The Stock-Picking Puzzle: Putting The Pieces Together

For most things in life, the simpler the better. The same goes for investing. In order to outperform the market, we need to be invested in individual stocks and ETFs that are outperforming the market. Unfortunately, most investors try to overcomplicate their stock-picking process which ultimately leads to too many details and subpar performance.

Following a rule-based system that removes emotion from the equation is paramount in helping us formulate our process. This system will allow us to factor in what is relevant and exclude information that isn’t vital to our success. The stock market is a dynamic environment where emotions typically play a large role in most investment decisions. By following a proven system, investors are able to bypass the obstacles that haunt the majority of investors.

The top-performing stocks all have two things in common. First, these companies all exhibit robust fundamental growth in some form or fashion. Typically, we see this in the form of enhanced revenue and earnings growth. As these companies go through their most bullish periods, this healthy fundamental evolution tips off the institutions that hold the type of buying power that is able move markets. These institutions load up on shares, increasing the buying pressure for the stock and creating the trends we see when we view price charts.

The second piece that these best-in-class companies have in common during their most bullish runs is that they are in strong price uptrends. Price charts are a retail investor’s best friend. Investors should seek to employ a combination of fundamental and technical analysis. In today’s investment landscape, it’s important to utilize both – not just one or the other. Interpreting price and volume action in order to identify stocks in the strongest uptrends is a skill that can be learned and successfully applied time and time again.

We aim to detect companies that are superior to their competition and have unique products or services. We don’t necessarily want to invest solely in companies that we know or are aware of at the current time, but we should thoroughly evaluate a stock before taking a position. Another sign to look out for is management activity. Is the company buying back shares? Are insiders at the company buying shares? This activity serves as a sign that management believes in the company and they expect good things in the future. After all, they know their company better than anyone else.

Fortunately for investors, the Zacks Rank employs a proven system that helps identify the top stocks each and every trading day. These stocks are all witnessing positive earnings estimate revision activity which has been proven over time to lead future stock price appreciation. Sticking to stocks that are either a Zacks Rank #1, 2, or 3 and that are in strong price uptrends can serve as a great starting point for investors.

Let’s take a look at three companies in the current investment climate that are exhibiting these characteristics.

Henry Schein, Inc. (HSIC)

Henry Schein is the world’s largest provider of healthcare products and services. HSIC serves office-based dental and medical practitioners as well as physician practices, laboratories, governments, and institutional healthcare clinics. The company offers a wide variety of dental products such as impression materials, anesthetics, dental implants, X-ray supplies and equipment, acrylics, and articulators. HSIC also provides medical products that fall under the pharmaceutical category such as vaccines, diagnostic tests, infection-control products, and vitamins. Henry Schein was founded in 1932 and is headquartered in Melville, NY.

A Zacks Rank #2 (Strong Buy) stock, HSIC presently operates in over 30 countries. Strong demand in the global dental and medical markets continues to drive healthy year-over-year increases in sales. During Q3, Henry Schein’s global dental sales increased 10.5% compared with the same period in 2020. As per a recent report from MarketWatch, the global dental services market was valued at $418.3 million in 2020 and is projected to reach $728.6 million by 2027. This healthy CAGR of 7.8% should allow HSIC to continue the recent sales growth trend.

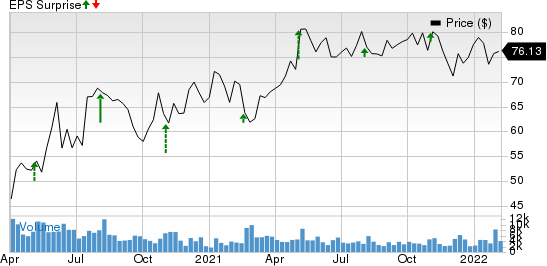

HSIC has strung together a noteworthy history of earnings surprises, exceeding estimates in each quarter for the last four years running. The healthcare product provider most recently reported EPS of $1.10, beating the $0.94 consensus estimate by 17.02%. HSIC has posted a trailing four-quarter average earnings surprise of 17.02%.

Henry Schein, Inc. Price and EPS Surprise

What the Zacks Model Unveils

The Zacks Earnings ESP (Expected Surprise Prediction) seeks to detect companies that have recently witnessed positive earnings estimate revision activity. This more recent information can give investors a leg up during earnings season. In fact, when combining a Zacks Rank #3 with a positive Earnings ESP, stocks produced a positive surprise 70% of the time according to our 10-year backtest.

