With Strong Deliveries and the New Backing of China, NIO Inc. (NYSE:NIO) is Positioned to Become a Major Player

This article was originally published on Simply Wall St News

Investors in NIO Inc. (NYSE:NIO) had a good week, as its shares rose 6.2% to close at US$45.85 following the release of its first-quarter results and the more recent vehicle deliveries report. In a twist of events, China is also moving both to back and protect Electrical Vehicle manufacturers.

In the report released on the 2nd August, NIO outlines:

NIO delivered 7,931 vehicles in July 2021, increasing by 124.5% year-over-year

Cumulative deliveries of the ES8, ES6 and EC6 as of July 31, 2021 reached 125,528

With this, NIO shows that it is in a tight contest vs other Chinese Electrical vehicle manufacturers: Li Auto (NASDAQ:LI), which delivered 8,589 vehicles in July and XPeng (NYSE:XPEV) which delivered 8,040 vehicles. It seems that Chinese EV manufacturers are in a tight race not to stay behind between the competition regarding vehicle deliveries.

Considering cumulative numbers, NIO is the clear leader in this category.

Two new pieces of information are also very important for the EV industry outlook in China. It seems that the Chinese government is on a campaign to support and protect EV manufacturers, and NIO is positioned to greatly benefit from this.

In the first report, (Sources 1, 2) China calls for more support for the domestic EV market, which implies concrete actions from Beijing and subsidies. In the second statement, China announced to launch an investigation into chipmakers for the automotive industry and severely punish price gauging, hoarding and driving up prices.

As we wait for the Q2 earnings report for NIO, scheduled for the 11 August, we want to get a better picture of what to expect both in the short and long term.

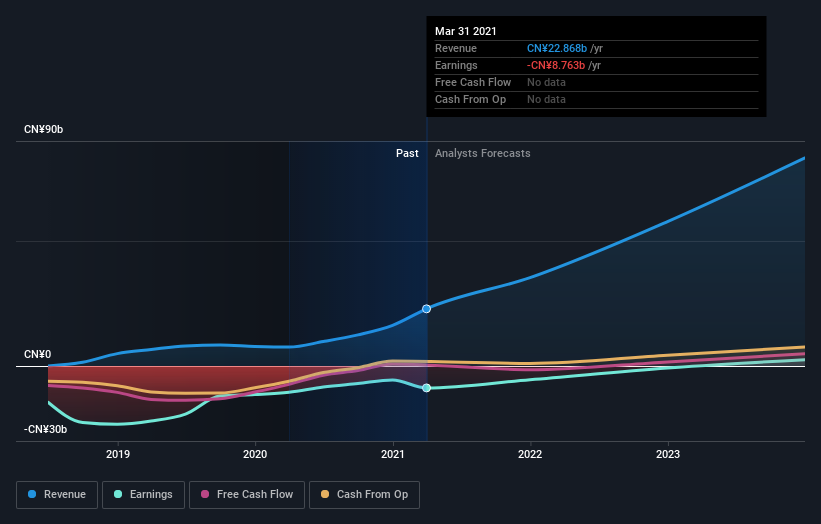

Starting from Q1 earnings, NIO beat revenue forecasts by a solid 17%, hitting CN¥8.0b. Statutory losses also blew out, with the loss per share reaching CN¥3.14, some 216% bigger than the analysts expected.

Earnings are an important time for investors, they outline if the company in sin sync with promises and expectations. We gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

See our latest analysis for NIO

After the latest results, the 21 analysts covering NIO are now predicting revenues of CN¥35.3b in 2021. If met, this would reflect a major 55% improvement in sales compared to the last 12 months.

The loss per share is expected to greatly reduce in the near future, narrowing 43% to CN¥3.83. Yet prior to the latest earnings, the analysts had been forecasting revenues of CN¥35.3b and losses of CN¥3.83 per share in 2021.

As you can observe, NIO is not expected to become profitable soon, and we want to stress that this is intentional because new companies need to reinvest massively in R&D, marketing, production etc, in order to stay competitive. Since NIO is targeting mass markets, it still has a long way to go in ensuring quality and production (original or 3rd party) capacity.

As a result there was no major change to the consensus price target of US$61.00, implying that the business is trading roughly in line with expectations despite ongoing losses. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic NIO analyst has a price target of US$91.93 per share, while the most pessimistic values it at US$42.27.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of NIO's historical trends, as the 79% annualized revenue growth to the end of 2021 is roughly in line with the 71% annual revenue growth over the past three years.

By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 22% per year. So it's pretty clear that NIO is forecast to grow substantially faster than its industry.

Conclusion

NIO is on track and somewhat exceeding its short term expectations, and we can expect a strong quarterly post on the 11th August.

The three main competitors are aggressively vying for investor attention, and that should make us just a bit cautious when interpreting numbers where there is a strong incentive to cross a psychological threshold - in this case, 8,000 vehicles.

NIO is reinvesting, and the industry is backed by the government, which should give them a surge of growth in the coming period.

The business still expected to grow faster than the wider industry. The consensus price target held steady at US$61.00.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for NIO going out to 2023, and you can see them free on our platform here..

However, before you get too enthused, we've discovered 2 warning signs for NIO that you should be aware of.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com