Stocks Barrow, Hanley, Mewhinney & Strauss Keeps Buying

- By Tiziano Frateschi

Barrow, Hanley, Mewhinney & Strauss, which serves as a subadvisor to more than 45 equity and fixed-income mutual funds, bought shares of the following stocks in both the second and third quarters.

Bank of New York Mellon Corp. (BK)

In the second quarter, the firm added 94.84% to its position and boosted it by 227.38% in the third quarter.

Warning! GuruFocus has detected 1 Warning Sign with BK. Click here to check it out.

The intrinsic value of BK

With a market cap of $47.66 billion, the company provides investment management services. Its revenue of $15.69 billion has grown 3.50% over the last five years.

Warren Buffett (Trades, Portfolio) is the largest shareholder of the company among the gurus with 6.55% of outstanding shares, followed by Dodge & Cox 4.64%, First Eagle Investment (Trades, Portfolio) with 1.93% and Chris Davis (Trades, Portfolio) with 1.77%.

Broadcom Inc. (AVGO)

The fund added 1.22% to the holding in the second quarter and increased it by 36.85% in the third quarter.

The company, which develops analog and digital semiconductor connectivity solutions, has a market cap of $92.46 billion. Its revenue of $20.24 billion has climbed 39.20% over the last five years.

The company's largest guru shareholder is First Pacific Advisors (Trades, Portfolio) with 0.49% of outstanding shares, followed by Spiros Segalas (Trades, Portfolio) with 0.46%, Steven Romick (Trades, Portfolio) with 0.38% and Barrow, Hanley, Mewhinney & Strauss with 0.32%.

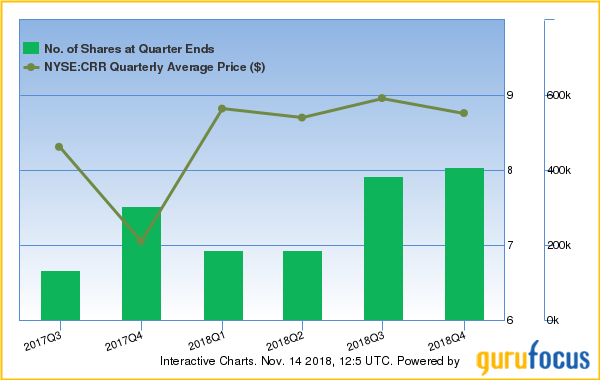

Carbo Ceramics Inc. (CRR)

The firm boosted the position 104.98% in the second quarter and added 6.61% in the third quarter.

The company, which sells proppant products used in hydraulic fracturing, has a market cap of $126.98 million. Its revenue of $221.52 million has declined 32.10% over the last five years.

Prem Watsa (Trades, Portfolio) is another notable guru shareholder of the company with 1.19% of outstanding shares, followed by Chuck Royce (Trades, Portfolio) with 0.9%, Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.48% and Murray Stahl (Trades, Portfolio) with 0.2%.

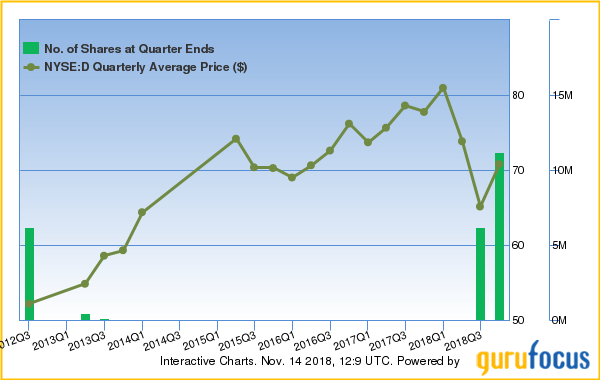

Dominion Energy Inc. (NYSE:D)

In the second quarter, the firm boosted the holding by 28,065% and added 79.99% in the third quarter.

The energy company has a market cap of $48.49 billion. Its revenue of $13.21 billion has fallen 3.40% over the last five years.

Another notable guru shareholder is Sarah Ketterer (Trades, Portfolio) with 0.34% of outstanding shares, followed by Simons' firm with 0.19%, Pioneer Investments (Trades, Portfolio) with 0.04% and Leucadia National (Trades, Portfolio) with 0.01%.

