Strong Memory Chip Demand to Aid Micron's (MU) Q1 Earnings

Micron Technology Inc. MU is scheduled to report first-quarter fiscal 2021 results on Jan 7.

The company’s performance in the soon-to-be-reported quarter is likely to have gained from strong memory-chip demand from PC manufacturers and data-center operators.

Robust Demand for Memory Chips

The COVID-19 pandemic-induced lockdown and social-distancing measures are spurring demand for PCs and notebooks as more and more workers and students are now working and learning from their homes. This trend is likely to have continued in the fiscal first quarter as well, thereby aiding its top-line performance.

Per IDC data, third-quarter 2020 (July-September) PC shipments grew 14.6% to 81.3 million. Lenovo was the top vendor, followed by HP Inc. HPQ, per IDC. Further, the market research firm forecasts 18.2% year-over-year PC shipment growth in the fourth quarter of 2020 (October-December).

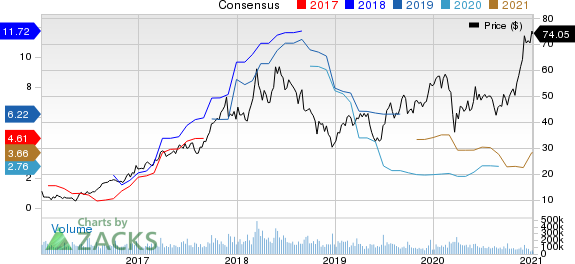

Micron Technology, Inc. Price and Consensus

Micron Technology, Inc. price-consensus-chart | Micron Technology, Inc. Quote

The work-and-learn-from-home necessity is also stoking demand for cloud storage. Furthermore, the social-distancing trend has boosted the usage of online services globally. Therefore, data-center operators are enhancing their cloud-storage capacities in a bid to accommodate the skyrocketing demand for cloud services, which is fueling demand for memory chips.

Per the IDC data, third-quarter 2020 server sales were impressive, which is anticipated to have aided Micron. Notably, Dell Technologies DELL and Hewlett Packard Enterprises HPE were ranked as the top vendors by IDC.

Moreover, strong recoveries in sales across the smartphone and automotive industries are likely to have supported Micron’s overall financial performance in the quarter under review. IDC had projected that the smartphone market will return to growth in fourth-quarter 2020 and mark a year-over-year increase of 2.4%.

Product wise, Micron’s quarterly DRAM revenues are likely to have improved year over year. The Zacks Consensus Estimate for DRAM revenues is currently pegged at $4.04 billion, indicating a 16.5% year-over-year jump.

Revenues from NAND products are likely to have remained almost flat at $1.41 billion when compared with the year-ago quarter sales of $1.42 billion.

Nonetheless, Micron’s heavy dependence on China is a headwind due to the long-standing tit-for-tat trade spat between the United States and China. Restrictions on exports to Huawei might have hurt the top-line performance of this Zacks Rank #1 (Strong Buy) company.

You can see the complete list of today’s Zacks #1 Rank stocks here.

In addition, higher mix of lower-margin NAND, along with low memory prices and minimal decline in manufacturing costs, is likely to have strained margins.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HP Inc. (HPQ) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research