Will Strat Aero Plc (AIM:AERO) Need To Raise More Money?

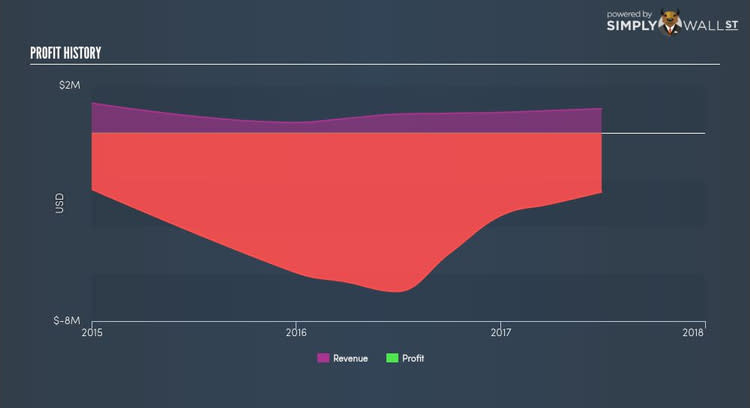

Strat Aero Plc (AIM:AERO) continues its loss-making streak, announcing a -£2.52M earnings for its latest financial year ending. A crucial question to bear in mind when you’re an investor of an unprofitable business, is whether the company will have to raise more capital in the near future. Today I’ve examined AERO’s financial data to roughly assess when the company may need to raise new capital. Check out our latest analysis for Strat Aero

What is cash burn?

AERO currently has £0.37M in the bank, with negative cash flows from operations of -£1.83M. The riskiest factor facing investors of AERO is the potential for the company to run out of cash without the ability to raise more money. AERO operates in the aerospace and defense industry, which has an average EPS of £0.34, meaning the majority of AERO’s peers are profitable. AERO faces the trade-off between running the risk of depleting its cash reserves too fast, or risk falling behind its profitable competitors by investing too slowly.

When will AERO need to raise more cash?

Opex declined by 0.48% over the past year, which could be an indication of AERO putting the brakes on ramping up high growth. However, this cost-reduction initiative is still not enough. Given the level of cash left in the bank, if AERO maintained its opex level of £2.8M, it will still run out of cash within the next couples of months. Even though this is analysis is fairly basic, and AERO still can cut its overhead further, or raise debt capital instead of coming to equity markets, the analysis still helps us understand how sustainable the AERO’s operation is, and when things may have to change.

What this means for you:

Are you a shareholder? Hopefully, the analysis has shed some light on the risks you should bear in mind as a shareholder of AERO, in particular, its tight cash runway moving forward. Now that we’ve accounted for opex, you should also look at expected revenue growth in order to gauge when the company may become breakeven.

Are you a potential investor? The risks involved in investing in loss-making AERO means you should think twice before diving into the stock. However, this should not prevent you from further researching it as an investment potential. The cash burn analysis result indicates a cash constraint for AERO, due to its current level of cash reserves. An opportunity may exist for you to enter into the stock at an attractive price, should AERO come to market to fund its operations.

Good management manages cash well – take a look at who sits on AERO’s board and the CEO’s back ground and experience here. If risky loss-making stocks do not appeal to you, see my list of highly profitable companies to add to your portfolio..

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.