Strike Specter Looms on Ryanair (RYAAY) Due to Labor Woes

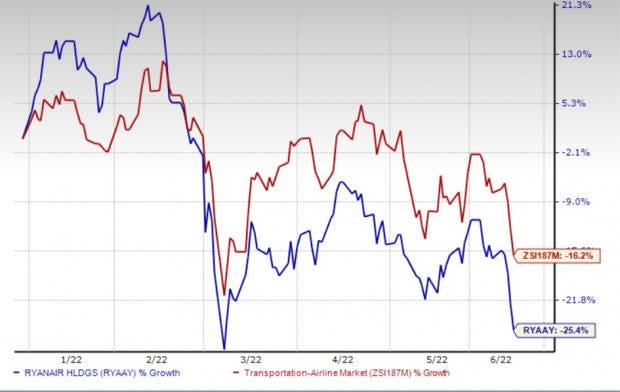

Shares of Ryanair Holdings RYAAY have declined 25.4% year to date, underperforming its industry’s 16.2% fall.

Image Source: Zacks Investment Research

The stock may face further hiccups as RYAAY’s cabin crew may possibly call a strike in many European nations during the summer season. Per a Bloomberg report, pay-related talks with two Spanish unions (SITCPLA and USO) failed.

Following Ryanair's walkout from negotiations, the unions accused RYAAY, currently carrying a Zacks Rank #5 (Strong Sell), of acting in bad faith. The unions intend to return for further negotiations.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A representative of the SITCPLA labor group said, “We’re coordinating our actions with European counterparts.” The two unions apart, workers’ organizations in countries like Belgium, France, Italy and Portugal are also in favor of taking drastic actions if Ryanair does not agree to resume a dialogue.

As a matter of fact, if this impasse continues and the strike threat materializes, Ryanair’s plans to generate substantial traffic and revenues during the usually busy summer season may take a hit.

Last month, RYAAY’s management had projected the load factor (percentage of seats occupied by passengers) to reach the pre-pandemic levels at 94-95% in June-August. RYAAY CEO Michael O'Leary had said at that time, "Bookings over the last number of weeks have continued to strengthen – both the numbers are strengthening and average fares being paid through the summer are rising."

It will be interesting to see if the above labor problem hampers these plans. Stay tuned for further updates on this burning issue.

Stocks to Consider

Better-ranked stocks within the broader Transportation sector include the following:

Golar LNG Limited GLNG currently has a Zacks Rank #2 (Buy). GLNG has a decent surprise history, as its earnings outperformed the Zacks Consensus Estimate in three of the preceding four quarters and missed the mark once, the average surprise being 42.1%.

Shares of Golar LNG have rallied more than 100% in a year. A strong LNG market boosted the stock. The staggering inflation flared up the oil and natural gas prices. Moreover, amid the Russia-Ukraine war, Europe is likely to look for gas supplies outside Russia. This is expected to drive demand for the LNG vessels, which bodes well for GLNG.

Southwest Airlines LUV: Continued recovery in air-travel demand bodes well for Southwest Airlines. Anticipating a steady improvement in bookings, the carrier expects to reap profits in the remaining three quarters of 2022 as well as during the full year. LUV's management predicts operating revenues to increase 12-15% in the second quarter of 2022 from the comparable period’s level in 2019. LUV is seeing strong bookings for the spring and summer trips.

The positivity surrounding the Southwest Airlines stock is evident from the Zacks Consensus Estimate for current-year earnings being revised in excess of 100% upward over the past 60 days. LUV has a Growth Style Score of B.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research