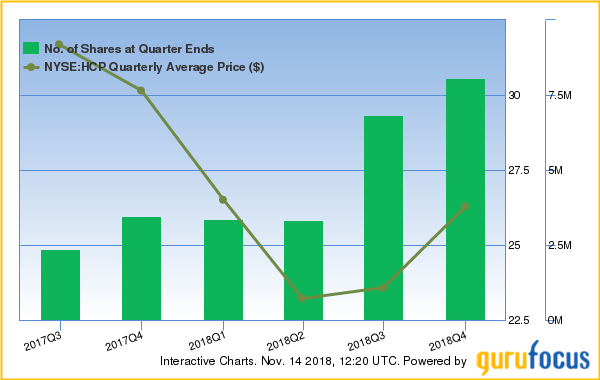

HCP Inc. (HCP)

The investment firm increased the holding 105.49% in the second quarter and added 17.94% in the third quarter.

With a market cap of $13.53 billion, the real estate investment trust invests in health care-related real estate. Its revenue of $1.77 billion has grown 7.20% over the last five years.

With 0.14% of outstanding shares, Pioneer Investments is another notable guru shareholder, followed by Simons with 0.12%, Steven Cohen (Trades, Portfolio) with 0.11% and Davis with 0.1%.

HighPoint Resources Corp. (HPR)

The firm boosted the stake by 200.47% in the second quarter and by 66.98% in the third quarter.

With a market cap of $866.78 billion, the company produces oil, natural gas and natural gas liquids. Its revenue of $405.71 million has declined 29.60% over the last five years.

The largest guru shareholder is Simons' firm with 4.68% of outstanding shares, followed by Royce with 0.68%.

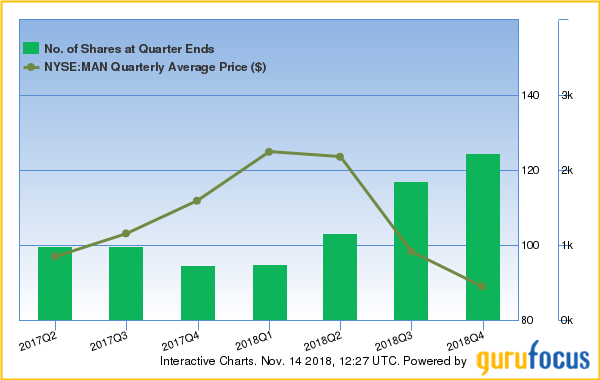

ManpowerGroup Inc. (MAN)

In the second quarter, the firm boosted the holding 59.69% and added another 20.06% in the third quarter.

The company, which operates in the employment services industry, has a market cap of $4.82 billion. It has a revenue of $22.23 billion that has grown 3.30% over the last five years.

Royce is the company's largest guru shareholder with 0.97% of outstanding shares, followed by Joel Greenblatt (Trades, Portfolio) with 0.37%, Pioneer Investments with 0.18% and John Buckingham (Trades, Portfolio) with 0.13%.

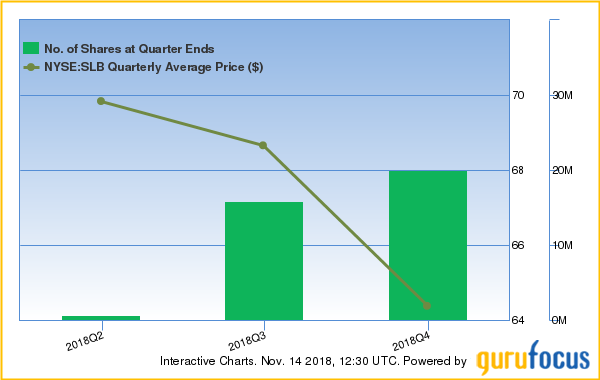

Schlumberger Ltd. (SLB)

The firm boosted the stake by 2,069.8% in the second quarter and by 26.11% in the third quarter.

With a market cap of $68.48 billion, the company supplies products and services to the oil and gas industry. Its revenue of $32.81 billion has fallen 9.70% over the last five years.

The largest shareholder among the gurus is Dodge & Cox with 3.11% of outstanding shares, followed by First Eagle Investment with 1.43%.

Disclosure: I do not own any stocks mentioned in this article.

Read more here:

Wallace Weitz's Top 5 Buys in 3rd Quarter

Mariko Gordon's Top 5 New Buys

Charlie Munger: Trying to Be a Better Investor by Not Being Stupid

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with BK. Click here to check it out.

The intrinsic value of BK