Stodgy Expedia, up 134%, Crushes its Sexy Spinoff, TripAdvisor, Since Parting Ways

Back in April 2011, when Expedia (EXPE) announced it would separate from its faster-growing and sexier unit, TripAdvisor (TRIP), who would have expected the dowdy hotels-and-airlines reservations site to out-perform the spin off?

Both companies – along with Priceline (PCLN) and Orbitz (OWW) – have had a great run since the spinoff date, December 6, 2011, as seen in a stock chart. An improving economy helped boost travel and consumers increasingly choose online travel resources over traditional reservations via phone.

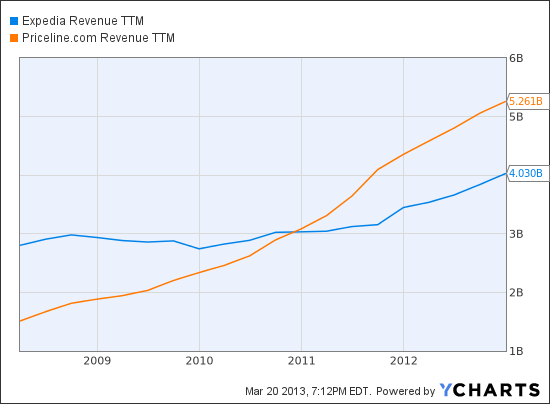

The interesting comparison, with Expedia having accelerated its growth since the separation from TripAdvisor, is Expedia vs. Priceline. They’re both mostly in the foreign hotel reservation business now, and it’s a great one for online middlemen because it’s so fragmented, with lots of little no-name hotels in cities in Europe and Asia. In the U.S., chains occupy a bigger portion of the market, and the less-fragmented nature of the hotel industry here reduces the opportunity for the middlemen.

Anyway, after technology investments in its main site, and also in Hotels.com and Hotwire.com, Expedia is growing more rapidly again.

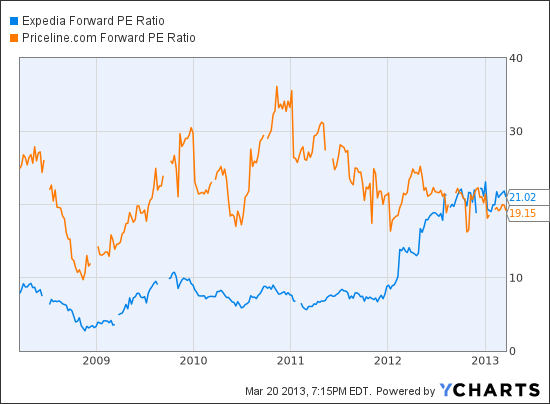

They’re both trading at about 20 times forward earnings estimates, pricey but not crazy for the growth and big market opportunity. Expedia says 59% of U.S. travel purchases already occur online, but Europe is just at 44% and Asia below that.

Jeff Bailey, The Editor of YCharts, is a former reporter, editor and columnist at the Wall Street Journal and New York Times. He can be reached at editor@ycharts.com.

More From YCharts