Strategy: Sell Stocks for a Quick Trade?

Talking Points

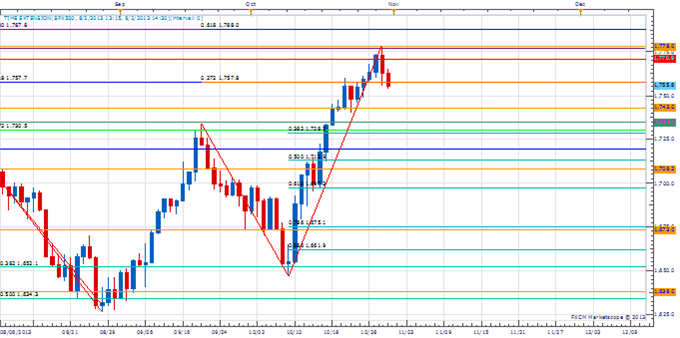

Index reverses from key Gann level

Sentiment at levels seen before other corrections

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

The FXCM S&P 500 fair value instrument reversed course yesterday at 1777, which is the 6th square root progression of the June 1559 low. In our experience 6th square root progressions off of significant lows often prompt reliable counter trend moves. What is potentially even more important about yesterday’s reversal is that it came during the first day of the cycle turn window that we highlighted in Monday’s Price & Time. With sentiment touching extremes this week that have presaged other corrections (Daily Sentiment Index touched 85% bulls) in the index there is certainly room for the decline to run if it can get through near-term support hurdles at 1750 and 1744. Today’s initial follow on weakness confirms at least a minor peak is in place and if not already short we like looking to sell on strength (which is not uncommon around the 1st of the month) over the next few sessions.

SPX Daily Chart: October 31, 2013

Charts Created using Marketscope – Prepared by Kristian Kerr

Key Event Risks in Coming Sessions:

Source: DailyFX Calendar

LEVELS TO WATCH

Resistance: 1770 (Gann), 1778 (Gann)

Support: 1744 (Gann), 1730 (Fibonacci)

Strategy: Sell SPX

Entry: Sell SPX at 1770

Stop: 1781

Target: 1730

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

Looking for way to pinpoint extremes in sentiment in real time? Try our proprietary SSI.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter at@KKerrFX.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.