Stratasys (SSYS) Reports Narrower-Than-Expected Loss in Q2

Stratasys Ltd. SSYS reported non-GAAP loss of 13 cents per share in second-quarter 2020, narrower than the Zacks Consensus Estimate of a loss of 23 cents. However, the bottom line compared unfavorably with the year-ago quarter’s earnings per share of 16 cents per share.

Stratasys’ revenues of $117.6 million missed the consensus mark of $121.1 million as well as declined 27.9% year over year. Economic weakness due to the outbreak of the coronavirus pandemic affected the top line.

Quarter Details

Segment wise, Product revenues plunged 33% from the year-ago quarter to $73.9 million. Within Product revenues, System revenues decreased 35.6% and Consumables revenues fell 30.6% year over year.

Revenues from Services decreased 17.2% year over year to $43.7 million. Within Service revenues, customer support revenues dropped 7.5% year over year.

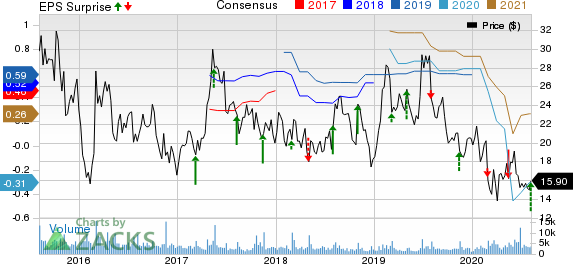

Stratasys, Ltd. Price, Consensus and EPS Surprise

Stratasys, Ltd. price-consensus-eps-surprise-chart | Stratasys, Ltd. Quote

Stratasys’ non-GAAP gross profit dipped 37.7% from the year-ago quarter to $53.3 million. Non-GAAP gross margin contracted 710 basis points (bps) to 45.4%.

Non-GAAP operating expenses declined 19.8% year over year to $61.4 million, aided by efforts to cut SG&A costs.

Non-GAAP operating loss totaled $8.1 million against an operating income of $0.8 million in the prior-year quarter.

The company exited the quarter with cash and cash equivalents of $313 million compared with the $325.5 million witnessed at the end of the previous quarter.

As of Jun 30, 2020, there was no long-term debt.

Net cash used in operating activities in the reported quarter was $9.7 million.

Zacks Rank and Key Picks

Currently, CDW carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector include Benefitfocus BNFT, Cogent Communications Holdings CCOI and Synaptics SYNA, all carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term earnings growth rate for Benefitfocus, Cogent and Synaptics is currently pegged at 30%, 10.6%, and 10%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stratasys, Ltd. (SSYS) : Free Stock Analysis Report

Synaptics Incorporated (SYNA) : Free Stock Analysis Report

Cogent Communications Holdings, Inc. (CCOI) : Free Stock Analysis Report

Benefitfocus, Inc. (BNFT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research