Stop Passing Over These 2 High-Yield Dividend Stocks

Not all high yield dividend stocks are created equal. Sometimes a company's dividend yield is inflated because its business is in peril and its stock price has plunged and other times a company might be overextending the amount it dishes out to investors. However, when investors uncover high-yield stocks with business upside it can seriously reward long-term shareholders: Target Corporation (NYSE: TGT) and Ford Motor Company (NYSE: F) are two companies that fit that bill.

Target on its back

It hasn't been a pleasant couple of years for most retailers with many chains closing stores and struggling to adapt to e-commerce. In addition to that, Target has found itself in between brick-and-mortar juggernaut Wal-Mart and online giant Amazon.com. Those factors have made life difficult for Target investors, but it has opportunities to grow its business and a dividend yield over 4% for investors willing to wait.

Image source: Getty Images.

One major opportunity for Target is to increase the penetration of its REDcard loyalty program. During the third-quarter its REDcard penetration was 24.2% and if Target can continue to offer valuable exclusives to cardholders it could help generate incremental foot traffic by creating additional loyal consumers. And it's valuable foot traffic, too, as REDcard members spend roughly twice the amount normal consumers do.

Target has also been successful using an addition by subtraction strategy. It exited its Canadian operations, sold its credit card portfolio and pharmacy and clinic business, which were all dragging on the company's business.

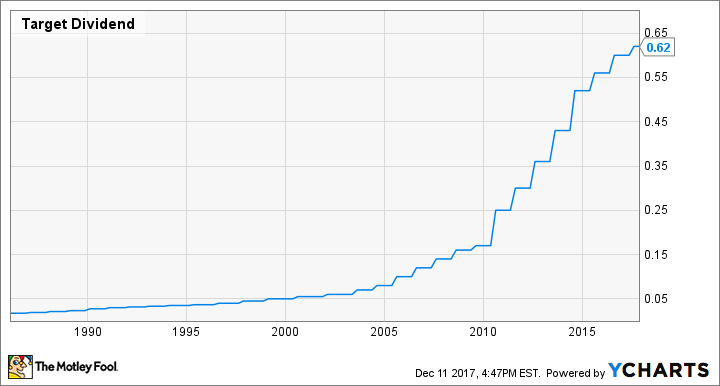

TGT Dividend data by YCharts.

Target's 4% dividend yield is attractive already, it's also a safe bet, and management has shown it's willing to hike it significantly since 2010. Target is definitely a high-yield dividend stock investors shouldn't overlook.

Doubling down

Similar to the doom and gloom retailers have faced this year is the pessimism surrounding the automotive industry. At a time when the lucrative U.S. market is peaking, many investors are shying away from investing in Detroit automakers. But Ford offers a solid dividend, is doubling down in China, and focusing on the long road ahead.

Investors have long hoped that China, already the world's largest automotive market, would become a second pillar of revenue for Detroit's second-largest automaker. But after making significant progress accelerating its sales in China between 2012 and 2015, that growth has slowed. Management recognizes that and recently set a plan that would beef up its effort in the region.

EVs will be crucial for automakers in China. Image source: Getty Images.

More specifically, Ford plans to launch 50 new models in China by 2025. It's a move that Peter Fleet, Ford's head of Asia Pacific, predicts will grow Ford's revenue in china by 50% over that timeframe. It also gives Ford the opportunity to develop electric vehicle technology as at least 15 of the new 50 models rolling out in China will be electric. It's a move that could enable Ford to improve its global scale when you consider that General Motors has sold more than three times the vehicles its cross-town rival has (Ford with 938,570 units through October and GM with 3.13 million).

Electric vehicles and driverless vehicle technology are going to intertwine down the road, and developing that technology ahead of the competition will be crucial for major automakers to control market share. If Ford can double down in China and develop critical technology for EVs and driverless vehicles, its 4.7% dividend yield makes it a stock investors shouldn't overlook.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Daniel Miller owns shares of Ford. The Motley Fool owns shares of and recommends Ford. The Motley Fool has a disclosure policy.