 40 years, at full employment. The mood is euphoric. But it is unsustainable and comes with costs such as bubbles in stocks and credit.”

Scott Minerd, Chairman of Investments and Global Chief Investment Officer of Guggenheim Partners has forecast a 40% retracement, while economist Ted Bauman believes the market could fall by 70%.

Finally, the CIA’s Financial Threat and Asymmetric Warfare Advisor Jim Rickards has claimed that a 70% drop is the best case scenario.

How Traders Can Take Advantage

With great volatility can come great rewards, and the right financial instruments give traders the opportunity to profit in both rising and falling markets.

By using share CFDs and index CFDs, traders can turn any potential market crash into a profit, or hedge their existing investments until the market turns, with short trades. However, keep in mind that volatile markets can result in higher trading risks, so proper risk management and volatility protection is essential.

This article was originally posted on FX Empire