HSIC sports a +1.94% Earnings ESP and a Zacks #2 ranking. Another earnings beat may be in the cards when the company reports its Q4 results on February 15th. Analysts are expecting full-year EPS of $4.35 from last year, which would represent growth of 46.46% relative to 2020. Sales are seen climbing higher by 21.08% to $12.25 billion. These are the types of trends bullish investors like to see.

AmerisourceBergen Corp. (ABC)

AmerisourceBergen sources and distributes pharmaceutical products both domestically and internationally. The company distributes branded and generic pharmaceuticals, over-the-counter healthcare products, and home-related supplies and equipment to a host of healthcare providers. ABC also provides pharmacy management and staffing services. AmerisourceBergen recently moved its headquarters to Conshohocken, PA.

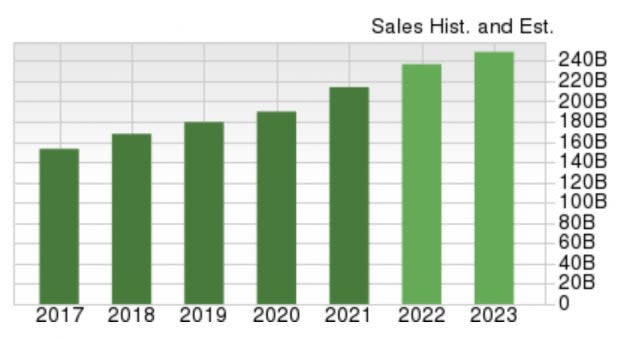

One of the world’s largest pharmaceutical services firms, ABC focuses on offering drug distribution services to reduce healthcare costs and improve patient outcomes. Revenues have witnessed steady growth over the past several years. Total revenue for fiscal 2021 came in at $213.99 billion. Digging into 2022 estimates, analysts are expecting sales growth of 10.62% to $236.72 billion.

Image Source: Zacks Investment Research

Excluding the recent and uncommon quarterly sales miss, ABC surpassed earnings estimates in each quarter for the past five years. Over the last four quarters, ABC has delivered an average earnings surprise of 2.29%, aiding the stock’s return of nearly 29% in the past year.

AmerisourceBergen Corporation Price and EPS Surprise

Currently rated a Zacks Rank #3 (Hold), ABC stock is relatively undervalued, trading at just a 12.71 forward P/E. Our Zacks Style Scores paint a pretty picture for ABC which sports the highest possible score of ‘A’ in each of the Growth, Momentum and Value categories – producing a top mark in our overall VGM score.

Analysts covering ABC have increased their fiscal ’22 EPS estimates by 0.66% in the past 30 days. The Zacks Consensus Estimate now stands at $10.75, translating to growth of 16.09% relative to 2021.

McKesson Corp. (MCK)

McKesson is a global leader in the medical supply space and provides healthcare supply chain management solutions, retail pharmacy, community oncology and specialty care, and healthcare IT. MCK offers medical products, healthcare services and medicines by partnering with pharmaceutical manufacturers, pharmacies, governments and related organizations. McKesson was founded in 1833 and is based out of Irving, TX.

MCK played a crucial role in the COVID-19 response efforts both domestically and abroad via the distribution of vaccines, ancillary supplies and testing kits. The company raised its fiscal 2022 earnings outlook as it delivered robust earnings throughout the past year. Over the past four quarters, MCK has posted an average earnings surprise of 20.64%. The healthcare provider most recently reported Q3 EPS last week of $6.15, a +14.31% surprise over consensus estimates.

McKesson Corporation Price and EPS Surprise

Despite the impressive 48% return over the past year, MCK is still relatively undervalued and trades at just an 11.41 forward P/E. Analysts covering MCK have increased their 2022 EPS estimates by 4.68% in the past 60 days. The Zacks Consensus Estimate is now $23.28, reflecting growth of 35.27% relative to fiscal 2021. MCK also boasts the highest possible ‘A’ score in each of our Zacks Style Score categories of Value, Growth and Momentum, paving the way for the overall top VGM score.

These three industry leaders are poised to continue their outperformance into 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research