Strategic Value Investing: Value Investing in Mutual Funds

Can you still be a value investor if you have turned to mutual funds or exchange-traded funds?

The authors of "Strategic Value Investing: Practical Techniques of Leading Value Investors" said you can. Stephen Horan, Robert R. Johnson and Thomas Robinson argued in chapter 15 that investing in mutual funds means making smart choices among the types of funds available.

Index funds

With so many index funds now on the market, you have many criteria for making choices. For example, you can invest according to capitalization levels (i.e., micro-cap, small-cap, mid-cap or large-cap); you can also invest by industries, by the growth segment of an index or the value segment of an index.

Value investors will favor value-oriented funds and also those with low expense ratios. Even a fraction of a point on an investment held for the long term will make a significant difference in ultimate returns. As the authors noted, the market has become quite competitive and expense ratios have come down significantly.

They also provided this table showing the differences between two Vanguard funds, the first being a conventional fund and the second being a value fund:

In a five-year comparison, the conventional fund outperforms the value fund. However, there is more to consider than just that. The value fund has a lower price-earnings ratio and its dividend is more than a half a point higher.

Also consider the time elapsed. According to the authors, the five-year outperformance is not unexpected because value usually wins over longer periods.

Another important observation: Index funds perform no fundamental analysis or screen, by design, since they are created by buying all stocks of a specific index (such as the S&P 500).

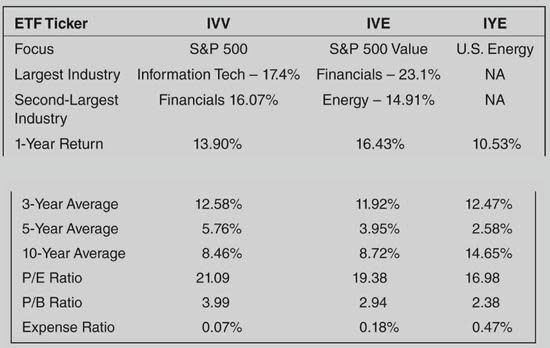

When it comes to industries or sectors, an investor can do an economic analysis that considers the environment for different types of stocks. This would mean a value approach to sector fund investments. The authors created this table to illustrate how a sector choice can be analyzed:

Note in this table that the energy fund (an ETF) has outperformed the S&P 500 and the S&P 500 Value funds quite handily over 10 years. But it is well behind in one-year returns, suggesting the sector is not performing as well now as it has in the past, something an economic analysis would likely flag. In addition, the energy sector fund is somewhat hobbled by its lack of diversification and a higher expense ratio.

Active funds

For investors who want to invest in active mutual funds or ETFs, due diligence can make a difference here as well.

Of necessity, active funds must charge higher rates than index funds because managers have to pick each stock or security individually, while index funds simply include all stocks named in a specific index.

In choosing active funds, you are choosing a manager as well as a fund. The authors recommended investing in funds with managers who have an established history of strong performance and charge reasonable expense ratios. Truly diligent investors will look into the manager's experience, education and personal certifications. In the words of the authors, "Studies have shown that all these factors tend to be positively correlated with manager skill and positively related to performance."

And, of course, you want to know the fundamentals when choosing funds. This table was created by the authors in 2013 to compare an S&P 500 index fund with funds operated by two active investing gurus:

In their assessment of the results, the authors noted both value managers outperformed the S&P 500 in the long term, 15 years. That's an impressive result considering the value managers have significantly higher expense ratios.

They also pointed out that Morningstar, the source of the data, classified the Weitz and Tweedy, Browne funds as being blends of value and growth, particularly in the Weitz case because that fund had a notably higher price-earnings ratio than the other two funds.

Conclusion

Value investing is alive and well for mutual fund investors, whether passive or active. Anyone choosing funds, including ETFs, must make tough choices and the information in this chapter helps us understand what we are analyzing.

Careful investors will scrutinize the names and descriptions of funds on their shortlists; in particular, they will look for "value" in the name. Alternatively, they can do a top-down analysis to identify sectors that have promise and then choose funds representing those sectors.

Above all, investors who take a thoughtful and deliberate approach to choosing their funds, by applying value investing principles, should outperform their more casual counterparts.

Given that this is the last section of the final chapter of "Strategic Value Investing: Practical Techniques of Leading Value Investors", the authors had some concluding remarks:

"Early in this book we showed why you should be a value investor: Over the long term, value wins. You can improve your performance by not being merely a value investor who buys inexpensive stocks but by being a strategic value investor who seeks to find good companies in industries expected to do well that are selling at discounts to their intrinsic value. You need to do your homework to evaluate the fundamentals of the company, its business, and industry. You also need to make many judgments about the future and use these judgments as inputs into a valuation model to assess the intrinsic value and margin of safety for every investment you make."

Finally, they added, you need to have confidence in yourself and to be patient, because while value investors may lose the battle in the short term, they can win the war in the long term.

Recommendation

When I began this book, I wasn't sure what to expect. Would it be a rehash of other information about value investing? What is "strategic" value investing?

To my pleasant surprise, I found this to be one of the best books on investing I have digested, and I have done dozens in the past couple of years.

What's remarkable about it is the organized and systematic look under the hood at value principles, comprehensively explaining what drives them and the connections among them.

I recommend "Strategic Value Investing: Practical Techniques of Leading Value Investors" to intermediate value investors and to new value investors who want to get up to speed quickly.

Disclosure: I do not own shares in any company listed, and do not expect to buy any in the next 72 hours.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.