Strategic Value Investing: Residual Income Models

What do you do if you want to value a bank or financial company? Odds are, the valuation models reviewed so far -- dividend growth and free cash flow -- likely won't do the job.

For that reason, the authors of "Strategic Value Investing: Practical Techniques of Leading Value Investors," Stephen Horan, Robert R. Johnson and Thomas Robinson, turned to residual income models in chapter 10 of their 2014 book.

As they pointed out, a financial company like a bank has a different business model, one in which they take cash from consumers and use it to make loans to other customers. For this brokerage service, they collect a "spread," the difference in interest between borrowed and loaned funds. "Fortunately, another approach exists that focuses on book value and earnings," the authors wrote. "This method is called a residual income model and is quite effective for valuing many companies, particularly those in the financial industry."

To explain the residual income model, they created a fictitious company called Cayse Logistics Company (CLC). It has $2 million in assets:

$1 million of shareholders' equity (book value), 10,000 shares at $100 per share.

$1 million financed with debt, at 8% per year.

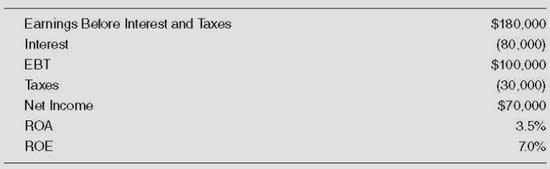

On that capital, CLC produces earnings of $180,000 before interest (8%) and taxes (the latter at 30%). Assume the company will pay out all earnings as dividends, leaving nothing to reinvest (a no-growth future). A traditional income statement would look like this:

As we can see, investors saw a 3.5% return on assets, but when leverage was considered, the return on equity was 7%. This was the result of borrowing at 8% and earning a return of 9% on those borrowed funds.

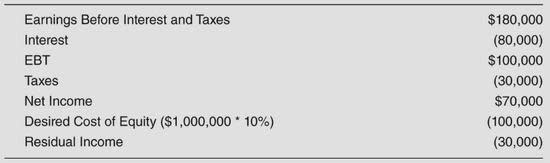

The authors pointed out, "One deficiency with the traditional income statement presented here is that while the cost of debt (interest) is reflected in the income statement, the cost of equity (the discount rate investors want) is not." They added that the traditional income statement can be "extended" to show the desired cost of equity:

Explanation? "Residual income is the amount of net income remaining after subtracting the required cost of equity capital. For Cayse, it is zero. The company earned exactly what shareholders required for the risk they assumed, so the residual income is zero."

We can now value the company without knowing its dividends, by adding the book value and the present value of future residual income. In this case, the book value was $1 million, and the present value of the future residual income would likely be $0 (as you will recall, the company set nothing aside for future growth).

Next, we have the same scenario, except that CLC can earn $220,000 before interest and taxes, again based on a total asset investment of $2 million:

With positive residual income of $28,000, the company had funds to reinvest and expected future growth. Put another way, it was earning more than shareholders required, so it was adding value.

Thus, it was worth more than just book value ($1 million), when the present value of future cash flows was calculated ($28,000/.07 = $400,000). The book value had increased from $1 million to $1.4 million; on a per-share basis, that worked out to $140 (up from the original $100) and the price-to-book ratio would similarly increase, to 1.4.

Not that residual income is always positive -- it also can be negative. For example, suppose investors demanded a 10% return on their $1 million investment:

A variation on the residual income model is the "forecasted residual income" model. The authors explained, "A forecasted residual income model involves forecasting out future residual income and then discounting it back to the present to combine with current book value to determine the current value:"

They added that the formula for the forecasted model is similar to the dividend discount and free cash flow models, and the difference is that the forecasted residual starts with book value, to which the present value of future residual income is added. The other models begin with some measure of cash flow, whether free cash flow or dividends.

The residual income model and the price-book value ratio

According to the authors, there is a close relationship between the residual income model and the price-book value model, a closeness that develops out of the mathematics involved.

For example, suppose you desire a 10% rate of return for a stock with a 15% return on equity; it is also a no-growth company. What is the most you should pay for it? Based on these assumptions, you would want a maximum price-book ratio of 1.5. If it trades for more than 1.5, then it is overvalued and there is no margin of safety. If the price-book is less than 1.5, the company may be a bargain, or at least worth further research.

In a mini case study, they referenced Bank of America (NYSE:BAC), trading at $12 per share and with a book value of roughly $20 per share (and thus a price-book ratio of 0.60). If you expect long-term return on equity to stay around 7.5%, the growth rate at 2.5% and you want an 11% return, what would be the justified price-book ratio?

Based on these assumptions, you would consider the Bank of America to be properly or fairly valued (price-book ratios at 0.60 and 0.59) and not a value stock at this price.

Finally, we were warned that because the residual income model is earnings based, it may be subject to manipulation:

Don't assume historical data and ratios such as return on equity are accurate and trends will continue into the future. Develop your own conservative forecasts of input data.

Watch for warning signs about the quality of earnings.

Conclusion

In the words of the authors of "Strategic Value Investing: Practical Techniques of Leading Value Investors," "Residual income is the amount of net income remaining after subtracting the required cost of equity capital."

Residual income can also be the source of another valuation model, along with dividend growth and cash flow models. The main application for this model is in valuing financial companies such as banks.

Disclosure: I do not own shares in any company listed, and do not expect to buy any in the next 72 hours.

Read more here:

Strategic Value Investing: Deep-Value Stocks

Strategic Value Investing: Replacement Value

Strategic Value Investing: Book Value

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.